Berkshire Hathaway 2000 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

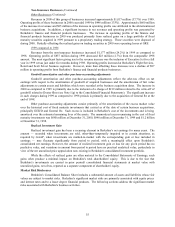

Interest Rate Risk (Continued)

The fair values of Berkshire's fixed maturity investments and borrowings under investment agreements

and other debt will fluctuate in response to changes in market interest rates. Increases and decreases in prevailing

interest rates generally translate into decreases and increases in fair values of those instruments. Additionally, fair

values of interest rate sensitive instruments may be affected by the credit worthiness of the issuer, prepayment

options, relative values of alternative investments, the liquidity of the instrument and other general market

conditions.

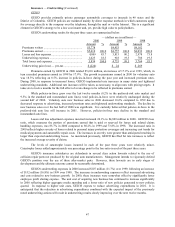

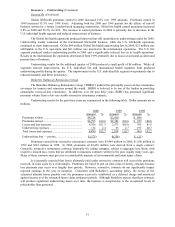

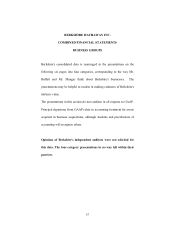

The following table summarizes the estimated effects of hypothetical increases and decreases in interest

rates on assets and liabilities that are subject to interest rate risk. It is assumed that the changes occur immediately

and uniformly to each category of instrument containing interest rate risks. The hypothetical changes in market

interest rates do not reflect what could be deemed best or worst case scenarios. Variations in market interest rates

could produce significant changes in the timing of repayments due to prepayment options available. For these

reasons, actual results might differ from those reflected in the table which follows. Dollars are in millions.

Estimated Fair Value after

Hypothetical Change in Interest Rates

(bp=basis points)

100 bp 100 bp 200 bp 300 bp

Fair decrease increase increase increase

As of December 31, 2000

Investments in securities with fixed maturities.... $32,567 $33,466 $31,346 $30,005 $28,690

Borrowings under investment agreements and

other debt......................................................... 2,470 2,540 2,404 2,336 2,274

As of December 31, 1999

Investments in securities with fixed maturities.... $30,222 $31,942 $28,483 $26,852 $25,413

Borrowings under investment agreements and

other debt......................................................... 1,971 2,059 1,891 1,819 1,753

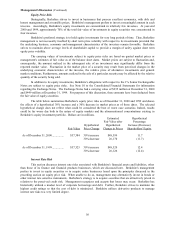

Financial Products Risk

The finance and financial products operations are subject to market risk principally through Gen Re

Securities Holdings Limited (“GRS”). GRS monitors its market risk on a daily basis across all swap and option

products by calculating the effect on operating results of potential changes in market variables over a one week

period, based on historical market volatility, correlation data and informed judgment. This evaluation is done on

an individual trading book basis, against limits set by individual book, to a 99% probability level. GRS sets market

risk limits for each type of risk, and for an aggregate measure of risk, based on a 99% probability that movements

in market rates will not affect the results from operations in excess of the risk limit over a one week period. GRS’s

weekly aggregate market risk limit was $22 million in 2000 and $15 million in 1999. During 1999, the actual

losses exceeded the market risk limit on one occasion. In addition to these daily and weekly assessments of risk,

GRS prepares periodic stress tests to assess its exposure to extreme movements in various market risk factors.

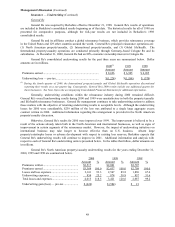

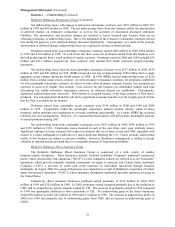

The table below shows the highest, lowest and average value at risk, as calculated using the above

methodology, by broad category of market risk to which GRS is exposed. Dollars are in millions.

2000

Foreign 1999

Interest Rate Exchange Rate Equity Credit All Risks All Risks

Highest ............................ $7 $6 $4 $3 $14 $10

Lowest............................. 3 3 — 1 1 4

Average ........................... 5 4 1 1 4 8