Avon 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

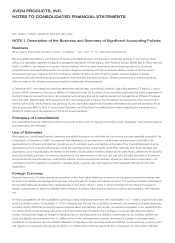

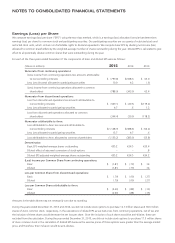

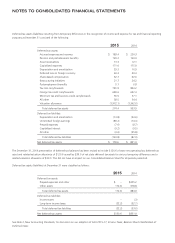

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

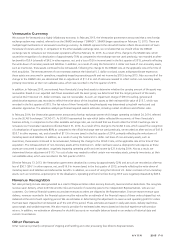

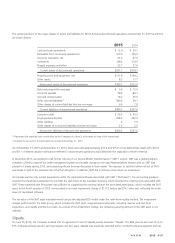

net assets to be contributed into NewCo, including certain pension and postretirement benefit plan liabilities and amounts in AOCI

associated with the North America business, which were primarily unrecognized losses associated with our U.S. defined benefit pension

plan, and costs to sell, as compared to the implied value of our ownership interests in NewCo which will be $43. The actual total loss on sale

will be dependent on a number of factors including discount rates and the actual return on plan assets. Post-separation, the Company will

account for its ownership interests in NewCo using the equity method of accounting, which will result in the Company recognizing its

proportionate share of NewCo’s income or loss.

NewCo will enter into a perpetual, irrevocable royalty-free licensing agreement with the Company for the use of the Avon brand and certain

other intellectual property. There will also be transition services agreements which include, among other things, information technology,

human resources and supply chain services and other commercial agreements, including research and development and manufacturing.

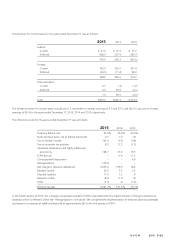

The major classes of financial statement components comprising the loss on discontinued operations, before tax for North America are

shown below:

Year ended December 31,

2015 2014 2013

Total revenue $1,012.5 $1,203.4 $1,458.2

Cost of sales 404.0 492.4 599.7

Selling, general and administrative

expenses(1) 606.2 745.2 971.1

Operating income (loss)(1) 2.3 (34.2) (112.6)

Other expense items 3.2 2.4 2.7

Loss from discontinued operations, before

tax(1) (.9) (36.6) (115.3)

Loss on sale of discontinued operations,

before tax (340.0) – –

Loss from discontinued operations, before

tax(1) $ (340.9) $ (36.6) $ (115.3)

(1) Includes a capitalized software impairment charge of $117.2 during 2013, as discussed below.

7553_fin.pdf 88