Avon 2015 Annual Report Download - page 97

Download and view the complete annual report

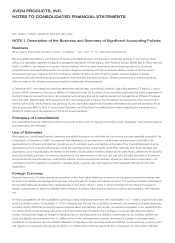

Please find page 97 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTE 2. New Accounting Standards

Standards Implemented

In November 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2015-17, Income

Taxes, Balance Sheet Classification of Deferred Taxes. ASU 2015-17 simplifies the presentation of deferred taxes by requiring all deferred tax

assets and liabilities to be classified as noncurrent on the balance sheet. We elected to early adopt ASU 2015-17 in the fourth quarter of

2015 on a prospective basis. This did not have an impact on our consolidated financial statements, other than balance sheet presentation as

of December 31, 2015, as prior periods were not retrospectively adjusted.

Standards to be Implemented

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers, issued as a new Topic, Accounting Standards

Codification Topic 606. The core principle of the guidance is that a Company should recognize revenue to depict the transfer of promised

goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those

goods or services. In August 2015, the FASB issued ASU 2015-14, Deferral of the Effective Date, which resulted in the standard being

effective beginning in 2018, with early adoption permitted in the beginning of 2017. This standard can be adopted either retrospectively or

as a cumulative-effect adjustment as of the date of adoption. We are currently evaluating the effect that adopting this new accounting

guidance will have on our consolidated financial statements.

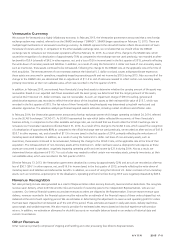

NOTE 3. Discontinued Operations and Divestitures

Discontinued Operations

North America

On December 17, 2015, the Company entered into definitive agreements with affiliates controlled by Cerberus. The agreements include a

an investment agreement providing for a $435 investment by Cleveland Apple Investor LLC (“Cleveland Investor”) (an affiliate of Cerberus)

in the Company through the purchase of perpetual convertible preferred stock and a separation and investment agreement providing for the

separation of the Company’s North America business, which represents the Company’s operations in the United States, Canada and Puerto

Rico, from the Company into a privately-held company (“NewCo”) that will be majority-owned and managed by Cleveland NA Investor LLC

(“Cleveland NA”) (an affiliate of Cerberus) as a result of the issuance to Cleveland NA of ownership interests in NewCo. Cleveland NA will

contribute $170 of cash into NewCo in exchange for 80.1% of its ownership interests. We will contribute the North America business,

certain pension and postretirement liabilities and $100 of cash into NewCo and will own 19.9% of NewCo’s ownership interests.

The $435 investment by Cleveland Investor in the Company will be in exchange for perpetual convertible preferred stock with an optional

conversion price for holders of $5.00 per share and a dividend that accrues at a rate of 5% per annum, subject to increase upon certain

events. The dividend is payable at the Company’s option in (i) cash, (ii) subject to certain conditions, in common shares or (iii) subject to

certain conditions, upon conversion of shares in Series C Preferred Stock, in shares of our non-voting, non-convertible Series D Preferred

Stock, par value $1.00 per share (the “Series D Preferred Stock”). Any such shares of Series D Preferred Stock issued would have similar

preferential rights. At the close of these transactions, the Company will make changes to its Board of Directors, including certain current

directors stepping down and other directors joining from Cerberus. In addition, new independent directors jointly selected by the Company

and Cerberus will be appointed at or as soon as practicable after the close of the transactions. The transactions are expected to close

concurrently in the first half of 2016. Proceeds from the sale of the perpetual convertible preferred stock are intended to be used to fund the

$100 cash contribution into NewCo, approximately $250 may be used to reduce debt, and the remainder will be used for restructuring and

reinvestment in the business. The Company considered that the transactions with affiliates of Cerberus should help to drive enhanced focus

on Avon’s international markets, revitalize the North America business and deliver long-term value to shareholders.

The North America business was previously its own reportable segment and has been presented as discontinued operations for all periods

presented as the separation represented a significant strategic shift and was determined to have a major effect on our operations and

financial results. Amounts previously allocated from Global Expenses to North America have been moved to Global Expenses for all periods

presented, as these represent costs associated with functions of the Company’s continuing operations.

As the carrying value exceeded the estimated fair value less costs to sell, in the fourth quarter of 2015, we recorded an estimated loss on

sale of discontinued operations of approximately $340 before tax (approximately $340 after tax). The estimated loss on sale represents the

A V O N 2015 F-15

7553_fin.pdf 87