Berkshire Hathaway 2000 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

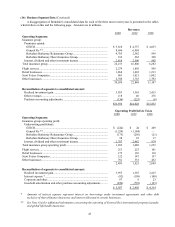

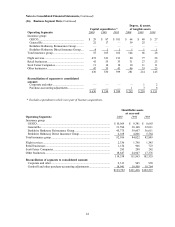

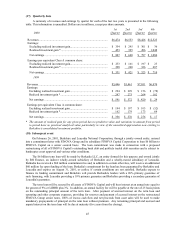

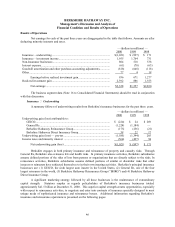

Management's Discussion (Continued)

Insurance — Underwriting (Continued)

Berkshire Hathaway Reinsurance Group (Continued)

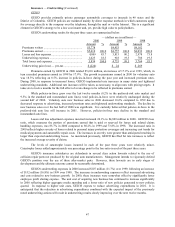

Net underwriting losses with respect to retroactive reinsurance contracts were $191 million in 2000, $97

million in 1999 and $90 million in 1998. The net underwriting losses from this business reflect the amortization

of deferred charges on retroactive reinsurance as well as the accretion of discounted structured settlement

liabilities. The amortization and accretion charges are reported as losses incurred and, because there are no

offsetting premiums, as underwriting losses. Due to the magnitude of the retroactive reinsurance contracts entered

into during the past two years, deferred charges increased significantly. Consequently, as a result of the periodic

amortization of deferred charges, underwriting losses are expected to increase in future periods.

Premiums earned from non-catastrophe reinsurance contracts totaled $447 million in 2000, $560 million

in 1999 and $310 million in 1998. In each of the last three years, the premiums earned from this business were

derived predominantly from a small number of sizable contracts. Premiums earned in 2000 and 1999 included $58

million and $113 million, respectively, from contracts with General Re’s North American property/casualty

operations.

Net underwriting losses from the non-catastrophe reinsurance business were $167 million in 2000, $355

million in 1999 and $86 million in 1998. BHRG incurred a net loss of approximately $186 million from a single

aggregate excess contract during the fourth quarter of 2000. In 1999, BHRG had net underwriting losses of $220

million from a similar single excess contract. As with retroactive reinsurance contracts, the premiums established

for non-catastrophe reinsurance contracts are based on time-value-of-money concepts because loss payments are

expected to occur over lengthy time periods. Loss reserves for this business are established without such time

discounting but, unlike retroactive reinsurance contracts, no deferred charges are established. Consequently,

significant underwriting losses can result. This business is accepted because of the large amounts of float that is

produced. It is anticipated that Berkshire will derive significant economic benefits over the lengthy period of time

that the float is available for investment.

Premiums earned from catastrophe excess contracts were $314 million in 2000 and 1999 and $286

million in 1998. Competition within the catastrophe reinsurance markets remains intense, which in many

instances, makes premium rates inadequate or coverage conditions unacceptable. As a result, BHRG has accepted

relatively few new arrangements. However, it is expected that this business will still produce meaningful amounts

of earned premiums during 2001.

Net underwriting gains from catastrophe reinsurance were $183 million in 2000, $196 million in 1999

and $155 million in 1998. Catastrophe losses incurred in each of the past three years were relatively minor.

Significant exposure to losses remains with respect to contracts that are in-force at year-end 2000, especially with

respect to a major earthquake in California or a major hurricane affecting the U.S. Future periodic underwriting

results of this business are subject to extreme volatility. However, Berkshire’s management is willing to accept

volatility in reported results, provided there is a reasonable prospect of long-term profitability.

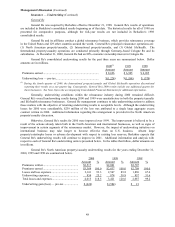

Berkshire Hathaway Direct Insurance Group

The Berkshire Hathaway Direct Insurance Group is comprised of a wide variety of smaller

property/casualty businesses. These businesses include: National Indemnity Company's traditional commercial

motor vehicle and specialty risk operations (“NICO”); several companies collectively referred to as the "homestate"

operations, which provide primarily standard commercial coverages to insureds and Central States Indemnity

Company (“CSI”), a provider of credit card credit insurance to individuals nationwide through financial

institutions. In August 2000, this group of businesses was expanded as a result of Berkshire’s acquisition of United

States Investment Corporation (“USIC”), whose insurance subsidiaries underwrite specialty insurance coverage in

the United States.

Collectively, direct insurance businesses produced earned premiums of $332 million in 2000, $262

million in 1999 and $328 million in 1998. In 2000, premiums earned increased primarily due to the inclusion of

USIC and to comparatively greater amounts earned by CSI. The decrease in premiums earned in 1999 compared

to 1998 was principally attributed to lower premiums at CSI. Net underwriting gains of the direct businesses

totaled $38 million in 2000, $22 million in 1999 and $17 million in 1998. The increase in underwriting profits in

2000 over 1999 was primarily due to underwriting gains from USIC and an increase in underwriting gains at

NICO.