Berkshire Hathaway 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

A column entitled “Today’s Rumors,” however, would not equate with the self-image of the many news

organizations that think themselves above such stuff. These members of the media would feel that publishing such

acknowledged fluff would be akin to L’Osservatore Romano initiating a gossip column. But rumors are what these

organizations often publish and broadcast, whatever euphemism they duck behind. At a minimum, readers deserve

honest terminology a warning label that will protect their financial health in the same way that smokers whose

physical health is at risk are given a warning.

The Constitution’s First Amendment allows the media to print or say almost anything. Journalism’s First

Principle should require that the media be scrupulous in deciding what that will be.

Miscellaneous

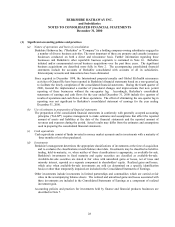

In last year’s report we examined the battle then raging over the use of “pooling” in accounting for

mergers. It seemed to us that both sides were voicing arguments that were strong in certain respects and seriously

flawed in others. We are pleased that the Financial Accounting Standards Board has since gone to an alternative

approach that strikes us as very sound.

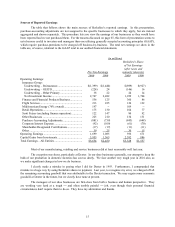

If the proposed rule becomes final, we will no longer incur a large annual charge for amortization of

intangibles. Consequently, our reported earnings will more closely reflect economic reality. (See page 65.) None

of this will have an effect on Berkshire’s intrinsic value. Your Chairman, however, will personally benefit in that

there will be one less item to explain in these letters.

* * * * * * * * * * * *

I’m enclosing a report generously supplied by Outstanding Investor Digest of Charlie’s remarks at

last May’s Wesco annual meeting. Charlie thinks about business economics and investment matters better than

anyone I know, and I’ve learned a lot over the years by listening to him. Reading his comments will improve your

understanding of Berkshire.

* * * * * * * * * * * *

In 1985, we purchased Scott Fetzer, acquiring not only a fine business but the services of Ralph Schey, a

truly outstanding CEO, as well. Ralph was then 61. Most companies, focused on the calendar rather than ability,

would have benefited from Ralph’s talents for only a few years.

At Berkshire, in contrast, Ralph ran Scott Fetzer for 15 years until his retirement at the end of 2000. Under

his leadership, the company distributed $1.03 billion to Berkshire against our net purchase price of $230 million.

We used these funds, in turn, to purchase other businesses. All told, Ralph’s contributions to Berkshire’s present

value extend well into the billions of dollars.

As a manager, Ralph belongs in Berkshire’s Hall of Fame, and Charlie and I welcome him to it.

* * * * * * * * * * * *

A bit of nostalgia: It was exactly 50 years ago that I entered Ben Graham’s class at Columbia. During the

decade before, I had enjoyed make that loved analyzing, buying and selling stocks. But my results were no

better than average.

Beginning in 1951 my performance improved. No, I hadn’t changed my diet or taken up exercise. The

only new ingredient was Ben’s ideas. Quite simply, a few hours spent at the feet of the master proved far more

valuable to me than had ten years of supposedly original thinking.

In addition to being a great teacher, Ben was a wonderful friend. My debt to him is incalculable.