Avon 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

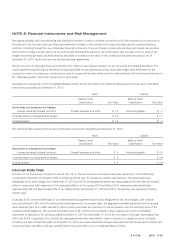

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

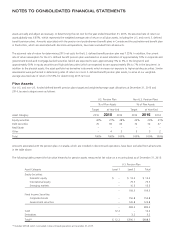

Stock Options

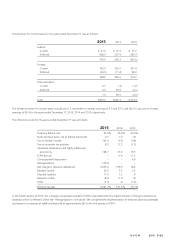

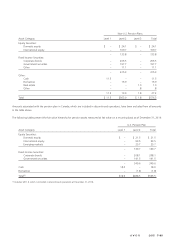

There were no stock options granted since 2012. A summary of stock options as of December 31, 2015, and changes during 2015, is as

follows:

Shares

(in 000’s)

Weighted-

Average

Exercise

Price

Weighted-

Average

Contractual

Term

Aggregate

Intrinsic

Value

Outstanding at January 1, 2015 17,158 $31.74

Granted – –

Exercised – –

Forfeited (6) 18.25

Expired (5,504) 38.20

Outstanding at December 31, 2015 11,648 $28.70 2.9 $ –

Exercisable at December 31, 2015 11,018 $28.18 2.9 $ –

We recognize expense on stock options using a graded vesting method, which recognizes the associated expense based on the timing of

option vesting dates. At December 31, 2015, there was no unrecognized compensation cost related to stock options outstanding.

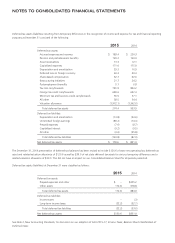

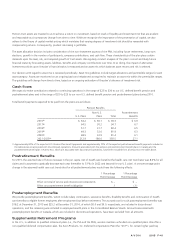

Cash proceeds, tax obligations and intrinsic value related to total stock options exercised during 2014 and 2013, were as follows:

2014 2013

Cash proceeds from stock options exercised $ .2 $19.4

Tax obligation realized for stock options exercised – (1.8)

Intrinsic value of stock options exercised – 6.4

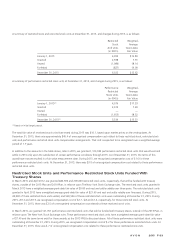

Restricted Stock, Restricted Stock Units and Performance Restricted Stock Units

The fair value of restricted stock units, and performance restricted stock units granted in 2013 and 2014, was determined based on the

closing price of our common stock on the date of grant. The fair value of the performance restricted stock units granted in 2015 was

determined using a Monte-Carlo simulation that estimates the fair value based on the Company’s share price activity, expected term of the

award, risk-free interest rate, expected dividends and the expected volatility of the stock of the Company.

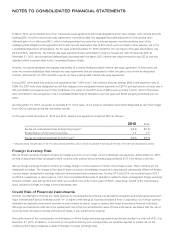

In 2013, we granted performance restricted stock units that would vest and settle after three years only upon the satisfaction of certain

performance conditions over three years. We have adjusted the compensation cost recognized to-date to reflect our estimated performance.

In 2014, we granted performance restricted stock units that would vest and settle after three years only upon the satisfaction of certain

performance conditions over three years. We have adjusted the compensation cost recognized to-date to reflect our estimated performance.

In 2015, we granted performance restricted stock units that would vest and settle after three years only upon the satisfaction of certain

performance conditions over two years (“2015 PRSUs”). In addition, if the performance conditions are achieved above target, these

performance restricted stock units are subject to a market condition in which the number of performance restricted stock units that vest will

be limited to the target amount if the Company’s absolute total shareholder return during the three-year service period is negative. If the

performance conditions are achieved, the range of possible payouts of these performance restricted stock units is limited to a minimum of

50% of target to a maximum of 150% of target. We currently believe that the achievement of the performance conditions is probable.

7553_fin.pdf 104