Berkshire Hathaway 2000 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

through their standard reinsurance arrangements. Therefore, any insurance CEO doing a piece of business like this

must run the small, but real, risk of a horrible quarterly earnings number, one that he would not enjoy explaining to

his board or shareholders. Charlie and I, however, like any proposition that makes compelling mathematical sense,

regardless of its effect on reported earnings.

At General Re, the news has turned considerably better: Ron Ferguson, along with Joe Brandon, Tad

Montross, and a talented supporting cast took many actions during 2000 to bring that company’s profitability back

to past standards. Though our pricing is not fully corrected, we have significantly repriced business that was

severely unprofitable or dropped it altogether. If there’s no mega-catastrophe in 2001, General Re’s float cost

should fall materially.

The last couple of years haven’t been any fun for Ron and his crew. But they have stepped up to tough

decisions, and Charlie and I applaud them for these. General Re has several important and enduring business

advantages. Better yet, it has managers who will make the most of them.

In aggregate, our smaller insurance operations produced an excellent underwriting profit in 2000 while

generating significant float — just as they have done for more than a decade. If these companies were a single and

separate operation, people would consider it an outstanding insurer. Because the companies instead reside in an

enterprise as large as Berkshire, the world may not appreciate their accomplishments — but I sure do. Last year I

thanked Rod Eldred, John Kizer, Don Towle and Don Wurster, and I again do so. In addition, we now also owe

thanks to Tom Nerney at U.S. Liability and Michael Stearns, the new head of Cypress.

You may notice that Brad Kinstler, who was CEO of Cypress and whose praises I’ve sung in the past, is no

longer in the list above. That’s because we needed a new manager at Fechheimer Bros., our Cincinnati-based

uniform company, and called on Brad. We seldom move Berkshire managers from one enterprise to another, but

maybe we should try it more often: Brad is hitting home runs in his new job, just as he always did at Cypress.

GEICO (1-800-847-7536 or GEICO.com)

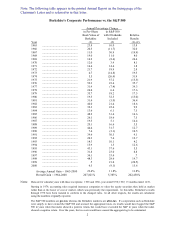

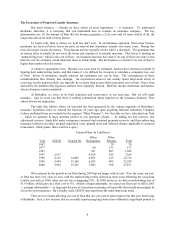

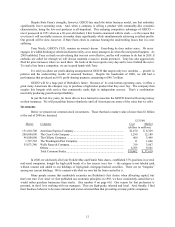

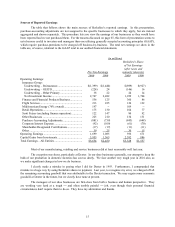

We show below the usual table detailing GEICO’s growth. Last year I enthusiastically told you that we

would step up our expenditures on advertising in 2000 and that the added dollars were the best investment that

GEICO could make. I was wrong: The extra money we spent did not produce a commensurate increase in

inquiries. Additionally, the percentage of inquiries that we converted into sales fell for the first time in many

years. These negative developments combined to produce a sharp increase in our per-policy acquisition cost.

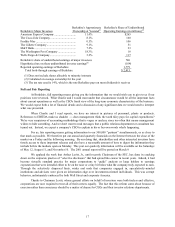

New Auto Auto Policies

Years Policies(1) In-Force(1)

1993 346,882 2,011,055

1994 384,217 2,147,549

1995 443,539 2,310,037

1996 592,300 2,543,699

1997 868,430 2,949,439

1998 1,249,875 3,562,644

1999 1,648,095 4,328,900

2000 1,472,853 4,696,842

(1) “Voluntary” only; excludes assigned risks and the like.

Agonizing over errors is a mistake. But acknowledging and analyzing them can be useful, though that

practice is rare in corporate boardrooms. There, Charlie and I have almost never witnessed a candid post-mortem of

a failed decision, particularly one involving an acquisition. A notable exception to this never-look-back approach is

that of The Washington Post Company, which unfailingly and objectively reviews its acquisitions three years after

they are made. Elsewhere, triumphs are trumpeted, but dumb decisions either get no follow-up or are rationalized.