Berkshire Hathaway 2000 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

BERKSHIRE HATHAWAY INC.

To the Shareholders of Berkshire Hathaway Inc.:

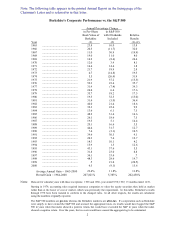

Our gain in net worth during 2000 was $3.96 billion, which increased the per-share book value of both

our Class A and Class B stock by 6.5%. Over the last 36 years (that is, since present management took over) per-

share book value has grown from $19 to $40,442, a gain of 23.6% compounded annually.∗

Overall, we had a decent year, our book-value gain having outpaced the performance of the S&P 500.

And, though this judgment is necessarily subjective, we believe Berkshire’s gain in per-share intrinsic value

moderately exceeded its gain in book value. (Intrinsic value, as well as other key investment and accounting terms

and concepts, are explained in our Owner’s Manual on pages 59-66. Intrinsic value is discussed on page 64.)

Furthermore, we completed two significant acquisitions that we negotiated in 1999 and initiated six more.

All told, these purchases have cost us about $8 billion, with 97% of that amount paid in cash and 3% in stock. The

eight businesses we’ve acquired have aggregate sales of about $13 billion and employ 58,000 people. Still, we

incurred no debt in making these purchases, and our shares outstanding have increased only 1/3 of 1%. Better yet,

we remain awash in liquid assets and are both eager and ready for even larger acquisitions.

I will detail our purchases in the next section of the report. But I will tell you now that we have embraced

the 21st century by entering such cutting-edge industries as brick, carpet, insulation and paint. Try to control your

excitement.

On the minus side, policyholder growth at GEICO slowed to a halt as the year progressed. It has become

much more expensive to obtain new business. I told you last year that we would get our money’s worth from

stepped-up advertising at GEICO in 2000, but I was wrong. We’ll examine the reasons later in the report.

Another negative — which has persisted for several years — is that we see our equity portfolio as only

mildly attractive. We own stocks of some excellent businesses, but most of our holdings are fully priced and are

unlikely to deliver more than moderate returns in the future. We’re not alone in facing this problem: The long-

term prospect for equities in general is far from exciting.

Finally, there is the negative that recurs annually: Charlie Munger, Berkshire’s Vice Chairman and my

partner, and I are a year older than when we last reported to you. Mitigating this adverse development is the

indisputable fact that the age of your top managers is increasing at a considerably lower rate — percentage-wise —

than is the case at almost all other major corporations. Better yet, this differential will widen in the future.

Charlie and I continue to aim at increasing Berkshire’s per-share value at a rate that, over time, will

modestly exceed the gain from owning the S&P 500. As the table on the facing page shows, a small annual

advantage in our favor can, if sustained, produce an anything-but-small long-term advantage. To reach our goal

we will need to add a few good businesses to Berkshire’s stable each year, have the businesses we own generally

gain in value, and avoid any material increase in our outstanding shares. We are confident about meeting the last

two objectives; the first will require some luck.

It’s appropriate here to thank two groups that made my job both easy and fun last year just as they do

every year. First, our operating managers continue to run their businesses in splendid fashion, which allows me to

spend my time allocating capital rather than supervising them. (I wouldn’t be good at that anyway.)

∗All figures used in this report apply to Berkshire's A shares, the successor to the only stock that the

company had outstanding before 1996. The B shares have an economic interest equal to 1/30th that of the A.