Avon 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

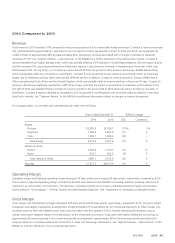

• gross margin benefited only slightly compared to the prior year period, as 2.1 points from the favorable net impact of mix and pricing,

which includes the realization of price increases in markets experiencing relatively high inflation (Venezuela and Argentina) was largely

offset by 2.0 points from the unfavorable impact of foreign currency transaction losses.

Venezuela Discussion

Currency restrictions enacted by the Venezuelan government since 2003 have impacted the ability of Avon Venezuela to obtain foreign

currency to pay for imported products. Since 2010, we have been accounting for our operations in Venezuela under accounting guidance

associated with highly inflationary economies. Under U.S. GAAP, the financial statements of a foreign entity operating in a highly

inflationary economy are required to be remeasured as if the functional currency is the company’s reporting currency, the U.S. dollar. This

generally results in translation adjustments, caused by changes in the exchange rate, being reported in earnings currently for monetary

assets (e.g., cash, accounts receivable) and liabilities (e.g., accounts payable, accrued expenses) and requires that different procedures be

used to translate non-monetary assets (e.g., inventories, fixed assets). Non-monetary assets and liabilities are remeasured at the historical

U.S. dollar cost basis. This diverges significantly from the application of accounting rules prior to designation as highly inflationary

accounting, where such gains and losses would have been recognized only in accumulated other comprehensive income (loss) (shareholders’

equity).

With respect to our 2013 results, effective February 13, 2013, the official exchange rate moved from 4.30 to 6.30, a devaluation of

approximately 32%. As a result of the change in the official rate to 6.30, we recorded an after-tax loss of approximately $51 (approximately

$34 in other expense, net, and approximately $17 in income taxes) in the first quarter of 2013, primarily reflecting the write-down of

monetary assets and liabilities and deferred tax benefits. Additionally, certain non-monetary assets are carried at their historical U.S. dollar

cost subsequent to the devaluation. Therefore, these costs will impact the income statement during 2015 at a disproportionate rate as they

were not devalued based on the new exchange rates, but were expensed at their historical U.S. dollar value. As a result of using the

historical U.S. dollar cost basis of non-monetary assets, such as inventories, these assets continued to be remeasured, following the

devaluation, at the applicable rate at the time of their acquisition. As a result, we recognized an additional negative impact of approximately

$45 to operating profit and net income relating to these non-monetary assets in the first, second, third and fourth quarters of 2013.

In March 2013, the Venezuelan government announced a foreign exchange system that increased government control over the allocation of

U.S. dollars in the country, referred to as the SICAD I exchange (“SICAD I”). In February 2014, the Venezuelan government announced a

foreign exchange system which began operating on March 24, 2014, referred to as the SICAD II exchange (“SICAD II”). While liquidity was

limited through the SICAD II market, in comparison to the other available exchange rates (the official rate and SICAD I rate), it represented

the rate which better reflected the economics of Avon Venezuela’s business activity. Accordingly, we concluded that we should utilize the

SICAD II exchange rate to remeasure our Venezuelan operations effective March 31, 2014.

With respect to our 2014 results, at March 31, 2014, the SICAD II exchange rate was approximately 50, as compared to the official

exchange rate of 6.30 that we used previously, which caused the recognition of a devaluation of approximately 88%. As a result of our

change to the SICAD II rate, we recorded an after-tax loss of approximately $42 (approximately $54 in other expense, net, and a benefit of

approximately $12 in income taxes) in the first quarter of 2014, primarily reflecting the write-down of monetary assets and liabilities. As a

result of using the historical U.S. dollar cost basis of non-monetary assets, such as inventories, these assets continued to be remeasured,

following the change to the SICAD II rate, at the applicable rate at the time of acquisition. As a result, we determined that an adjustment of

approximately $116 to cost of sales was needed to reflect certain non-monetary assets at their net realizable value, which was recorded in

the first quarter of 2014. We recognized an additional negative impact of approximately $21 to operating profit and net income relating to

these non-monetary assets in the second, third and fourth quarters of 2014.

In February 2015, the Venezuelan government announced that the SICAD II market would no longer be available, and a new foreign

exchange system was created, referred to as the SIMADI exchange (“SIMADI”). SIMADI began operating on February 12, 2015. The SICAD I

and SICAD II markets merged to create a single foreign exchange system, referred to as the SICAD exchange (“SICAD”). At December 31,

2015, the SICAD exchange rate was approximately 13. The exchange rates established through the SIMADI market fluctuate and have been

significantly higher than both the official rate and SICAD rate. In March 2015, we began to access the SIMADI market and have been able to

obtain only limited U.S. dollars. While liquidity is limited through the SIMADI market, in comparison to the other available exchange rates (the

official rate and SICAD rate), it represents the rate which better reflects the economics of Avon Venezuela’s business activity. Accordingly, we

concluded that we should utilize the SIMADI exchange rate to remeasure our Venezuelan operations effective February 12, 2015.

7553_fin.pdf 50