Avon 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

of approximately $15, primarily in Russia, which was largely due to lower earnings, which were significantly impacted by foreign exchange

losses on working capital balances. In addition, in the fourth quarter of 2015, we recognized a benefit of approximately $19 as a result of

the implementation of foreign tax planning strategies. The additional valuation allowances for deferred tax assets in 2015 caused income

taxes to be significantly in excess of income before taxes.

The effective tax rate in 2014 was negatively impacted by a non-cash income tax charge of approximately $396. This was largely due to a

valuation allowance, recorded in the fourth quarter of 2014, against deferred tax assets of approximately $375 which is primarily due to the

strengthening of the U.S. dollar against currencies of some of our key markets. The approximate $375 includes the valuation allowance

recorded for U.S. deferred tax assets of approximately $367, as well as approximately $8 associated with other foreign subsidiaries.

In addition, the effective tax rates in 2015 and 2014 were negatively impacted by the devaluations of the Venezuelan currency in

conjunction with highly inflationary accounting discussed further within “Segment Review – Latin America” in this MD&A.

See Note 7, Income Taxes on pages F-22 through F-26 of our 2015 Annual Report, for more information.

The Adjusted effective tax rate in 2015 was negatively impacted by the country mix of earnings and the inability to recognize additional

deferred tax assets in various jurisdictions related to our current-year operating results. The Adjusted effective tax rate in 2014 was

negatively impacted by an adjustment to the carrying value of our state deferred tax balances due to changes in the expected tax rate,

valuation allowances for deferred taxes, including the impact of legislative changes, and out-of-period adjustments of approximately $6

recorded in the fourth quarter of 2014.

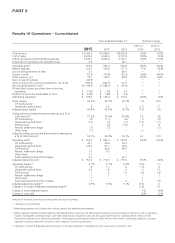

Discontinued Operations

Loss from discontinued operations, net of tax was $349 compared to a loss of $40 for 2014. During 2015, we recorded a charge of

approximately $340 before tax ($340 after tax) associated with the estimated loss on the sale of the North America business that is expected

to be completed in 2016. In addition, the North America operations achieved higher operating income in 2015 as compared with 2014

despite lower revenues as a result of significant cost savings, as well as lower costs to implement restructuring initiatives.

The estimated loss on sale was comprised of the following:

Pension and postretirement benefit plan liabilities $ 236

Cash to be contributed to the North America business at closing (100)

Gain on net liability reduction 136

Acceleration of pension and postretirement items in AOCI (278)

Total pension and postretirement related items (142)

Net assets to be contributed at closing (excluding pension items above) (206)

Costs to sell (35)

Implied value of ownership interest in North America business 43

Estimated loss on sale $ (340)

See Note 3, Discontinued Operations and Divestitures on pages F-15 through F-18 of our 2015 Annual Report for a further discussion of the

pension settlement charges.

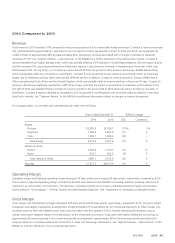

Impact of Foreign Currency

During 2015, foreign currency had a significant impact on our financial results. Specifically, as compared to the prior-year period, foreign

currency has impacted our consolidated financial results as a result of:

• foreign currency transaction losses (classified within cost of sales, and selling, general and administrative expenses), which had an

unfavorable impact to Adjusted operating profit of an estimated $210, or approximately 280 points to Adjusted operating margin;

• foreign currency translation, which had an unfavorable impact to Adjusted operating profit of approximately $265 (of which

approximately $90 related to Venezuela), or approximately 200 points to Adjusted operating margin; and

• lower foreign exchange losses (classified within other expense, net), which had a favorable impact of approximately $10 before tax.

7553_fin.pdf 44