Berkshire Hathaway 2000 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

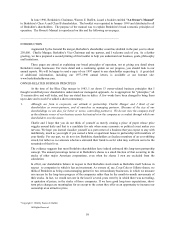

Charlie and I mainly attend to capital allocation and the care and feeding of our key managers. Most of these

managers are happiest when they are left alone to run their businesses, and that is customarily just how we leave them. That

puts them in charge of all operating decisions and of dispatching the excess cash they generate to headquarters. By sending

it to us, they don't get diverted by the various enticements that would come their way were they responsible for deploying

the cash their businesses throw off. Furthermore, Charlie and I are exposed to a much wider range of possibilities for

investing these funds than any of our managers could find in his or her own industry.

Most of our managers are independently wealthy, and it's therefore up to us to create a climate that encourages

them to choose working with Berkshire over golfing or fishing. This leaves us needing to treat them fairly and in the

manner that we would wish to be treated if our positions were reversed.

As for the allocation of capital, that's an activity both Charlie and I enjoy and in which we have acquired some

useful experience. In a general sense, grey hair doesn't hurt on this playing field: You don't need good hand-eye

coordination or well-toned muscles to push money around (thank heavens). As long as our minds continue to function

effectively, Charlie and I can keep on doing our jobs pretty much as we have in the past.

On my death, Berkshire's ownership picture will change but not in a disruptive way: First, only about 1% of my

stock will have to be sold to take care of bequests and taxes; second, the balance of my stock will go to my wife, Susan, if

she survives me, or to a family foundation if she doesn't. In either event, Berkshire will possess a controlling shareholder

guided by the same philosophy and objectives that now set our course.

At that juncture, the Buffett family will not be involved in managing the business, only in picking and overseeing

the managers who do. Just who those managers will be, of course, depends on the date of my death. But I can anticipate

what the management structure will be: Essentially my job will be split into two parts, with one executive becoming

responsible for investments and another for operations. If the acquisition of new businesses is in prospect, the two will

cooperate in making the decisions needed. Both executives will report to a board of directors who will be responsive to the

controlling shareholder, whose interests will in turn be aligned with yours.

Were we to need the management structure I have just described on an immediate basis, my family and a few key

individuals know who I would pick to fill both posts. Both currently work for Berkshire and are people in whom I have total

confidence.

I will continue to keep my family posted on the succession issue. Since Berkshire stock will make up virtually my

entire estate and will account for a similar portion of the assets of either my wife or the foundation for a considerable period

after my death, you can be sure that I have thought through the succession question carefully. You can be equally sure that

the principles we have employed to date in running Berkshire will continue to guide the managers who succeed me.

Lest we end on a morbid note, I also want to assure you that I have never felt better. I love running Berkshire, and

if enjoying life promotes longevity, Methuselah's record is in jeopardy.

Warren E. Buffett

Chairman