Berkshire Hathaway 2000 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

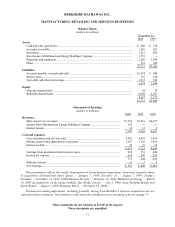

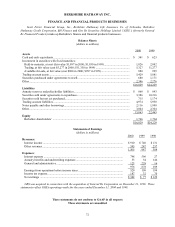

BERKSHIRE HATHAWAY INC.

MANUFACTURING, RETAILING AND SERVICES BUSINESSES

Balance Sheets

(dollars in millions)

December 31,

2000 1999

Assets

Cash and cash equivalents................................................................................................... $ 400 $ 370

Accounts receivable............................................................................................................. 1,226 923

Inventories .......................................................................................................................... 1,215 806

Investments in MidAmerican Energy Holdings Company.................................................... 1,719

Properties and equipment .................................................................................................... 2,250 1,509

Other................................................................................................................................... 921 388

$7,731 $3,996

Liabilities

Accounts payable, accruals and other .................................................................................. $1,674 $ 908

Income taxes ....................................................................................................................... 187 196

Term debt and other borrowings.......................................................................................... 1,213 740

3,074 1,844

Equity

Minority shareholders’ ........................................................................................................ 59 75

Berkshire shareholders’ ....................................................................................................... 4,598 2,077

4,657 2,152

$7,731 $3,996

Statements of Earnings

(dollars in millions)

2000 1999 1998

Revenues:

Sales and service revenues................................................................................... $7,326 $5,918 $4,675

Income from MidAmerican Energy Holdings Company ...................................... 197

Interest income.................................................................................................... 18 11 8

7,541 5,929 4,683

Cost and expenses:

Cost of products and services sold ....................................................................... 4,893 4,061 3,010

Selling, general and administrative expenses....................................................... 1,657 1,126 1,014

Interest on debt.................................................................................................... 85 31 19

6,635 5,218 4,043

Earnings from operations before income taxes..................................................... 906 711 640

Income tax expense ............................................................................................. 334 267 234

572 444 406

Minority interest ................................................................................................. 21 5 5

Net earnings........................................................................................................ $ 551 $ 439 $ 401

This presentation reflects the results of operations of recent business acquisitions from their respective dates

of acquisition; (International Dairy Queen — January 7, 1998; Executive Jet — August 7, 1998; Jordan’s

Furniture — November 13, 1999; CORT Business Services — February 18, 2000; MidAmerican Energy — March

14, 2000 (accounted for on the equity method); Ben Bridge Jeweler — July 3, 2000; Acme Building Brands and

Justin Brands — August 1, 2000; Benjamin Moore — December 18, 2000).

Purchase-accounting adjustments, including goodwill, arising from Berkshire's business acquisitions are not

reflected in these statements, but instead are reflected in the statements of non-operating activities at page 73.

These statements do not conform to GAAP in all respects

These statements are unaudited