Berkshire Hathaway 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

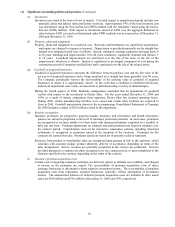

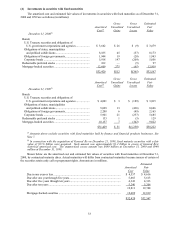

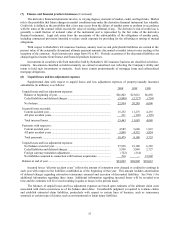

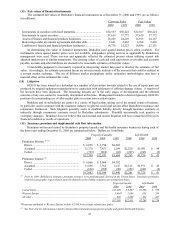

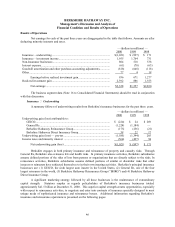

(9) Income taxes (Continued)

Charges for income taxes are reconciled to hypothetical amounts computed at the federal statutory rate in the table

shown below (in millions):

2000 1999 1998

Earnings before income taxes.............................................................................. $5,587 $2,450 $4,314

Hypothetical amounts applicable to above

computed at the federal statutory rate ............................................................... $1,955 $ 858 $1,510

Decreases resulting from:

Tax-exempt interest income ............................................................................. (135) (145) (30)

Dividends received deduction........................................................................... (116) (95) (78)

Goodwill amortization ........................................................................................ 240 161 39

State income taxes, less federal income tax benefit .............................................. 21 28 20

Foreign tax rate differential................................................................................. 34 45 —

Other differences, net.......................................................................................... 19 — (4)

Total income taxes.............................................................................................. $2,018 $ 852 $1,457

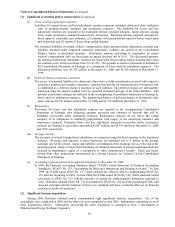

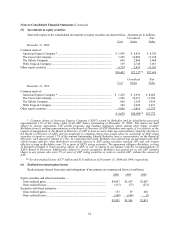

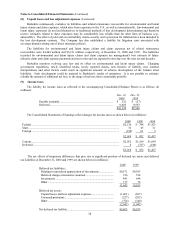

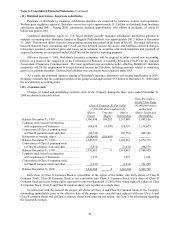

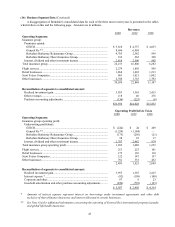

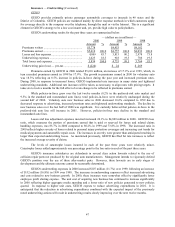

(10) Borrowings under investment agreements and other debt

Liabilities for this balance sheet caption are as follows (in millions): Dec. 31, Dec. 31,

2000 1999

Commercial paper and other short-term borrowings................................................................ $ 991 $ 484

Borrowings under investment agreements............................................................................... 508 613

1% Senior Exchangeable Notes due 2001 (“Exchange Notes”) ............................................... 235 449

General Re Corporation 9% debentures due 2009 (non-callable)............................................. 150 150

GEICO Corporation 7.35% debentures due 2023 (non-callable).............................................. 160 160

Other debt due 2001 – 2028 ................................................................................................... 619 609

$ 2,663 $ 2,465

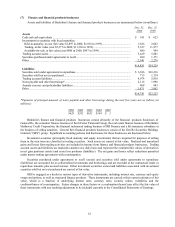

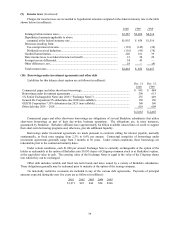

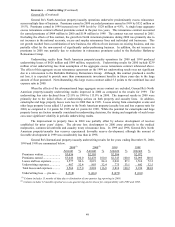

Commercial paper and other short-term borrowings are obligations of several Berkshire subsidiaries that utilize

short-term borrowings as part of their day-to-day business operations. The obligations are, in most instances,

guaranteed by Berkshire. Berkshire affiliates have approximately $4 billion available unused lines of credit to support

their short-term borrowing programs and, otherwise, provide additional liquidity.

Borrowings under investment agreements are made pursuant to contracts calling for interest payable, normally

semiannually, at fixed rates ranging from 2.5% to 8.6% per annum. Contractual maturities of borrowings under

investment agreements generally range from 3 months to 30 years. Under certain conditions, these borrowings are

redeemable prior to the contractual maturity dates.

Under certain conditions, each $1,000 par amount Exchange Note is currently exchangeable at the option of the

holder or redeemable at the option of Berkshire into 59.833 shares of Citigroup common stock or at Berkshire’s option,

at the equivalent value in cash. The carrying value of the Exchange Notes is equal to the value of the Citigroup shares

into which they can be exchanged.

Other debt includes variable and fixed rate term bonds and notes issued by a variety of Berkshire subsidiaries.

These obligations generally may be redeemed prior to maturity at the option of the issuing company.

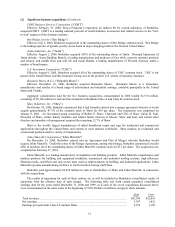

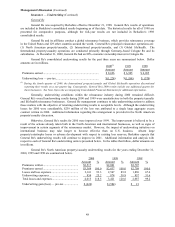

No materially restrictive covenants are included in any of the various debt agreements. Payments of principal

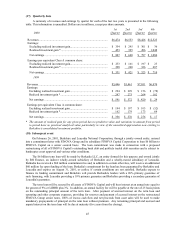

amounts expected during the next five years are as follows (in millions):

2001 2002 2003 2004 2005

$1,271 $22 $46 $24 $266