Berkshire Hathaway 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BERKSHIRE HATHAWAY INC.

2000 ANNUAL REPORT

TABLE OF CONTENTS

Business Activities .................................................. Inside Front Cover

Corporate Performance vs. the S&P 500 .............................................. 2

Chairman's Letter*............................................................................... 3

Selected Financial Data For The

Past Five Years ...............................................................................22

Acquisition Criteria..............................................................................23

Independent Auditors' Report ...............................................................23

Consolidated Financial Statements........................................................24

Management's Discussion.....................................................................46

Owner's Manual...................................................................................59

Combined Financial Statements — Unaudited —

for Berkshire Business Groups .........................................................67

Shareholder-Designated Contributions..................................................74

Common Stock Data ............................................................................76

Directors and Officers of the Company.........................Inside Back Cover

*Copyright © 2001 By Warren E. Buffett

All Rights Reserved

Table of contents

-

Page 1

...' Report ...23 Consolidated Financial Statements...24 Management's Discussion...46 Owner's Manual...59 Combined Financial Statements - Unaudited - for Berkshire Business Groups ...67 Shareholder-Designated Contributions...74 Common Stock Data ...76 Directors and Officers of the Company...Inside Back... -

Page 2

... concrete masonry products and ceramic and marble wall tile; and CORT, a provider of rental furniture, accessories and related services. In late 2000 and early 2001, Berkshire's non-insurance business activities expanded significantly through the acquisitions of Benjamin Moore, a leading formulator... -

Page 3

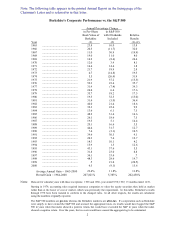

... table appears in the printed Annual Report on the facing page of the Chairman's Letter and is referred to in that letter. Berkshire's Corporate Performance vs. the S&P 500 Annual Percentage Change in Per-Share in S&P 500 Book Value of with Dividends Berkshire Included (1) (2) 23.8 10.0 20.3 (11... -

Page 4

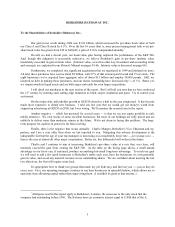

... INC. To the Shareholders of Berkshire Hathaway Inc.: Our gain in net worth during 2000 was $3.96 billion, which increased the per-share book value of both our Class A and Class B stock by 6.5%. Over the last 36 years (that is, since present management took over) pershare book value has grown from... -

Page 5

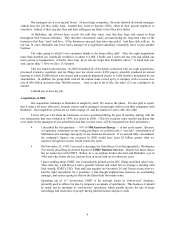

... purchase - 76% of MidAmerican Energy - in last year's report. Because of regulatory constraints on our voting privileges, we perform only a "one-line" consolidation of MidAmerican's earnings and equity in our financial statements. If we instead fully consolidated the company's figures, our revenues... -

Page 6

... proposed to sell its company, Barnett gave Berkshire a strong recommendation. Ed then called and explained his business to me, also sending some figures, and we made a deal, again half for cash and half for stock. Ed and Jon are fourth generation owner-managers of a business started 89 years ago in... -

Page 7

...spot. In October, their board approved the transaction, and we completed it in December. Benjamin Moore has been making paint for 117 years and has thousands of independent dealers that are a vital asset to its business. Make sure you specify our product for your next paint job. • Finally, in late... -

Page 8

... and also has major positions in roofing systems and a variety of engineered products. The company's sales exceed $2 billion and the business has earned good, if cyclical, returns. Jerry Henry, JM's CEO, had announced his retirement plans a year ago, but I'm happy to report that Charlie and... -

Page 9

... unpleasant. The table that follows shows (at intervals) the float generated by the various segments of Berkshire's insurance operations since we entered the business 34 years ago upon acquiring National Indemnity Company (whose traditional lines are included in the segment "Other Primary"). For the... -

Page 10

... our quarterly and annual management discussion. By their nature, these losses will continue for many years, often stretching into decades. As an offset, though, we have the use of float  lots of it. Clearly, float carrying an annual cost of this kind is not as desirable as float we generate from... -

Page 11

... seldom move Berkshire managers from one enterprise to another, but maybe we should try it more often: Brad is hitting home runs in his new job, just as he always did at Cypress. GEICO (1-800-847-7536 or GEICO.com) We show below the usual table detailing GEICO's growth. Last year I enthusiastically... -

Page 12

..., the business never had the stock options or lavish salaries that many people think vital if an American enterprise is to attract able managers and thrive. In the end, however, State Farm eclipsed all its competitors. In fact, by 1999 the company had amassed a tangible net worth exceeding that... -

Page 13

... stock investments. Those that had a market value of more than $1 billion at the end of 2000 are itemized. Shares 151,610,700 200,000,000 96,000,000 1,727,765 55,071,380 Company American Express Company ...The Coca-Cola Company ...The Gillette Company...The Washington Post Company ...Wells Fargo... -

Page 14

...we owe no tax on the dividend. And, if the earnings are retained and we were to sell the subsidiary  not likely at Berkshire!  for $1million more than we paid for it, we would owe no capital gains tax. That's because our "tax cost" upon sale would include both what we paid for the business and... -

Page 15

... primary goal of a company's promoters. At bottom, the "business model" for these companies has been the old-fashioned chain letter, for which many fee-hungry investment bankers acted as eager postmen. But a pin lies in wait for every bubble. And when the two eventually meet, a new wave of investors... -

Page 16

... managers than one utilizing generally accepted accounting principles (GAAP), which require purchase-premiums to be charged off business-by-business. The total net earnings we show in the table are, of course, identical to the GAAP total in our audited financial statements. (in millions) Berkshire... -

Page 17

... of Aircraft Services  pilot training at FlightSafety (FSI) and fractional ownership of business jets at Executive Jet (EJA). Both companies are run by their remarkable founders. Al Ueltschi at FSI is now 83 and continues to operate at full throttle. Though I am not a fan of stock splits, I am... -

Page 18

... important facts about current operations as well as the CEO's frank view of the long-term economic characteristics of the business. We would expect both a lot of financial details and a discussion of any significant data we would need to interpret what was presented. When Charlie and I read reports... -

Page 19

... own internal goals and, in our view, it's even appropriate for the CEO to publicly express some hopes about the future, if these expectations are accompanied by sensible caveats. But for a major corporation to predict that its per-share earnings will grow over the long term at, say, 15% annually is... -

Page 20

... company distributed $1.03 billion to Berkshire against our net purchase price of $230 million. We used these funds, in turn, to purchase other businesses. All told, Ralph's contributions to Berkshire's present value extend well into the billions of dollars. As a manager, Ralph belongs in Berkshire... -

Page 21

... and to Nebraska Furniture Mart, Borsheim's and the airport. Even so, you are likely to find a car useful. We have added so many new companies to Berkshire this year that I'm not going to detail all of the products that we will be selling at the meeting. But come prepared to carry home everything... -

Page 22

...purchases between Wednesday, April 25 and Monday, April 30 and also present your meeting credential. The period's special pricing will even apply to the products of several prestige manufacturers that normally have ironclad rules against discounting but that, in the spirit of our shareholder weekend... -

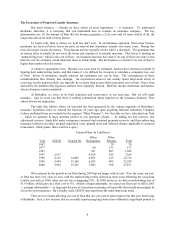

Page 23

... INC. Selected Financial Data for the Past Five Years (dollars in millions, except per share data) 2000 Revenues: Insurance premiums earned...$19,343 Sales and service revenues...7,331 Interest, dividend and other investment income ...2,791 Income from finance and financial products businesses...556... -

Page 24

... intrinsic business value as we give. Charlie and I frequently get approached about acquisitions that don't come close to meeting our tests: We've found that if you advertise an interest in buying collies, a lot of people will call hoping to sell you their cocker spaniels. A line from a country song... -

Page 25

... equivalents...Investments: Securities with fixed maturities...Equity securities...Other ...Receivables...Inventories...Investments in MidAmerican Energy Holdings Company ...Assets of finance and financial products businesses ...Property, plant and equipment...Goodwill of acquired businesses...Other... -

Page 26

... 1999 1998 Revenues: Insurance premiums earned ...Sales and service revenues...Interest, dividend and other investment income...Income from MidAmerican Energy Holdings Company...Income from finance and financial products businesses...Realized investment gain...Cost and expenses: Insurance losses and... -

Page 27

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS (dollars in millions) Year Ended December 31, 2000 1999 1998 Cash flows from operating activities: Net earnings...Adjustments to reconcile net earnings to cash flows from operating activities: Realized investment gain ...... -

Page 28

... IN SHAREHOLDERS' EQUITY (dollars in millions) Accumulated Class A & B Capital in Other Common Excess of Retained Comprehensive Comprehensive Stock Par Value Earnings Income Income Balance December 31, 1997 ...$ 7 Common stock issued in connection with acquisitions of businesses...1 Net earnings... -

Page 29

.../casualty and Global life/health reinsurance activities of General Re have been reported in Berkshire's financial statements based on a one-quarter lag to facilitate the timely completion of the consolidated financial statements. During the fourth quarter of 2000, General Re implemented a number of... -

Page 30

.... Goodwill of acquired businesses Goodwill of acquired businesses represents the difference between purchase cost and the fair value of the net assets of acquired businesses and is being amortized on a straight line basis generally over 40 years. The Company periodically reviews the recoverability... -

Page 31

... Sheets at discounted amounts. Discounted amounts pertaining to reinsurance of certain workers' compensation risks are based upon an annual discount rate of 4.5%. The discounted amounts for structured settlement reinsurance contracts are based upon the prevailing market discount rates when the... -

Page 32

... a number of brand names. U.S. Investment Corporation ("USIC") Effective August 8, 2000, Berkshire acquired all of the outstanding shares of USIC common stock. USIC is the parent of the United States Liability Insurance Group, one of the premier U.S. writers of specialty insurance. Benjamin Moore... -

Page 33

...Re"), a major international reinsurer. General Re operates in 28 countries and provides reinsurance coverage in 130 countries around the world. In addition, General Re affiliates write excess and surplus lines insurance, provide reinsurance brokerage services, manage aviation insurance risks, act as... -

Page 34

... and financial products businesses. See Note 7. (2) In connection with the acquisition of General Re on December 21, 1998, fixed maturity securities with a fair value of $17.6 billion were acquired. Such amount was approximately $1.2 billion in excess of General Re's historical amortized cost. The... -

Page 35

... securities Data with respect to the consolidated investments in equity securities are shown below. Amounts are in millions. Unrealized Fair Gains Value Cost December 31, 2000 Common stock of: American Express Company * ...The Coca-Cola Company ...The Gillette Company...Wells Fargo & Company...Other... -

Page 36

... estate finance business of Berkshire Hathaway Credit Corporation, the financial instrument trading business of BH Finance and a life insurance subsidiary in the business of selling annuities. General Re's financial products businesses consist of the Gen Re Securities Holdings Limited ("GRS") group... -

Page 37

...which the option's underlying market interest rate exceeds the fixed cap or falls below the fixed floor, applied to a notional amount. Futures contracts are commitments to either purchase or sell a financial instrument at a future date for a specified price and are generally settled in cash. Forward... -

Page 38

... of mutual obligations. With respect to Berkshire's life insurance business, annuity reserves and policyholder liabilities are carried at the present value of the actuarially determined ultimate payment amounts discounted at market interest rates existing at the inception of the contracts. Such... -

Page 39

... loss development estimate. The Company has also established a liability for litigation costs associated with coverage disputes arising out of direct insurance policies. The liabilities for environmental and latent injury claims and claim expenses net of related reinsurance recoverables were $4,444... -

Page 40

... to the value of the Citigroup shares into which they can be exchanged. Other debt includes variable and fixed rate term bonds and notes issued by a variety of Berkshire subsidiaries. These obligations generally may be redeemed prior to maturity at the option of the issuing company. No materially... -

Page 41

...gains and losses on investments in securities with fixed maturities and goodwill of acquired businesses are recognized under GAAP but not for statutory reporting purposes. Effective January 1, 2001, Berkshire's insurance companies will be required to adopt several new accounting policies as a result... -

Page 42

... and financial products businesses...14,730 22,223 14,896 22,151 In determining fair value of financial instruments, Berkshire used quoted market prices when available. For instruments where quoted market prices were not available, independent pricing services or appraisals by Berkshire's management... -

Page 43

.... Business Identity GEICO General Re Berkshire Hathaway Reinsurance Group Berkshire Hathaway Direct Insurance Group FlightSafety and Executive Jet ("Flight Services") Nebraska Furniture Mart, R.C. Willey Home Furnishings, Star Furniture Company, Jordan's Furniture, Borsheim's, Helzberg's Diamond... -

Page 44

...: Premiums earned: GEICO...General Re **...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Direct Insurance Group...Interest, dividend and other investment income...Total insurance group...Flight services...Retail businesses ...Scott Fetzer Companies...Other businesses ...Revenues 1999... -

Page 45

... part of business acquisitions. Operating Segments: Insurance group: GEICO...General Re ...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Direct Insurance Group...Total insurance group...Flight services ...Retail businesses ...Scott Fetzer Companies ...Other businesses...Reconciliation... -

Page 46

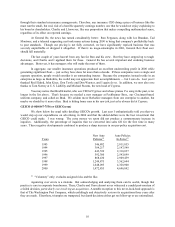

... by quarter for each of the last two years is presented in the following table. This information is unaudited. Dollars are in millions, except per share amounts. 2000 Revenues ...Earnings: Excluding realized investment gain...Realized investment gain * ...Net earnings...Earnings per equivalent Class... -

Page 47

... own insuring activities. Berkshire's principal insurance businesses are: (1) GEICO, the sixth largest auto insurer in the United States, (2) General Re, one of the four largest reinsurers in the world, (3) Berkshire Hathaway Reinsurance Group ("BHRG") and (4) Berkshire Hathaway Direct Insurance... -

Page 48

... apply for coverage directly to the company over the telephone, through the mail or via the Internet. This is a significant element in GEICO's strategy to be a low cost insurer and, yet, provide high value to policyholders. GEICO's underwriting results for the past three years are summarized below... -

Page 49

...year results are not included in Berkshire's 1998 consolidated results. General Re and its affiliates conduct a global reinsurance business, which provides reinsurance coverage in the United States and 129 other countries around the world. General Re's principal reinsurance operations are: (1) North... -

Page 50

...the growth in North American premiums during 2000 was primarily due to net increases in the national accounts, excess and surplus reinsurance lines and individual risk businesses. This net growth resulted from a combination of new business, the effects of rate increases on existing business, and was... -

Page 51

Management's Discussion (Continued) Insurance - Underwriting (Continued) General Re (Continued) The International property/casualty operations write quota-share and excess reinsurance on risks around the world. In recent years, the largest international markets have been in Germany and Western ... -

Page 52

...) General Re (Continued) Global life/health premiums earned in 2000 increased 2.8% over 1999 amounts. Premiums earned in 1999 increased 33.5% over 1998 levels. Adjusting both the 2000 and 1999 periods for the effects of run-off business written by a former London-based managing underwriter, Global... -

Page 53

... of credit card credit insurance to individuals nationwide through financial institutions. In August 2000, this group of businesses was expanded as a result of Berkshire's acquisition of United States Investment Corporation ("USIC"), whose insurance subsidiaries underwrite specialty insurance... -

Page 54

... assets grew by about $25 billion in 1998 as a result of the General Re acquisition. Berkshire's insurance businesses generate large amounts of investment income derived from shareholder capital, as well as policyholder float. Float represents an estimate of the amount of funds ultimately payable to... -

Page 55

... (Nebraska Furniture Mart, R.C. Willey Home Furnishings, Star Furniture and Jordan's Furniture) and three independently managed retailers of fine jewelry (Borsheim's, Helzberg's Diamond Shops and Ben Bridge Jeweler). Two of these businesses were acquired during the past two years (Jordan's Furniture... -

Page 56

...Other purchase-accounting adjustments consist primarily of the amortization of the excess market value over the historical cost of fixed maturity investments that existed as of the date of certain business acquisitions, principally GEICO and General Re. Such excess is included in Berkshire's cost of... -

Page 57

... average levels of shareholder capital to provide a margin of safety against short term equity price volatility. The carrying values of investments subject to equity price risks are based on quoted market prices or management's estimates of fair value as of the balance sheet dates. Market prices... -

Page 58

... Risk (Continued) The fair values of Berkshire's fixed maturity investments and borrowings under investment agreements and other debt will fluctuate in response to changes in market interest rates. Increases and decreases in prevailing interest rates generally translate into decreases and increases... -

Page 59

... financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible future Company actions, which may be provided by management are also forward-looking statements as defined by the Act. Forward-looking statements are based on current... -

Page 60

...effect, our shareholders behave in respect to their Berkshire stock much as Berkshire itself behaves in respect to companies in which it has an investment. As owners of, say, Coca-Cola or Gillette shares, we think of Berkshire as being a non-managing partner in two extraordinary businesses, in which... -

Page 61

... our goal by directly owning a diversified group of businesses that generate cash and consistently earn above-average returns on capital. Our second choice is to own parts of similar businesses, attained primarily through purchases of marketable common stocks by our insurance subsidiaries. The price... -

Page 62

...the individual businesses, should generally aid you in making judgments about them. To state things simply, we try to give you in the annual report the numbers and other information that really matter. Charlie and I pay a great deal of attention to how well our businesses are doing, and we also work... -

Page 63

... your own portfolios through direct purchases in the stock market. Charlie and I are interested only in acquisitions that we believe will raise the per-share intrinsic value of Berkshire's stock. The size of our paychecks or our offices will never be related to the size of Berkshire's balance sheet... -

Page 64

...giving earnings "guidance" or other information of value to analysts or large shareholders. Our goal is to have all of our owners updated at the same time. 13. Despite our policy of candor, we will discuss our activities in marketable securities only to the extent legally required. Good investment... -

Page 65

... reason we never give you our estimates of intrinsic value. What our annual reports do supply, though, are the facts that we ourselves use to calculate this value. Meanwhile, we regularly report our per-share book value, an easily calculable number, though one of limited use. The limitations do not... -

Page 66

... think earnings of that description have far more economic meaning than the earnings produced by GAAP. When Berkshire buys a business for a premium over the GAAP net worth of the acquiree - as will usually be the case, since most companies we'd want to buy don't come at a discount - that premium has... -

Page 67

..., of course, depends on the date of my death. But I can anticipate what the management structure will be: Essentially my job will be split into two parts, with one executive becoming responsible for investments and another for operations. If the acquisition of new businesses is in prospect, the two... -

Page 68

BERKSHIRE HATHAWAY INC. COMBINED FINANCIAL STATEMENTS BUSINESS GROUPS Berkshire's consolidated data is rearranged in the presentations on the following six pages into four categories, corresponding to the way Mr. Buffett and Mr. Munger think about Berkshire's businesses. The presentations may be ... -

Page 69

... for risks in an increasing number of selected states. Cypress Insurance Company provides workers' compensation insurance to employers in California and other states. Central States Indemnity Company issues credit insurance distributed through credit card issuers nationwide, Kansas Bankers Surety... -

Page 70

BERKSHIRE HATHAWAY INC. INSURANCE GROUP Balance Sheets (dollars in millions) December 31, 2000 1999 Assets Investments: Fixed maturities at market...Equity securities and other investments at market: American Express Company...The Coca-Cola Company ...Freddie Mac...The Gillette Company...Wells Fargo... -

Page 71

... Business Services Dexter Shoe Company Douglas Products Executive Jet Fechheimer Bros. Co. FlightSafety France H. H. Brown Shoe Co. Halex Helzberg's Diamond Shops International Dairy Queen Jordan's Furniture Justin Brands Kingston Kirby Lowell Shoe, Inc. Meriam MidAmerican Energy Nebraska Furniture... -

Page 72

...844 75 2,077 2,152 $3,996 Statements of Earnings (dollars in millions) 2000 Revenues: Sales and service revenues...Income from MidAmerican Energy Holdings Company ...Interest income...Cost and expenses: Cost of products and services sold ...Selling, general and administrative expenses...Interest on... -

Page 73

...AND FINANCIAL PRODUCTS BUSINESSES Scott Fetzer Financial Group, Inc., Berkshire Hathaway Life Insurance Co. of Nebraska, Berkshire Hathaway Credit Corporation, BH Finance and Gen Re Securities Holdings Limited ("GRS") (formerly General Re Financial Products) make up Berkshire's finance and financial... -

Page 74

BERKSHIRE HATHAWAY INC. NON-OPERATING ACTIVITIES These statements reflect the consolidated financial statement values for assets, liabilities, shareholders' equity, revenues and expenses that were not assigned to any Berkshire operating group in the unaudited, and not fully GAAP - adjusted group ... -

Page 75

... the program. Portions of that letter follow: "On September 30, 1981 Berkshire received a tax ruling from the U.S. Treasury Department that, in most years, should produce a significant benefit for charities of your choice. "Each Berkshire shareholder - on a basis proportional to the number of shares... -

Page 76

... to local level decisions of operating managers of the businesses. * * * The program may not be conducted in the occasional year, if any, when the contributions would produce substandard or no tax deductions. In other years Berkshire expects to inform shareholders of the amount per share that may... -

Page 77

... owners. Price Range of Common Stock Berkshire's Class A and Class B Common Stock are listed for trading on the New York Stock Exchange, trading symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange Composite List... -

Page 78

...of Taxes MARK D. MILLARD, Director of Financial Assets Letters from Annual Reports (1977 through 2000), quarterly reports, press releases and other information about Berkshire may be obtained on the Internet at berkshirehathaway.com. Berkshire's 2001 quarterly reports are scheduled to be posted on...