Berkshire Hathaway 2000 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

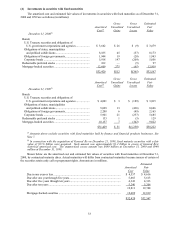

24

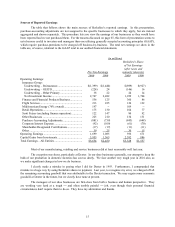

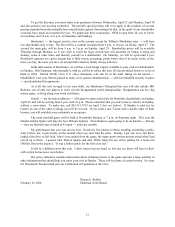

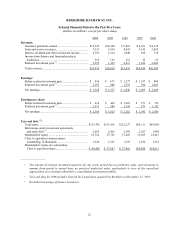

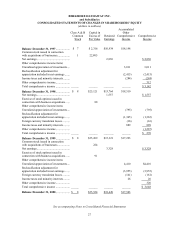

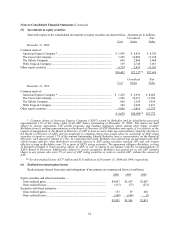

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(dollars in millions except per share amounts)

December 31,

2000 1999

ASSETS

Cash and cash equivalents............................................................................................... $ 5,263 $ 3,835

Investments:

Securities with fixed maturities..................................................................................... 32,567 30,222

Equity securities........................................................................................................... 37,619 37,772

Other ........................................................................................................................... 1,637 1,736

Receivables..................................................................................................................... 11,764 8,558

Inventories...................................................................................................................... 1,275 844

Investments in MidAmerican Energy Holdings Company ................................................ 1,719 —

Assets of finance and financial products businesses ......................................................... 16,829 24,229

Property, plant and equipment......................................................................................... 2,699 1,903

Goodwill of acquired businesses...................................................................................... 18,875 18,281

Other assets .................................................................................................................... 5,545 4,036

$135,792 $131,416

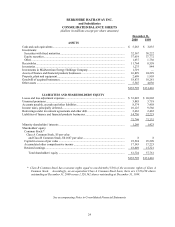

LIABILITIES AND SHAREHOLDERS’ EQUITY

Losses and loss adjustment expenses ............................................................................... $ 33,022 $ 26,802

Unearned premiums........................................................................................................ 3,885 3,718

Accounts payable, accruals and other liabilities ............................................................... 8,374 7,458

Income taxes, principally deferred................................................................................... 10,125 9,566

Borrowings under investment agreements and other debt ................................................. 2,663 2,465

Liabilities of finance and financial products businesses.................................................... 14,730 22,223

72,799 72,232

Minority shareholders’ interests ...................................................................................... 1,269 1,423

Shareholders’ equity:

Common Stock:*

Class A Common Stock, $5 par value

and Class B Common Stock, $0.1667 par value....................................................... 8 8

Capital in excess of par value ....................................................................................... 25,524 25,209

Accumulated other comprehensive income ................................................................... 17,543 17,223

Retained earnings......................................................................................................... 18,649 15,321

Total shareholders’ equity ....................................................................................... 61,724 57,761

$135,792 $131,416

* Class B Common Stock has economic rights equal to one-thirtieth (1/30) of the economic rights of Class A

Common Stock. Accordingly, on an equivalent Class A Common Stock basis, there are 1,526,230 shares

outstanding at December 31, 2000 versus 1,520,562 shares outstanding at December 31, 1999.

See accompanying Notes to Consolidated Financial Statements