Berkshire Hathaway 2000 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16

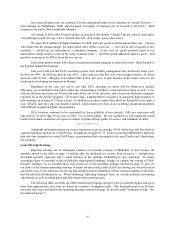

On a more pleasant note, we continue to be the undisputed leader in two branches of Aircraft Services

pilot training at FlightSafety (FSI) and fractional ownership of business jets at Executive Jet (EJA). Both

companies are run by their remarkable founders.

Al Ueltschi at FSI is now 83 and continues to operate at full throttle. Though I am not a fan of stock splits,

I am planning to split Al’s age 2-for-1 when he hits 100. (If it works, guess who’s next.)

We spent $272 million on flight simulators in 2000, and we’ll spend a similar amount this year. Anyone

who thinks that the annual charges for depreciation don’t reflect a real cost every bit as real as payroll or raw

materials should get an internship at a simulator company. Every year we spend amounts equal to our

depreciation charge simply to stay in the same economic place and then spend additional sums to grow. And

growth is in prospect for FSI as far as the eye can see.

Even faster growth awaits EJA (whose fractional-ownership program is called NetJets). Rich Santulli is

the dynamo behind this business.

Last year I told you that EJA’s recurring revenue from monthly management fees and hourly usage grew

by 46% in 1999. In 2000 the growth was 49%. I also told you that this was a low-margin business, in which

survivors will be few. Margins were indeed slim at EJA last year, in part because of the major costs we are

incurring in developing our business in Europe.

Regardless of the cost, you can be sure that EJA’s spending on safety will be whatever is needed.

Obviously, we would follow this policy under any circumstances, but there’s some self-interest here as well: I, my

wife, my children, my sisters, my 94-year-old aunt, all but one of our directors, and at least nine Berkshire managers

regularly fly in the NetJets program. Given that cargo, I applaud Rich’s insistence on unusually high amounts of

pilot training (an average of 23 days a year). In addition, our pilots cement their skills by flying 800 or so hours a

year. Finally, each flies only one model of aircraft, which means our crews do no switching around among planes

with different cockpit and flight characteristics.

EJA’s business continues to be constrained by the availability of new aircraft. Still, our custo mers will

take delivery of more than 50 new jets in 2001, 7% of world output. We are confident we will remain the world

leader in fractional ownership, in respect to number of planes flying, quality of service, and standards of safety.

* * * * * * * * * *

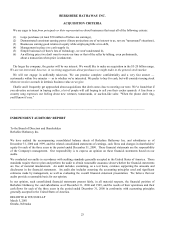

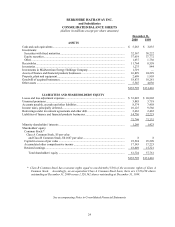

Additional information about our various businesses is given on pages 42-58, where you will also find our

segment earnings reported on a GAAP basis. In addition, on pages 67-73, we have rearranged Berkshire’s financial

data into four segments on a non-GAAP basis, a presentation that corresponds to the way Charlie and I think about

the company.

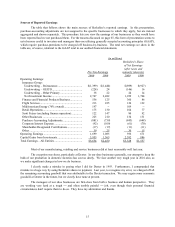

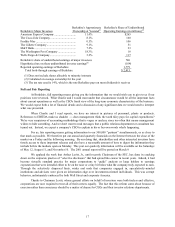

Look-Through Earnings

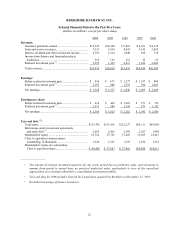

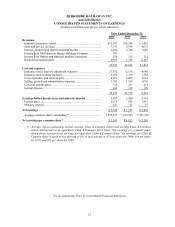

Reported earnings are an inadequate measure of economic progress at Berkshire, in part because the

numbers shown in the table on page 15 include only the dividends we receive from investees though these

dividends typically represent only a small fraction of the earnings attributable to our ownership. To depict

something closer to economic reality at Berkshire than reported earnings, though, we employ the concept of "look-

through" earnings. As we calculate these, they consist of: (1) the operating earnings reported on page 15; plus; (2)

our share of the retained operating earnings of major investees that, under GAAP accounting, are not reflected in

our profits, less; (3) an allowance for the tax that would be paid by Berkshire if these retained earnings of investees

had instead been distributed to us. When tabulating "operating earnings" here, we exclude purchase-accounting

adjustments as well as capital gains and other major non-recurring items.

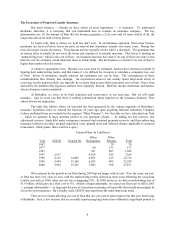

The following table sets forth our 2000 look-through earnings, though I warn you that the figures can be no

more than approximate, since they are based on a number of judgment calls. (The dividends paid to us by these

investees have been included in the operating earnings itemized on page 15, mostly under "Insurance Group: Net

Investment Income.")