Berkshire Hathaway 2000 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Management's Discussion (Continued)

Insurance — Underwriting (Continued)

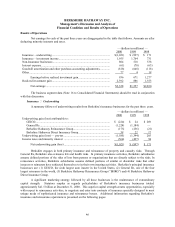

General Re

General Re was acquired by Berkshire effective December 21, 1998. General Re’s results of operations

are included in Berkshire’s consolidated results beginning as of that date. The historical results for all of 1998 are

presented for comparative purposes, although the full-year results are not included in Berkshire’s 1998

consolidated results.

General Re and its affiliates conduct a global reinsurance business, which provides reinsurance coverage

in the United States and 129 other countries around the world. General Re’s principal reinsurance operations are:

(1) North American property/casualty, (2) International property/casualty, and (3) Global life/health. The

International property/casualty operations are conducted primarily through Germany-based Cologne Re and its

subsidiaries. At December 31, 2000, General Re had an 88% economic ownership interest in Cologne Re.

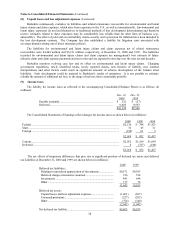

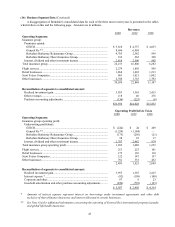

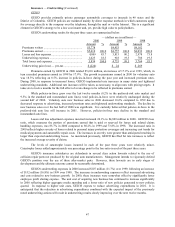

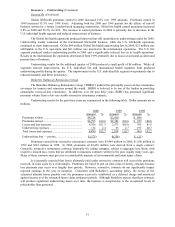

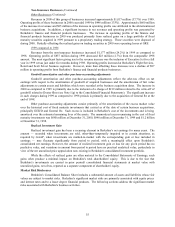

General Re’s consolid ated underwriting results for the past three years are summarized below. Dollar

amounts are in millions.

2000

(1)

1999 1998

Amount Amount Amount

Premiums earned .......................................................................... $ 8,696 $ 6,905 $ 6,095

Underwriting loss — pre-tax......................................................... $(1,224)$(1,184) $ (370)

(1) During the fourth quarter of 2000, the International property/casualty and Global life/health operations discontinued

reporting their results on a one-quarter lag. Consequently, General Re’s 2000 results include one additional quarter for

these businesses. See Note 1(a) to the accompanying Consolidated Financial Statements for additional information.

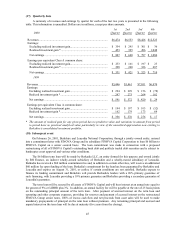

Generally, underwriting conditions within the reinsurance industry during 2000 remained difficult.

General Re’s overall underwriting results during 2000 and 1999 were unsatisfactory in both the property/casualty

and life/health reinsurance businesses. General Re management continues to take underwriting actions to address

these matters with the objective of returning underwriting results to acceptable levels. Although the underwriting

losses for 2000 were considerable, $239 million of the loss was attributed to a single large aggregate excess

contract written in 2000. Additional information regarding this arrangement is provided in the North American

property/casualty discussion.

Otherwise, General Re’s results for 2000 were improved over 1999. The improvement is believed to be a

result of the actions already taken both in the North American and international businesses, as well as signs of

improvement in certain segments of the reinsurance market. However, the impact of underwriting initiatives on

international business may take longer to become effective than on U.S. business. Absent large

property/catastrophe losses or adverse development with respect to existing loss reserves, Berkshire expects that

General Re’s underwriting results will continue to improve in 2001. Additional information and analysis with

respect to each of General Re’s underwriting units is presented below. In the tables that follow, dollar amounts are

in millions.

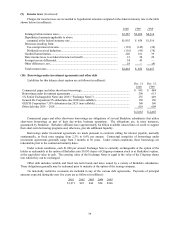

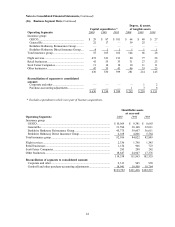

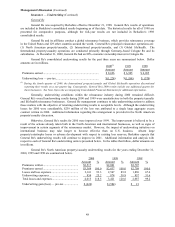

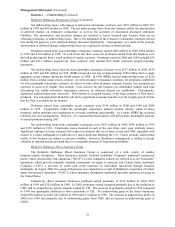

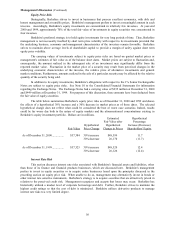

General Re’s North American property/casualty underwriting results for the years ending December 31,

2000, 1999 and 1998 are summarized below.

2000 1999 1998

Amount %Amount %Amount %

Premiums written............................................... $3,517 $2,801 $2,707

Premiums earned ............................................... $3,389 100.0 $2,837 100.0 $2,708 100.0

Losses and loss expenses.................................... 3,161 93.3 2,547 89.8 1,830 67.6

Underwriting expenses....................................... 854 25.2 874 30.8 857 31.6

Total losses and expenses................................... 4,015 118.5 3,421 120.6 2,687 99.2

Underwriting gain (loss) — pre-tax ................... $ (626)$ (584)$ 21