Avon 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

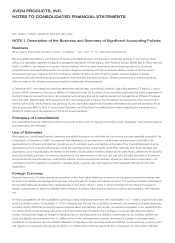

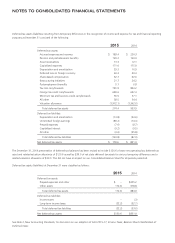

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

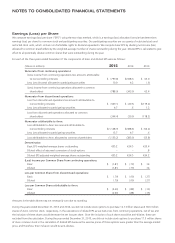

Earnings (Loss) per Share

We compute earnings (loss) per share (“EPS”) using the two-class method, which is a earnings (loss) allocation formula that determines

earnings (loss) per share for common stock and participating securities. Our participating securities are our grants of restricted stock and

restricted stock units, which contain non-forfeitable rights to dividend equivalents. We compute basic EPS by dividing net income (loss)

allocated to common shareholders by the weighted-average number of shares outstanding during the year. Diluted EPS is calculated to give

effect to all potentially dilutive common shares that were outstanding during the year.

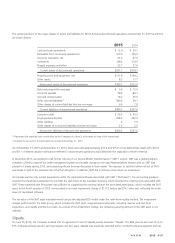

For each of the three years ended December 31 the components of basic and diluted EPS were as follows:

(Shares in millions) 2015 2014 2013

Numerator from continuing operations:

(Loss) income from continuing operations less amounts attributable

to noncontrolling interests $ (799.8) $(348.1) $ 63.0

Less: Loss (income) allocated to participating securities 10.9 4.2 (.6)

(Loss) income from continuing operations allocated to common

shareholders (788.9) (343.9) 62.4

Numerator from discontinued operations:

Loss from discontinued operations less amounts attributable to

noncontrolling interests $ (349.1) $ (40.5) $(119.4)

Less: Loss allocated to participating securities 4.7 .6 1.2

Loss from discontinued operations allocated to common

shareholders (344.4) (39.9) (118.2)

Numerator attributable to Avon:

Loss attributable to Avon less amounts attributable to

noncontrolling interests $(1,148.9) $(388.6) $ (56.4)

Less: Loss allocated to participating securities 15.7 4.7 .6

Loss attributable to Avon allocated to common shareholders (1,133.2) (383.9) (55.8)

Denominator:

Basic EPS weighted-average shares outstanding 435.2 434.5 433.4

Diluted effect of assumed conversion of stock options – – .8

Diluted EPS adjusted weighted-average shares outstanding 435.2 434.5 434.2

(Loss) Income per Common Share from continuing operations:

Basic $ (1.81) $ (.79) $ .14

Diluted (1.81) (.79) .14

Loss per Common Share from discontinued operations:

Basic $ (.79) $ (.09) $ (.27)

Diluted (.79) (.09) (.27)

Loss per Common Share attributable to Avon:

Basic $ (2.60) $ (.88) $ (.13)

Diluted (2.60) (.88) (.13)

Amounts in the table above may not necessarily sum due to rounding.

During the years ended December 31, 2015 and 2014, we did not include stock options to purchase 12.7 million shares and 18.0 million

shares of Avon common stock, respectively, in the calculations of diluted EPS as we had a loss from continuing operations, net of tax and

the inclusion of these shares would decrease the net loss per share. Since the inclusion of such shares would be anti-dilutive, these are

excluded from the calculation. During the year ended December 31, 2013, we did not include stock options to purchase 17.5 million shares

of Avon common stock in the calculation of diluted EPS because the exercise prices of those options were greater than the average market

price, and therefore, their inclusion would be anti-dilutive.

7553_fin.pdf 86