Avon 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

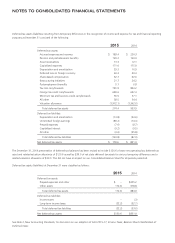

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

In conjunction with the expected separation of North America, approximately $235.0 of deferred tax assets and a related valuation

allowance of $235.0 will be reflected as a deferred tax asset associated with the Company’s investment in NewCo. There are also U.S. state

net operating loss and investment tax credit deferred tax assets of $129.3 and a related valuation allowance of $129.3 which may not be

capable of being fully utilized before expiration by the Company after the separation of North America due to the elimination of the U.S.

operations in substantially all state taxing jurisdictions.

Uncertain Tax Positions

At December 31, 2015, we had $53.0 of total gross unrecognized tax benefits of which approximately $33.7 would favorably impact the

provision for income taxes, if recognized.

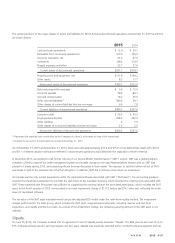

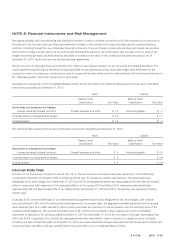

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Balance at December 31, 2012 $ 32.0

Additions based on tax positions related to the current year 5.3

Additions for tax positions of prior years 1.9

Reductions for tax positions of prior years (7.8)

Reductions due to lapse of statute of limitations (3.1)

Reductions due to settlements with tax authorities (2.3)

Balance at December 31, 2013 26.0

Additions based on tax positions related to the current year 1.4

Additions for tax positions of prior years 37.7

Reductions for tax positions of prior years (4.7)

Reductions due to lapse of statute of limitations (1.7)

Reductions due to settlements with tax authorities (2.0)

Balance at December 31, 2014 56.7

Additions based on tax positions related to the current year 3.5

Additions for tax positions of prior years 5.7

Reductions for tax positions of prior years (1.5)

Reductions due to lapse of statute of limitations (0.4)

Reductions due to settlements with tax authorities (11.0)

Balance at December 31, 2015 $ 53.0

We accrue interest and penalties related to unrecognized tax benefits in the provision for income taxes. We recorded expense of $2.8, $.9

and $.9 for interest and penalties, net of taxes during 2015, 2014 and 2013, respectively. At December 31, 2015 and December 31, 2014

we had $6.6 and $4.4 recorded for interest and penalties, net of tax benefit.

We file income tax returns in the U.S. and foreign jurisdictions. As of December 31, 2015, the tax years that remained subject to

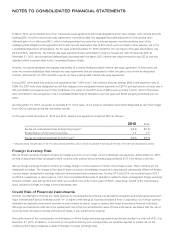

examination by major tax jurisdiction for our most significant subsidiaries were as follows:

Jurisdiction Open Years

Brazil 2010-2015

Mexico 2009-2015

Poland 2010-2015

Russia 2011-2015

United States (Federal) 2014-2015

We anticipate that it is reasonably possible that the total amount of unrecognized tax benefits could decrease in the range of $1 to $18.1

within the next twelve months due to the closure of tax years by expiration of the statute of limitations and audit settlements.

7553_fin.pdf 98