Berkshire Hathaway 2000 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

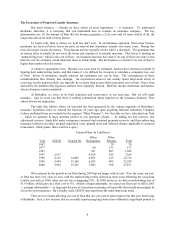

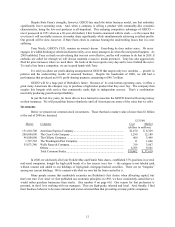

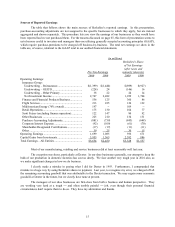

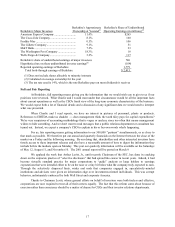

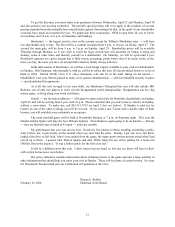

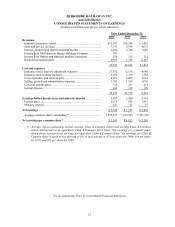

Sources of Reported Earnings

The table that follows shows the main sources of Berkshire's reported earnings. In this presentation,

purchase-accounting adjustments are not assigned to the specific businesses to which they apply, but are instead

aggregated and shown separately. This procedure lets you view the earnings of our businesses as they would have

been reported had we not purchased them. For the reasons discussed on page 65, this form of presentation seems to

us to be more useful to investors and managers than one utilizing generally accepted accounting principles (GAAP),

which require purchase-premiums to be charged off business-by-business. The total net earnings we show in the

table are, of course, identical to the GAAP total in our audited financial statements.

(in millions) Berkshire's Share

of Net Earnings

(after taxes and

Pre-Tax Earnings minority interests)

2000 1999 2000 1999

Operating Earnings:

Insurance Group:

Underwriting – Reinsurance................................. $(1,399) $(1,440) $(899) $(927)

Underwriting – GEICO........................................ (224) 24 (146) 16

Underwriting – Other Primary ............................. 38 22 24 14

Net Investment Income ........................................ 2,747 2,482 1,929 1,764

Finance and Financial Products Business................ 556 125 360 86

Flight Services........................................................ 213 225 126 132

MidAmerican Energy (76% owned)........................ 197 -- 109 --

Retail Operations.................................................... 175 130 104 77

Scott Fetzer (excluding finance operation) .............. 122 147 80 92

Other Businesses .................................................... 225 210 134 131

Purchase-Accounting Adjustments.......................... (881) (739) (843) (648)

Corporate Interest Expense ..................................... (92) (109) (61) (70)

Shareholder-Designated Contributions.................... (17) (17) (11) (11)

Other ...................................................................... 39 25 30 15

Operating Earnings ................................................... 1,699 1,085 936 671

Capital Gains from Investments................................. 3,955 1,365 2,392 886

Total Earnings – All Entities..................................... $5,654 $2,450 $3,328 $1,557

Most of our manufacturing, retailing and service businesses did at least reasonably well last year.

The exception was shoes, particularly at Dexter. In our shoe businesses generally, our attempt to keep the

bulk of our production in domestic factories has cost us dearly. We face another very tough year in 2001 also, as

we make significant changes in how we do business.

I clearly made a mistake in paying what I did for Dexter in 1993. Furthermore, I compounded that

mistake in a huge way by using Berkshire shares in payment. Last year, to recognize my error, we charged off all

the remaining accounting goodwill that was attributable to the Dexter transaction. We may regain some economic

goodwill at Dexter in the future, but we clearly have none at present.

The managers of our shoe businesses are first-class from both a business and human perspective. They

are working very hard at a tough and often terribly painful job, even though their personal financial

circumstances don’t require them to do so. They have my admiration and thanks.