Berkshire Hathaway 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

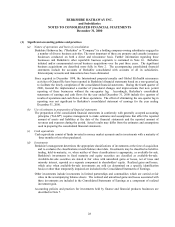

(2) Significant business acquisitions (Continued)

CORT Business Services Corporation (“CORT”)

Effective February 18, 2000, Wesco Financial Corporation, an indirect 80.1% owned subsidiary of Berkshire,

acquired CORT. CORT is a leading national provider of rental furniture, accessories and related services in the "rent-

to-rent" segment of the furniture industry.

Ben Bridge Jeweler ("Ben Bridge")

Effective July 3, 2000, Berkshire acquired all of the outstanding shares of Ben Bridge common stock. Ben Bridge

is the leading operator of upscale jewelry stores based in major shopping malls in the Western United States.

Justin Industries, Inc. ("Justin")

Effective August 1, 2000, Berkshire acquired 100% of the outstanding shares of Justin. Principal businesses of

Justin include: Acme Building Brands, a leading manufacturer and producer of face brick, concrete masonry products

and ceramic and marble floor and wall tile and Justin Brands, a leading manufacturer of Western footwear under a

number of brand names.

U.S. Investment Corporation ("USIC")

Effective August 8, 2000, Berkshire acquired all of the outstanding shares of USIC common stock. USIC is the

parent of the United States Liability Insurance Group, one of the premier U.S. writers of specialty insurance.

Benjamin Moore & Co. (“Benjamin Moore”)

Effective December 18, 2000, Berkshire acquired Benjamin Moore. Benjamin Moore is a formulator,

manufacturer and retailer of a broad range of architectural and industrial coatings, available principally in the United

States and Canada.

Aggregate consideration paid for the five business acquisitions consummated in 2000 totaled $2,370 million,

consisting of $2,146 million in cash and the remainder in Berkshire Class A and Class B common stock.

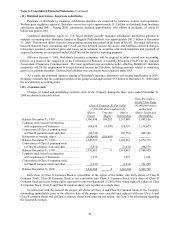

Shaw Industries, Inc. (“Shaw”)

On October 20, 2000, Berkshire announced that it had formally entered into a merger agreement whereby it would

acquire approximately 87.3% of the common stock of Shaw for $19 per share. The transaction was completed on

January 8, 2001. An investment group consisting of Robert E. Shaw, Chairman and CEO of Shaw, Julian D. Saul,

President of Shaw, certain family members and related family interests of Messrs. Shaw and Saul, and certain other

directors and members of management acquired the remaining 12.7% of Shaw.

Shaw is the world's largest manufacturer of tufted broadloom carpet and rugs for residential and commercial

applications throughout the United States and exports to most markets worldwide. Shaw markets its residential and

commercial products under a variety of brand names.

Johns Manville Corporation ("Johns Manville")

On December 19, 2000, Berkshire entered into an Agreement and Plan of Merger whereby Berkshire would

acquire Johns Manville. Under the terms of the Merger Agreement, among other things, Berkshire commenced a tender

offer to purchase all of the outstanding shares of Johns Manville common stock for $13 per share. The acquisition was

completed on February 27, 2001.

Johns Manville is a leading manufacturer of insulation and building products. Johns Manville manufactures and

markets products for building and equipment insulation, commercial and industrial roofing systems, high-efficiency

filtration media, and fibers and non-woven mats used as reinforcements in building and industrial applications. Johns

Manville operates manufacturing facilities in North America, Europe and China.

Berkshire paid approximately $3,830 million in cash to shareholders of Shaw and Johns Manville in connection

with the acquisitions.

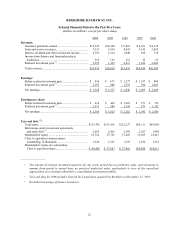

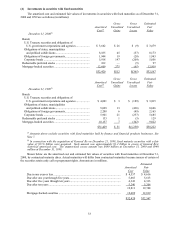

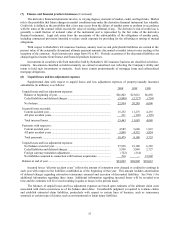

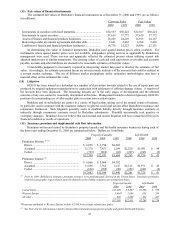

The results of operations for each of these entities are or will be included in Berkshire's consolidated results of

operations from the effective date of each merger. The following table sets forth certain unaudited consolidated

earnings data for the years ended December 31, 2000 and 1999, as if each of the seven acquisitions discussed above

were consummated on the same terms at the beginning of 1999. Dollars in millions except per share amounts.

2000 1999

Total revenues.................................................................................................................... $41,396 $32,014

Net earnings....................................................................................................................... 3,347 1,812

Earnings per equivalent Class A Common Share ................................................................. 2,195 1,189