Avon 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

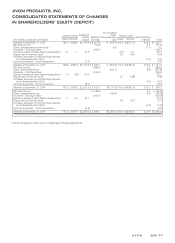

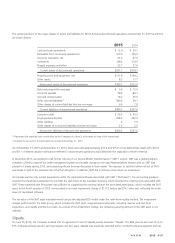

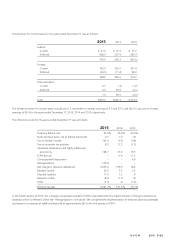

The carrying amount of the major classes of assets and liabilities for North America discontinued operations at December 31, 2015 and 2014

are shown below:

2015 2014

Cash and cash equivalents $ (2.2) $ 24.1

Receivable from continuing operations(2) 100.0 100.0

Accounts receivable, net 41.4 47.9

Inventories 128.2 114.5

Prepaid expenses and other 23.7 27.6

Current assets of discontinued operations $291.1 $314.1

Property, plant and equipment, net $171.8 $194.2

Other assets 8.3 17.7

Noncurrent assets of discontinued operations $180.1 $211.9

Debt maturing within one year $ 5.9 $ 15.4

Accounts payable 78.4 89.1

Accrued compensation 18.2 35.6

Other accrued liabilities(3) 380.6 59.7

Other classes of current liabilities that are not major 6.6 7.8

Current liabilities of discontinued operations $489.7 $207.6

Long-term debt $ 29.3 $ 35.2

Employee benefit plans 228.2 252.2

Other liabilities .2 7.0

Other classes of noncurrent liabilities that are not major 2.5 2.6

Noncurrent liabilities of discontinued operations $260.2 $297.0

(2) Represents the expected cash contribution by the Company into NewCo to be made at close of the transactions.

(3) Includes the accrual for the estimated loss on sale at December 31, 2015.

As of December 31, 2015 and December 31, 2014, there were also approximately $19.4 and $15.6 of net deferred tax assets with $19.4

and $9.1 of related valuation allowances reflected in discontinued operations associated with the separation of North America.

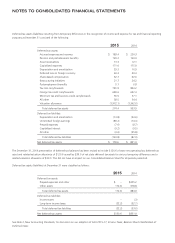

In December 2013, we decided to halt further roll-out of our Service Model Transformation (“SMT”) project. SMT was a global program

initiated in 2009 to improve our order management system and enable changes to the way Representatives interact with us. SMT was

piloted in Canada during 2013, and caused significant business disruption in that market. This decision to halt the further roll-out of SMT

was made in light of the potential risk of further disruption. In addition, SMT did not show a clear return on investment.

As Canada was the only market expected to utilize the capitalized software associated with SMT (“SMT asset”), the accounting guidance

requires the impairment assessment to consider the cash flows of the Canadian business, which includes the ongoing costs associated with

SMT. These expected cash flows were not sufficient to supporting the carrying value of the associated asset group, which includes the SMT

asset. In the fourth quarter of 2013, we recorded a non-cash impairment charge of $117.2 before tax ($74.1 after tax), reflecting the write-

down of capitalized software.

The fair value of the SMT asset was determined using a risk-adjusted DCF model under the relief-from-royalty method. The impairment

analysis performed for the asset group, which includes the SMT asset, required several estimates, including revenue and cash flow

projections, and royalty and discount rates. As a result of this impairment charge, the remaining carrying amount of the SMT asset is not

material.

Silpada

On June 30, 2013, the Company entered into an agreement to sell its Silpada jewelry business (“Silpada”) for $85, plus an earn-out of up to

$15 if Silpada achieves specific earnings targets over two years. Silpada was previously reported within our North America segment and has

A V O N 2015 F-17

7553_fin.pdf 89