Berkshire Hathaway 2000 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

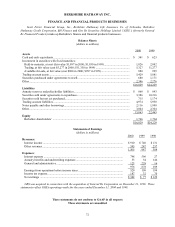

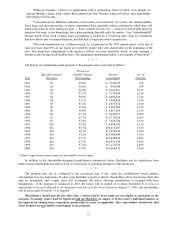

BERKSHIRE HATHAWAY INC.

FINANCE AND FINANCIAL PRODUCTS BUSINESSES

Scott Fetzer Financial Group, Inc., Berkshire Hathaway Life Insurance Co. of Nebraska, Berkshire

Hathaway Credit Corporation, BH Finance and Gen Re Securities Holdings Limited (“GRS”) (formerly General

Re Financial Products) make up Berkshire's finance and financial products businesses.

Balance Sheets

(dollars in millions)

2000 1999

Assets

Cash and cash equivalents ..................................................................................................... $ 341 $ 623

Investment in securities with fixed maturities:

Held-to-maturity, at cost (fair value $1,897 in 2000; $1,930 in 1999).................................. 1,826 2,002

Trading, at fair value (cost $5,277 in 2000; $11,330 in 1999) ............................................. 5,327 11,277

Available-for-sale, at fair value (cost $880 in 2000; $997 in 1999)...................................... 880 999

Trading account assets........................................................................................................... 5,429 5,881

Securities purchased under agreements to resell..................................................................... 680 1,171

Other ..................................................................................................................................... 2,346 2,276

$16,829 $24,229

Liabilities

Annuity reserves and policyholder liabilities.......................................................................... $ 868 $ 843

Securities sold under agreements to repurchase...................................................................... 3,386 10,216

Securities sold but not yet purchased...................................................................................... 715 1,174

Trading account liabilities ..................................................................................................... 4,974 5,930

Notes payable and other borrowings....................................................................................... 2,116 1,998

Other ..................................................................................................................................... 3,004 2,304

15,063 22,465

Equity

Berkshire shareholders’ ...................................................................................................... 1,766 1,764

$16,829 $24,229

Statements of Earnings

(dollars in millions)

2000 1999 1998

Revenues:

Interest income .......................................................................................................... $ 910 $ 740 $ 131

Other revenues........................................................................................................... 595 247 257

1,505 987 388

Expenses:

Interest expense ......................................................................................................... 798 596 27

Annuity benefits and underwriting expenses .............................................................. 55 54 146

General and administrative ........................................................................................ 123 228 16

976 878 189

Earnings from operations before income taxes ........................................................... 529 109 199

Income tax expense.................................................................................................... 187 32 70

Net earnings .............................................................................................................. $ 342 $ 77 $ 129

GRS was acquired in connection with the acquisition of General Re Corporation on December 21, 1998. These

statements reflect GRS’s operating results for the years ended December 31, 2000 and 1999.

These statements do not conform to GAAP in all respects

These statements are unaudited