Berkshire Hathaway 2000 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

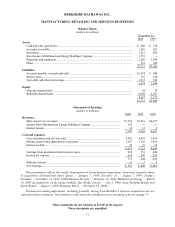

5. Because of our two-pronged approach to business ownership and because of the limitations of

conventional accounting, consolidated reported earnings may reveal relatively little about our true

economic performance. Charlie and I, both as owners and managers, virtually ignore such consolidated

numbers. However, we will also report to you the earnings of each major business we control, numbers we

consider of great importance. These figures, along with other information we will supply about the

individual businesses, should generally aid you in making judgments about them.

To state things simply, we try to give you in the annual report the numbers and other information that

really matter. Charlie and I pay a great deal of attention to how well our businesses are doing, and we also

work to understand the environment in which each business is operating. For example, is one of our

businesses enjoying an industry tailwind or is it facing a headwind? Charlie and I need to know exactly

which situation prevails and to adjust our expectations accordingly. We will also pass along our

conclusions to you.

Over time, practically all of our businesses have exceeded our expectations. But occasionally we have

disappointments, and we will try to be as candid in informing you about those as we are in describing the

happier experiences. When we use unconventional measures to chart our progress — for instance, you

will be reading in our annual reports about insurance "float" — we will try to explain these concepts and

why we regard them as important. In other words, we believe in telling you how we think so that you can

evaluate not only Berkshire's businesses but also assess our approach to management and capital

allocation.

6. Accounting consequences do not influence our operating or capital-allocation decisions. When

acquisition costs are similar, we much prefer to purchase $2 of earnings that is not reportable by us

under standard accounting principles than to purchase $1 of earnings that is reportable. This is precisely

the choice that often faces us since entire businesses (whose earnings will be fully reportable) frequently

sell for double the pro-rata price of small portions (whose earnings will be largely unreportable). In

aggregate and over time, we expect the unreported earnings to be fully reflected in our intrinsic business

value through capital gains.

We attempt to offset the shortcomings of conventional accounting by regularly reporting "look-through"

earnings (though, for special and nonrecurring reasons, we occasionally omit them). The look-through

numbers include Berkshire's own reported operating earnings, excluding capital gains and purchase-

accounting adjustments (an explanation of which occurs later in this message) plus Berkshire's share of

the undistributed earnings of our major investees — amounts that are not included in Berkshire's figures

under conventional accounting. From these undistributed earnings of our investees we subtract the tax we

would have owed had the earnings been paid to us as dividends. We also exclude capital gains, purchase-

accounting adjustments and extraordinary charges or credits from the investee numbers.

We have found over time that the undistributed earnings of our investees, in aggregate, have been fully as

beneficial to Berkshire as if they had been distributed to us (and therefore had been included in the

earnings we officially report). This pleasant result has occurred because most of our investees are engaged

in truly outstanding businesses that can often employ incremental capital to great advantage, either by

putting it to work in their businesses or by repurchasing their shares. Obviously, every capital decision

that our investees have made has not benefitted us as shareholders, but overall we have garnered far more

than a dollar of value for each dollar they have retained. We consequently regard look-through earnings as

realistically portraying our yearly gain from operations.

In 1992, our look-through earnings were $604 million, and in that same year we set a goal of raising them

by an average of 15% per annum to $1.8 billion in the year 2000. Since that time, however, we have

issued additional shares — including a significant number in the 1998 merger with General Re — so that

we now need look-through earnings of $2.4 billion in 2000 to match the per-share goal we originally were

shooting for. This is a target we still hope to hit.