Berkshire Hathaway 2000 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

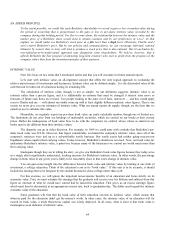

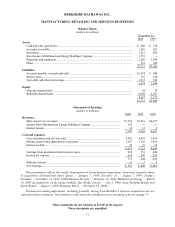

BERKSHIRE HATHAWAY INC.

INSURANCE GROUP

Balance Sheets

(dollars in millions)

December 31,

2000 1999

Assets

Investments:

Fixed maturities at market................................................................................................. $32,381 $30,217

Equity securities and other investments at market:

American Express Company........................................................................................ 8,147 8,218

The Coca-Cola Company ............................................................................................. 12,159 11,622

Freddie Mac................................................................................................................. 146 2,803

The Gillette Company.................................................................................................. 3,468 3,954

Wells Fargo & Company.............................................................................................. 2,964 2,316

Other ........................................................................................................................... 12,008 10,256

71,273 69,386

Cash and cash equivalents.................................................................................................... 4,700 2,981

Deferred costs ...................................................................................................................... 3,508 2,309

Other ................................................................................................................................... 12,808 9,490

$92,289 $84,166

Liabilities

Losses and loss adjustment expenses .................................................................................... $33,022 $26,802

Unearned premiums............................................................................................................. 3,885 3,718

Policyholder liabilities and other accruals ............................................................................ 6,986 6,537

Income taxes, principally deferred........................................................................................ 9,729 9,430

53,622 46,487

Equity

Minority shareholders’ ......................................................................................................... 1,157 1,337

Berkshire shareholders’ ....................................................................................................... 37,510 36,342

38,667 37,679

$92,289 $84,166

Statements of Earnings

(dollars in millions)

2000 1999 1998

Premiums written .................................................................................................... $19,662 $14,667 $5,476

Premiums earned ..................................................................................................... $19,343 $14,306 $5,300

Losses and loss expenses.......................................................................................... 17,326 12,518 3,904

Underwriting expenses ............................................................................................ 3,602 3,182 1,131

Total losses and expenses...................................................................................... 20,928 15,700 5,035

Underwriting gain (loss) — pre-tax ......................................................................... (1,585) (1,394) 265

Net investment income* .......................................................................................... 2,811 2,488 974

Realized investment gain ......................................................................................... 3,920 1,364 2,462

Earnings before income taxes .................................................................................. 5,146 2,458 3,701

Income tax expense.................................................................................................. 1,604 672 1,186

3,542 1,786 2,515

Minority interest...................................................................................................... 230 35 17

Net earnings ............................................................................................................ $ 3,312 $ 1,751 $2,498

* Net investment income is summarized below:

Dividends....................................................................................................................... $ 493 $ 476 $363

Interest........................................................................................................................... 2,340 2,030 621

Investment expenses........................................................................................................ (22) (18) (10)

$2,811 $2,488 $974

These statements do not conform to GAAP in all respects

These statements are unaudited