Avon 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

been presented as discontinued operations for all periods presented. The transaction closed on July 3, 2013. Proceeds from the sale were

used for general corporate purposes, including the repayment of outstanding debt. The earn-out was not achieved by Silpada for fiscal year

2014, and as of December 31, 2015, we do not believe that the financial performance of Silpada will result in the achievement of the earn-

out for fiscal year 2015. In 2013, we recorded a loss on sale of $79.4 before tax ($50.4 after tax), representing the difference between the

carrying value of the Silpada business and the proceeds. Of the total loss on sale, $79.0 before tax ($50.0 after tax), was recorded in the

second quarter of 2013, reflecting the expected loss on sale at that time.

In the first quarter of 2013, the Company disclosed that it was reviewing strategic alternatives for Silpada. In connection with this review, we

ran a broad auction process that included potential financial and strategic buyers. The initial offers that were received through April of 2013

were lower than the carrying value of Silpada. At that time, we did not believe that these offers were representative of the underlying fair

value of the Silpada business. In June 2013, the Company received final offers for the Silpada business that were also at a level below what

previously had been expected as the fair value of the business. The Company decided to agree to the offer that emerged at the time as the

highest bid, based in part on consideration of a) the timeline and investment required to return the business to historical levels of profitability

and b) the deterioration of Silpada’s business performance in the second quarter of 2013. The Company also considered that this divestiture

would allow greater focus of time and resources on the core Avon business. This transaction was approved by the Board of Directors on

June 26, 2013, subject to certain conditions which were satisfied on June 30, 2013.

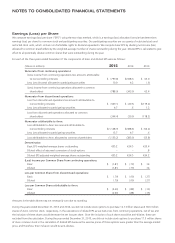

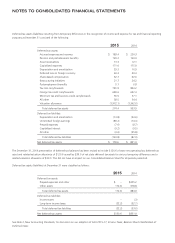

Summarized financial information for Silpada discontinued operations is shown below:

Year ended

December 31,

2013

Total revenue $ 54.5

Operating loss(4) (81.0)

(4) Operating loss includes a charge of $79.0 before tax recorded in the second quarter of 2013, reflecting the expected loss on sale at that time, as well as an

additional loss on sale of $.4 before tax recorded in the third quarter of 2013.

Divestitures

Liz Earle

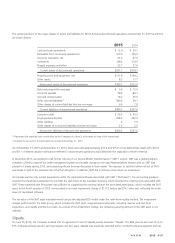

On July 9, 2015, the Company sold Liz Earle Beauty Co. Limited (“Liz Earle”) for approximately $215, less expenses of approximately $5. Liz

Earle was previously reported within our Europe, Middle East & Africa segment. In 2015, we recorded a gain on sale of $44.9 before tax,

which was reported separately in the Consolidated Statements of Operations, and $51.6 after tax, representing the difference between the

proceeds, including the expected working capital settlement, and the carrying value of the Liz Earle business on the date of sale. Proceeds

from the sale of Liz Earle were used to fund a portion of the Company’s redemption of the $250 principal amount of its 2.375% Notes due

March 15, 2016, which occurred on August 10, 2015. See Note 5, Debt and Other Financing for additional information.

NOTE 4. Inventories

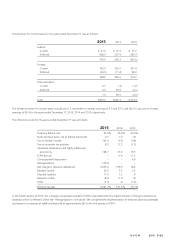

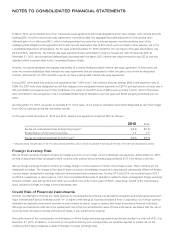

Inventories at December 31 consisted of the following:

2015 2014

Raw materials $180.5 $232.9

Finished goods 443.5 474.8

Total $624.0 $707.7

7553_fin.pdf 90