Berkshire Hathaway 2000 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Insurance — Underwriting (Continued)

General Re (Continued)

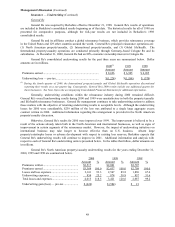

Global life/health premiums earned in 2000 increased 2.8% over 1999 amounts. Premiums earned in

1999 increased 33.5% over 1998 levels. Adjusting both the 2000 and 1999 periods for the effects of run-off

business written by a former London-based managing underwriter, Global life/health earned premiums increased

9.8% in 2000 and 20.3% in 1999. The increase in earned premiums in 2000 is primarily due to increases in the

U.S. individual health segment and reduced retrocessions of business.

The Global life/health operations produced improved but still unsatisfactory underwriting results for 2000.

Underwriting results weakened in the international life/health business, while the U.S. life/health operations

continued to show improvement. Of the $84 million Global life/health underwriting loss in 2000, $23 million was

attributable to the U.S. operations and $61 million was incurred in the international operations. The U.S. life

segment produced modest underwriting profits in 2000 and a significantly reduced loss in its health operations.

Results in the international life operations deteriorated from 1999, primarily due to losses on personal accident and

pension lines of business.

Underwriting results for the additional quarter of 2000 produced a small profit of $4 million. While all

segments showed improvement, the U.S. individual life and international health segments both produced

underwriting profits during the quarter. The improvement in the U.S. individual life segment was primarily due to

reduced mortality and better persistency.

Berkshire Hathaway Reinsurance Group

The Berkshire Hathaway Reinsurance Group (“BHRG”) underwrites principally excess-of-loss reinsurance

coverages for insurers and reinsurers around the world. BHRG is believed to be one of the leaders in providing

catastrophe excess-of-loss reinsurance. In addition, over the past three years, BHRG has generated significant

premium volume from a few very sizable retroactive reinsurance contracts.

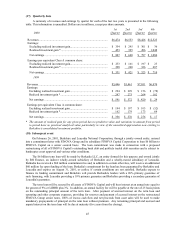

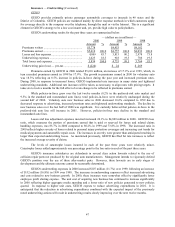

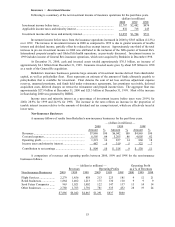

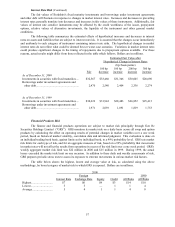

Underwriting results for the past three years are summarized in the following table. Dollar amounts are in

millions.

2000 1999 1998

Amount %Amount %Amount %

Premiums written ................................................... $4,724 $2,410 $ 986

Premiums earned .................................................... $4,705 100.0 $2,382 100.0 $ 939 100.0

Losses and loss expenses......................................... 4,766 101.3 2,573 108.0 765 81.5

Underwriting expenses ........................................... 114 2.4 65 2.7 195 20.7

Total losses and expenses........................................ 4,880 103.7 2,638 110.7 960 102.2

Underwriting loss — pre-tax................................... $ (175)$(256)$ (21)

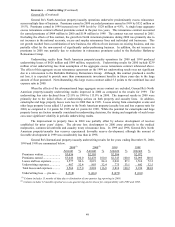

Premiums earned from retroactive reinsurance contracts were $3,944 million in 2000, $1,508 million in

1999 and $343 million in 1998. In 2000, premiums of $2,438 million were derived from a single contract.

Generally, retroactive reinsurance contracts indemnify the ceding company, subject to aggregate loss limits, with

respect to insured loss events that are attributed to insurance contracts written in the past, usually many years ago.

Many of these contracts may give rise to considerable amounts of environmental and latent injury claims.

It is generally expected that losses ultimately paid under retroactive contracts will exceed the premiums

received, in some cases by a wide margin. Premiums are based in part on time-value-of-money concepts because

loss payments may occur over lengthy time periods. However, retroactive contracts do not significantly impact

reported earnings in the year of inception. Consistent with Berkshire’s accounting policy, the excess of the

estimated ultimate losses payable over the premiums received is established as a deferred charge and amortized

against income over the estimated future claim settlement periods. Although Berkshire expects that these contracts

will produce significant underwriting losses over time, the business is accepted due to the exceptional levels of

policyholder float generated.