Berkshire Hathaway 2000 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Notes to Consolidated Financial Statements (Continued)

(15) Insurance premium and supplemental cash flow information (Continued)

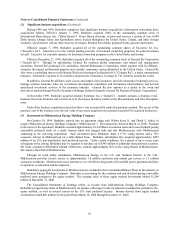

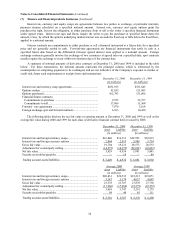

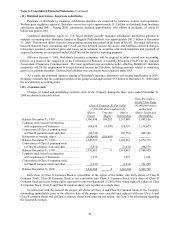

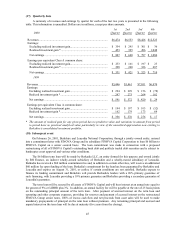

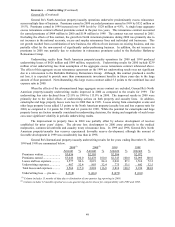

A summary of supplemental cash flow information is presented in the following table (in millions):

2000 1999 1998

Cash paid during the year for:

Income taxes .......................................................................................................... $1,396 $2,215 $1,703

Interest of finance and financial products businesses ............................................... 794 513 21

Other interest.......................................................................................................... 157 136 111

Non-cash investing and financing activities:

Liabilities assumed in connection with acquisitions of businesses............................ 901 61 36,064

Common shares issued in connection with acquisitions of businesses ...................... 224 — 22,795

Contingent value of Exchange Notes recognized in earnings ................................... 117 87 54

Value of equity securities used to redeem Exchange Notes ...................................... 278 298 344

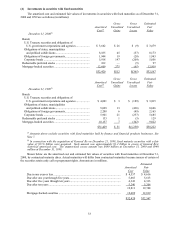

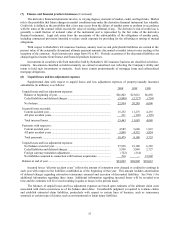

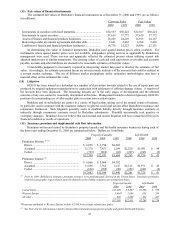

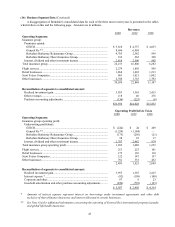

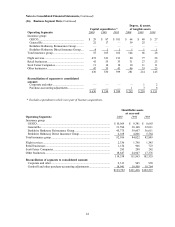

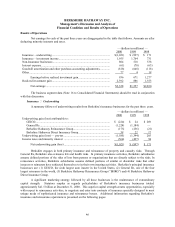

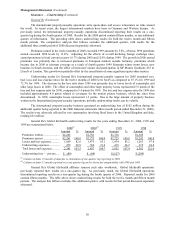

(16) Business Segment Data

SFAS No. 131 requires certain disclosures about operating segments in a manner that is consistent with how

management evaluates the performance of the segment. Information related to Berkshire’s reportable business operating

segments is shown below.

Business Identity

Business Activity

GEICO Underwriting private passenger automobile insurance

mainly by direct response methods

General Re Underwriting excess-of-loss, quota-share and facultative

reinsurance worldwide

Berkshire Hathaway Reinsurance Group Underwriting excess-of-loss and quota-share reinsurance for

property and casualty insurers and reinsurers

Berkshire Hathaway Direct Insurance Group Underwriting multiple lines of property and casualty

insurance policies for primarily commercial accounts

FlightSafety and Executive Jet (“Flight Services”) Training to operators of aircraft and ships and providing

fractional ownership programs for general aviation aircraft

Nebraska Furniture Mart, R.C. Willey Home

Furnishings, Star Furniture Company, Jordan’s

Furniture, Borsheim’s, Helzberg’s Diamond

Shops and Ben Bridge Jeweler (“Retail

Businesses”)

Retail sales of home furnishings, appliances, electronics,

fine jewelry and gifts

Scott Fetzer Companies Diversified manufacturing and distribution of various

consumer and commercial products with principal brand

names including Kirby and Campbell Hausfeld

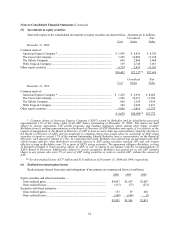

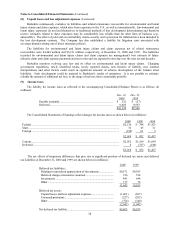

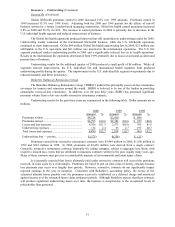

Other businesses not specifically identified above consist of: Buffalo News, a daily newspaper publisher in

Western New York; International Dairy Queen, which licenses and services a system of almost 6,000 Dairy Queen

stores; See’s Candies, a manufacturer and distributor of boxed chocolates and other confectionery products; H.H. Brown

Shoe, Lowell Shoe, Dexter Shoe and Justin Brands, manufacturers and distributors of footwear and Acme Building

Brands, a manufacturer and distributor of building materials. This group of businesses also includes several

independently operated finance and financial products businesses. In 2000, other businesses also include CORT

Business Services, a leading national provider of rental furniture and related services and Benjamin Moore, a

formulator, manufacturer and retailer of a range of architectural and industrial coatings and paints.

General Re’s reinsurance business is included as a separate reportable segment beginning in 1999.