Berkshire Hathaway 2000 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

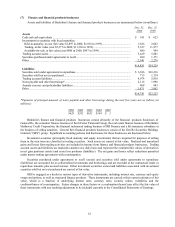

Notes to Consolidated Financial Statements (Continued)

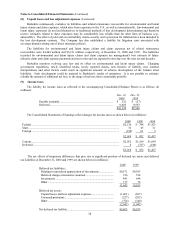

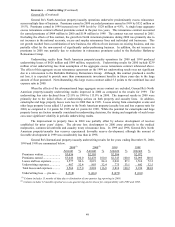

(11) Dividend restrictions - Insurance subsidiaries

Payments of dividends by insurance subsidiaries members are restricted by insurance statutes and regulations.

Without prior regulatory approval, Berkshire can receive up to approximately $1.1 billion as dividends from insurance

subsidiaries during 2001. During 2000, subsidiaries declared approximately $4.8 billion in dividends, of which $2

billion was paid in 2001.

Combined shareholders' equity of U.S. based property/casualty insurance subsidiaries determined pursuant to

statutory accounting rules (Statutory Surplus as Regards Policyholders) was approximately $41.5 billion at December

31, 2000. This amount differs from the corresponding amount determined on the basis of GAAP. The major differences

between statutory basis accounting and GAAP are that deferred income tax assets and liabilities, deferred charges-

reinsurance assumed, unrealized gains and losses on investments in securities with fixed maturities and goodwill of

acquired businesses are recognized under GAAP but not for statutory reporting purposes.

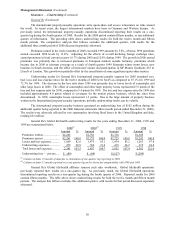

Effective January 1, 2001, Berkshire’s insurance companies will be required to adopt several new accounting

policies as a result of the completion of the Codification of Statutory Accounting Principles (“SAP”) by the National

Association of Insurance Commissioners. The most significant new accounting policy affecting Berkshire’s insurance

companies will be the requirement to record deferred income tax liabilities, including amounts related to unrealized

gains in investment securities. Deferred tax liabilities were previously not recognized under SAP.

As a result, the combined statutory surplus of Berkshire’s insurance businesses will decline significantly in 2001.

Berkshire estimates that the combined surplus of the group would approximate $33 billion at December 31, 2000 under

the new statutory accounting rules.

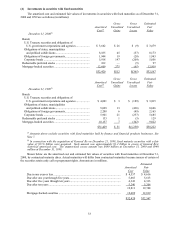

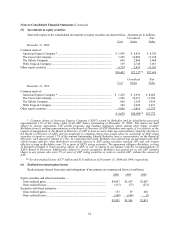

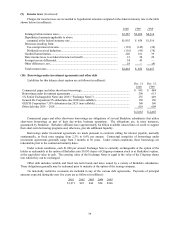

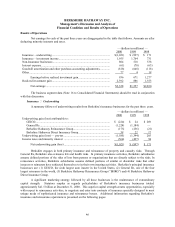

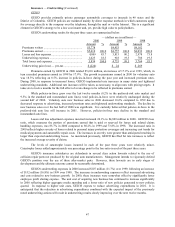

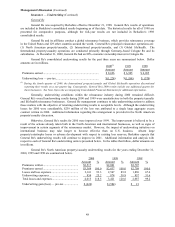

(12) Common stock

Changes in issued and outstanding common stock of the Company during the three years ended December 31,

2000 are shown in the table below. Class B Common

$0.1667 Par Value

Class A Common, $5 Par Value (55,000,000 shares

(1,650,000 shares authorized) authorized)

Shares Treasury Shares Shares Issued and

Issued Shares Outstanding Outstanding

Balance December 31, 1997.................................. 1,366,090 168,202 1,197,888 1,087,156

Common stock issued in connection

with acquisitions of businesses ........................... 168,670 (9,709) 178,379 3,174,677

Conversions of Class A common stock

to Class B common stock and other .................... (26,732) (26,732) 808,546

Retirement of treasury shares ................................ (158,493)(158,493)

Balance December 31, 1998.................................. 1,349,535 0 1,349,535 5,070,379

Conversions of Class A common stock

to Class B common stock and other .................... (7,872)_______ (7,872) 296,576

Balance December 31, 1999.................................. 1,341,663 0 1,341,663 5,366,955

Common stock issued in connection

with acquisitions of businesses ........................... 3,572 3,572 1,626

Conversions of Class A common stock

to Class B common stock and other .................... (1,331) (1,331) 101,205

Balance December 31, 2000.................................. 1,343,904 0 1,343,904 5,469,786

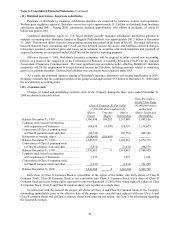

Each share of Class A Common Stock is convertible, at the option of the holder, into thirty shares of Class B

Common Stock. Class B Common Stock is not convertible into Class A Common Stock. Each share of Class B

Common Stock possesses voting rights equivalent to one-two-hundredth (1/200) of the voting rights of a share of Class

A Common Stock. Class A and Class B common shares vote together as a single class.

In connection with the General Re merger, all shares of Class A and Class B Common Stock of the Company

outstanding immediately prior to the effective date of the merger were canceled and replaced with new Class A and

Class B common shares and all Class A treasury shares were canceled and retired. See Note 2 for information regarding

the General Re merger.