Avon 2015 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

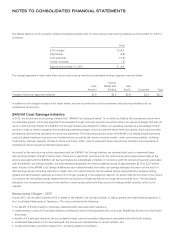

SCHEDULE II

AVON PRODUCTS, INC. AND SUBSIDIARIES

VALUATION AND QUALIFYING ACCOUNTS

Years ended December 31, 2015, 2014 and 2013

Additions

(In millions)

Description

Balance at

Beginning

of Period

Charged

to Costs

and

Expenses

Charged

to

Revenue Deductions

Balance

at End of

Period

2015

Allowance for doubtful accounts receivable $ 93.7 $144.1 $ – $(160.2)(1) $ 77.6

Allowance for sales returns 13.2 – 190.8 (194.9)(2) 9.1

Allowance for inventory obsolescence 98.9 45.4 – (73.0)(3) 71.3

Deferred tax asset valuation allowance 1,362.6 609.5(4) – – 1,972.1

2014

Allowance for doubtful accounts receivable $ 118.4 $171.1 $ – $(195.8)(1) $ 93.7

Allowance for sales returns 14.5 – 240.9 (242.2)(2) 13.2

Allowance for inventory obsolescence 113.9 78.4 – (93.4)(3) 98.9

Deferred tax asset valuation allowance 942.1 420.5(4) – – 1,362.6

2013

Allowance for doubtful accounts receivable $ 121.3 $209.2 $ – $(212.1)(1) $ 118.4

Allowance for sales returns 23.2 – 274.2 (282.9)(2) 14.5

Allowance for inventory obsolescence 134.4 82.0 – (102.5)(3) 113.9

Deferred tax asset valuation allowance 786.1 156.0(4) – – 942.1

(1) Accounts written off, net of recoveries and foreign currency translation adjustment.

(2) Returned product destroyed and foreign currency translation adjustment.

(3) Obsolete inventory destroyed and foreign currency translation adjustment.

(4) Increase in valuation allowance primarily for deferred tax assets that are not more likely than not to be realized in the future.

7553_fin.pdf 128