Berkshire Hathaway 2000 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

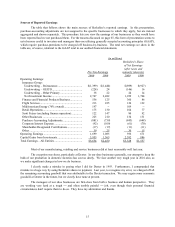

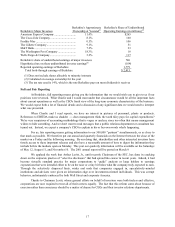

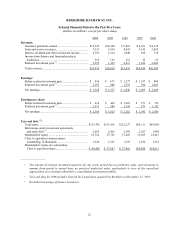

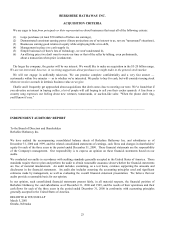

17

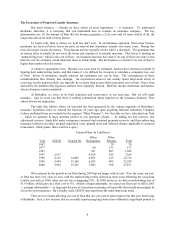

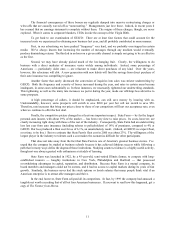

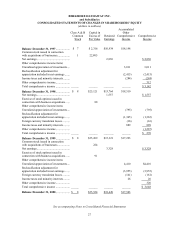

Berkshire's Approximate Berkshire's Share of Undistributed

Berkshire's Major Investees Ownership at Yearend(1) Operating Earnings (in millions)(2)

American Express Company ............................. 11.4% $265

The Coca-Cola Company .................................. 8.1% 160

Freddie Mac ..................................................... 0.3% 106

The Gillette Company....................................... 9.1% 51

M&T Bank ....................................................... 7.2% 23

The Washington Post Company ........................ 18.3% 18

Wells Fargo & Company................................... 3.2% 117

Berkshire's share of undistributed earnings of major investees 740

Hypothetical tax on these undistributed investee earnings(3) (104)

Reported operating earnings of Berkshire 1,779

Total look-through earnings of Berkshire $ 2,415

(1) Does not include shares allocable to minority interests

(2) Calculated on average ownership for the year

(3) The tax rate used is 14%, which is the rate Berkshire pays on most dividends it receives

Full and Fair Reporting

At Berkshire, full reporting means giving you the information that we would wish you to give to us if our

positions were reversed. What Charlie and I would want under that circumstance would be all the important facts

about current operations as well as the CEO’s frank view of the long-term economic characteristics of the business.

We would expect both a lot of financial details and a discussion of any significant data we would need to interpret

what was presented.

When Charlie and I read reports, we have no interest in pictures of personnel, plants or products.

References to EBITDA make us shudder does management think the tooth fairy pays for capital expenditures?

We’re very suspicious of accounting methodology that is vague or unclear, since too often that means management

wishes to hide something. And we don’t want to read messages that a public relations department or consultant has

turned out. Instead, we expect a company’s CEO to explain in his or her own words what’s happening.

For us, fair reporting means getting information to our 300,000 “partners” simultaneously, or as close to

that mark as possible. We therefore put our annual and quarterly financials on the Internet between the close of the

market on a Friday and the following morning. By our doing that, shareholders and other interested investors have

timely access to these important releases and also have a reasonable amount of time to digest the information they

include before the markets open on Monday. This year our quarterly information will be available on the Saturdays

of May 12, August 11, and November 10. The 2001 annual report will be posted on March 9.

We applaud the work that Arthur Levitt, Jr., until recently Chairman of the SEC, has done in cracking

down on the corporate practice of “selective disclosure” that had spread like cancer in recent years. Indeed, it had

become virtually standard practice for major corporations to “guide” analysts or large holders to earnings

expectations that were intended either to be on the nose or a tiny bit below what the company truly expected to earn.

Through the selectively dispersed hints, winks and nods that companies engaged in, speculatively-minded

institutions and advisors were given an information edge over investment-oriented individuals. This was corrupt

behavior, unfortunately embraced by both Wall Street and corporate America.

Thanks to Chairman Levitt, whose general efforts on behalf of investors were both tireless and effective,

corporations are now required to treat all of their owners equally. The fact that this reform came about because of

coercion rather than conscience should be a matter of shame for CEOs and their investor relations departments.