Berkshire Hathaway 2000 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Notes to Consolidated Financial Statements (Continued)

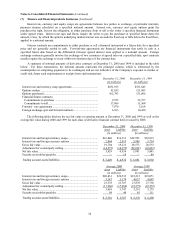

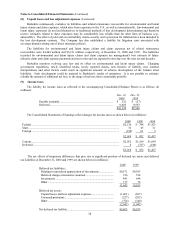

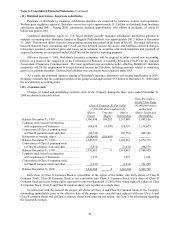

(8) Unpaid losses and loss adjustment expenses (Continued)

Berkshire continuously evaluates its liabilities and related reinsurance recoverable for environmental and latent

injury claims and claim expenses, which arise from exposures in the U.S., as well as internationally. Environmental and

latent injury exposures do not lend themselves to traditional methods of loss development determination and therefore

reserve estimates related to these exposures may be considerably less reliable than for other lines of business (e.g.,

automobile). The effect of joint and several liability claims severity and a provision for inflation have been included in

the loss development estimate. The Company has also established a liability for litigation costs associated with

coverage disputes arising out of direct insurance policies.

The liabilities for environmental and latent injury claims and claim expenses net of related reinsurance

recoverables were $4,444 million and $3,211 million, respectively, at December 31, 2000 and 1999. The liabilities

recorded for environmental and latent injury claims and claim expenses are management’s best estimate of future

ultimate claim and claim expense payments and recoveries and are expected to develop over the next several decades.

Berkshire monitors evolving case law and its effect on environmental and latent injury claims. Changing

government regulations, newly identified toxins, newly reported claims, new theories of liability, new contract

interpretations and other factors could result in significant amounts of adverse development of the balance sheet

liabilities. Such development could be material to Berkshire’s results of operations. It is not possible to estimate

reliably the amount of additional net loss, or the range of net loss, that is reasonably possible.

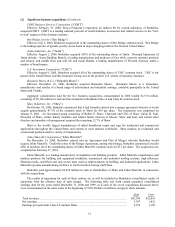

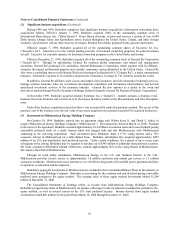

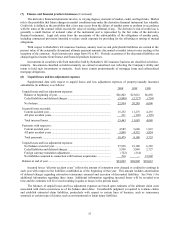

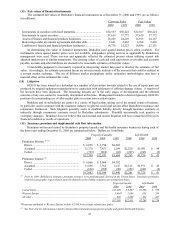

(9) Income taxes

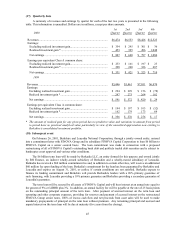

The liability for income taxes as reflected in the accompanying Consolidated Balance Sheets is as follows (in

millions):

Dec. 31, Dec. 31,

2000 1999

Payable currently....................................................................... $ 522 $ (27)

Deferred.................................................................................... 9,603 9,593

$10,125 $9,566

The Consolidated Statements of Earnings reflect charges for income taxes as shown below (in millions):

2000 1999 1998

Federal .................................................................................................................... $2,136 $ 748 $1,421

State ........................................................................................................................ 32 43 31

Foreign.................................................................................................................... (150) 61 5

$2,018 $ 852 $1,457

Current .................................................................................................................... $2,012 $1,189 $1,643

Deferred .................................................................................................................. 6 (337) (186)

$2,018 $ 852 $1,457

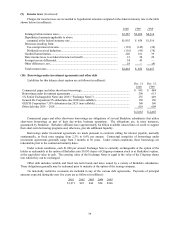

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and deferred

tax liabilities at December 31, 2000 and 1999 are shown below (in millions):

2000 1999

Deferred tax liabilities:

Relating to unrealized appreciation of investments.................... $9,571 $9,383

Deferred charges reinsurance assumed...................................... 916 534

Investments.............................................................................. 441 644

Other ....................................................................................... 717 74

11,645 10,635

Deferred tax assets:

Unpaid losses and loss adjustment expenses ............................. (1,061) (697)

Unearned premiums ................................................................. (227) (205)

Other ....................................................................................... (754) (140)

(2,042) (1,042)

Net deferred tax liability.............................................................. $9,603 $9,593