Berkshire Hathaway 2000 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Management's Discussion (Continued)

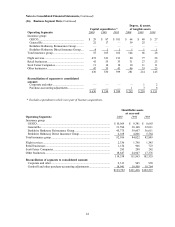

Non-Insurance Businesses (Continued)

2000 compared to 1999

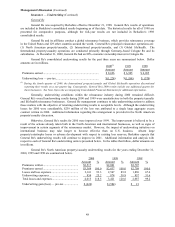

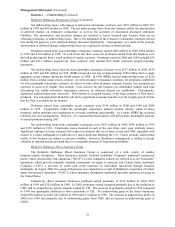

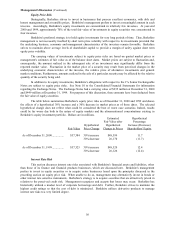

Revenues from Berkshire’s numerous and diverse non-insurance businesses of $7,886 million in 2000

increased $1,844 million (30.5%) from the prior year. The aggregate operating profits from these businesses of

$1,291 million in 2000 increased $454 million (54.2%). Revenues and operating results for Berkshire’s non-

insurance business activities will change considerably in 2001. Just prior to the end of 2000, Berkshire acquired

Benjamin Moore, a leading formulator and manufacturer of architectural and industrial coatings. Additionally,

during the first two months of 2001, Berkshire acquired 87.3% of Shaw Industries, the world’s largest producer of

tufted broadloom carpet and rugs and Johns Manville, a leading producer of insulation and building products.

These three businesses generated approximately $7 billion in sales revenues in 2000.

The following is a discussion of significant matters impacting comparative results for the non-insurance

businesses.

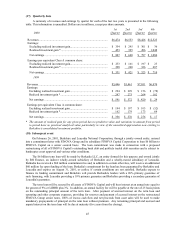

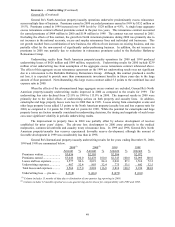

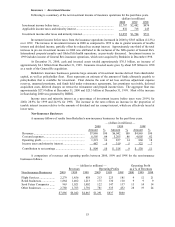

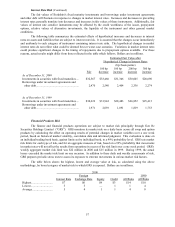

Flight Services

This segment includes FlightSafety and Executive Jet. FlightSafety provides high technology training to

operators of aircraft and ships. FlightSafety’s worldwide clients include corporations, the military and government

agencies. Executive Jet is the world’s leading provider of fractional ownership programs for general aviation

aircraft. Revenues from flight services in 2000 increased $423 million (22.8%) over 1999. Most of the increase in

revenues was attributed to Executive Jet, which produced significant increases in revenues from both flight

operations and aircraft sales. Revenues from FlightSafety also increased approximately 10% in 2000 as compared

to 1999, reflecting both increased training revenues and product sales. Operating profits in 2000 decreased $12

million (5.3%) as compared to 1999. Increased operating profits at FlightSafety were more than offset by reduced

operating profits at Executive Jet. Executive Jet’s results in 2000 and 1999 reflect operating losses related to

expansion into Europe as well as significantly higher operating costs incurred to generate future domestic growth.

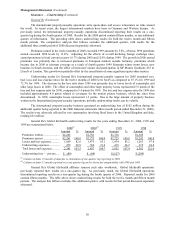

Retail Businesses

These businesses include four independently managed retailers of home furnishings (Nebraska Furniture

Mart, R.C. Willey Home Furnishings, Star Furniture and Jordan’s Furniture) and three independently managed

retailers of fine jewelry (Borsheim’s, Helzberg’s Diamond Shops and Ben Bridge Jeweler). Two of these

businesses were acquired during the past two years (Jordan’s Furniture – November, 1999 and Ben Bridge Jeweler

– July, 2000). Revenues of these businesses in 2000 increased $462 million (33.0%) as compared to 1999 and

operating profits in 2000 increased $45 million (34.6%) as compared to 1999. Approximately 70% of the increase

in revenues and 80% of the increase in operating profits in 2000 was due to the inclusion of the results of Jordan’s

for the full year in 2000 and to the inclusion of Ben Bridge from the date of its acquisition.

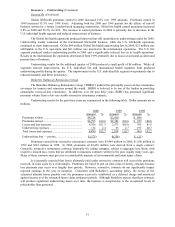

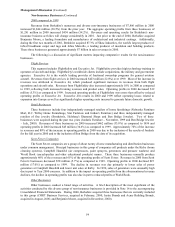

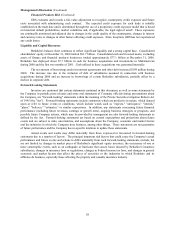

Scott Fetzer Companies

The Scott Fetzer companies are a group of about twenty diverse manufacturing and distribution businesses

under common management. Principal businesses in this group of companies sell products under the Kirby (home

cleaning systems), Campbell Hausfeld (air compressors, paint sprayers, generators and pressure washers) and

World Book (encyclopedias and other educational products) names. These three businesses normally produce

approximately 60% of the revenues and 65% of the operating profits of Scott Fetzer. Revenues in 2000 from Scott

Fetzer’s businesses decreased $58 million (5.7%) as compared to 1999. Operating profits in 2000 declined $25

million (17.0%) as compared to 1999. The decline in revenues was due primarily to lower sales of power

generators at Campbell Hausfeld and lower unit sales at Kirby. In 1999, sales of generators were unusually high

due in part to Year 2000 concerns. In addition to the impact on operating profits from the aforementioned revenue

declines, the decline in operating profits was also due in part to reduced profits at World Book.

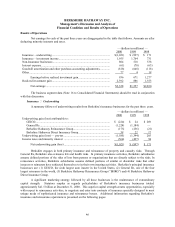

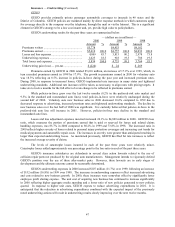

Other Businesses

Other businesses conduct a broad range of activities. A brief description of the most significant of the

activities conducted by this diverse group of non-insurance businesses is provided in Note 16 to the accompanying

Consolidated Financial Statements. During 2000, Berkshire acquired three businesses that are currently included

in this group (CORT Business Services, acquired in February, 2000; Justin Brands and Acme Building Brands,

acquired in August, 2000; and Benjamin Moore, acquired in December, 2000).