Avon 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

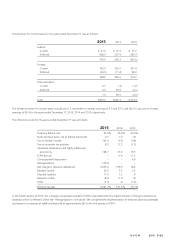

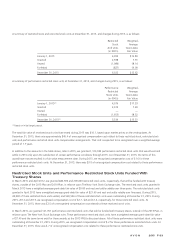

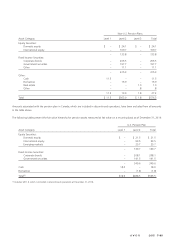

A summary of restricted stock and restricted stock units at December 31, 2015, and changes during 2015, is as follows:

Restricted

Stock

And Units

(in 000’s)

Weighted-

Average

Grant-Date

Fair Value

January 1, 2015 4,995 $16.80

Granted 2,938 7.91

Vested (1,084) 18.14

Forfeited (827) 14.09

December 31, 2015 6,022 $12.62

A summary of performance restricted stock units at December 31, 2015, and changes during 2015, is as follows:

Performance

Restricted

Stock Units

(in 000’s)

Weighted-

Average

Grant-Date

Fair Value

January 1, 2015(1) 4,976 $17.53

Granted 2,013 7.49

Vested — —

Forfeited (1,655) 18.32

December 31, 2015(1) 5,334 $13.51

(1) Based on initial target payout.

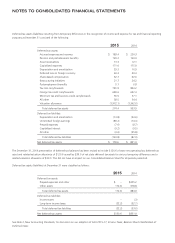

The total fair value of restricted stock units that vested during 2015 was $10.1, based upon market prices on the vesting dates. At

December 31, 2015, there was approximately $45.4 of unrecognized compensation cost related to these restricted stock, restricted stock

units and performance restricted stock units compensation arrangements. That cost is expected to be recognized over a weighted-average

period of 1.7 years.

In addition to the amounts in the table above, later in 2015, we granted 1,123,183 performance restricted stock units that would vest and

settle in 2016 only upon the satisfaction of certain performance conditions through 2015. As of December 31, 2015, the terms of this

award have not yet resulted in a fair value measurement date. During 2015, we recognized compensation cost of $1.6 for these

performance restricted stock units. At December 31, 2015, there was $3.0 of unrecognized compensation cost related to these performance

restricted stock units.

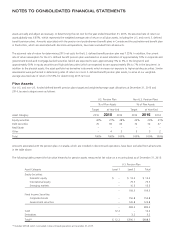

Restricted Stock Units and Performance Restricted Stock Units Funded With

Treasury Shares

In March 2015 and April 2012, we granted 489,596 and 200,000 restricted stock units, respectively, that will be funded with treasury

shares, outside of the 2013 Plan and 2010 Plan, in reliance upon The New York Stock Exchange rules. The restricted stock units granted in

March 2015 have a weighted-average grant-date fair value of $9.00 and vest and settle ratably over three years. The restricted stock units

granted in April 2012 have a weighted-average grant-date fair value of $21.69 and vest and settle ratably over five years. During 2015,

40,000 of these restricted stock units vested, and 569,596 of these restricted stock units were outstanding at December 31, 2015. During

2015, 2014 and 2013, we recognized compensation cost of $2.7, $.8 and $1.4, respectively, for these restricted stock units. At

December 31, 2015, there was $2.5 of unrecognized compensation cost related to these restricted stock units.

In March 2015, we granted 121,951 performance restricted stock units that will be funded with treasury shares, outside of the 2013 Plan, in

reliance upon The New York Stock Exchange rules. These performance restricted stock units have a weighted-average grant-date fair value

of $7.49 and the same terms exist for these awards as the 2015 PRSUs discussed above. All of these performance restricted stock units were

outstanding at December 31, 2015. During 2015, we recognized compensation cost of $.2 for these performance restricted stock units. At

December 31, 2015, there was $.7 of unrecognized compensation cost related to these performance restricted stock units.

A V O N 2015 F-33

7553_fin.pdf 105