Avon 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

average order. In the United Kingdom, revenue declined 12%, which was unfavorably impacted by foreign exchange. On a Constant $ basis,

the United Kingdom’s revenue declined 5%, primarily due to a decrease in Active Representatives. In Turkey, revenue declined 15%, which

was unfavorably impacted by foreign exchange. On a Constant $ basis, Turkey’s revenue grew 5%. In South Africa, revenue grew 1%,

which was unfavorably impacted by foreign exchange. On a Constant $ basis, South Africa’s revenue grew 19%, primarily due to an

increase in Active Representatives and higher average order.

Operating margin was negatively impacted by .3 points as compared to the prior-year period due to the impact of a non-cash goodwill

impairment charge associated with our Egypt business during 2015. The non-cash goodwill impairment charge in the fourth quarter of 2015

was recorded based on our annual impairment analysis. See Note 16, Goodwill and Intangible Assets on pages F-51 through F-53 of our

2015 Annual Report for more information on Egypt. Operating margin benefited by .7 points as compared to the prior-year period from

lower CTI restructuring. Adjusted operating margin decreased 2.0 points, or .7 points on a Constant $ basis, primarily as a result of:

• a decline of 2.4 points due to lower gross margin caused primarily by an estimated 4 points from the unfavorable impact of foreign

currency transaction losses, partially offset by approximately 1.2 points from lower supply chain costs and .8 points from the favorable net

impact of mix and pricing. Supply chain costs benefited primarily as a result of lower overhead costs which were attributable to increased

productivity. The favorable net impact of mix and pricing was primarily driven by Eastern Europe;

• a decline of .6 points from higher Representative, sales leader and field expense; and

• a net benefit of 2.0 points primarily due to the Constant $ revenue growth with respect to our fixed expenses and a reduction of

corporate expenses, which are allocated from Global.

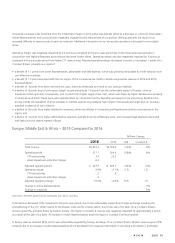

Europe, Middle East & Africa – 2014 Compared to 2013

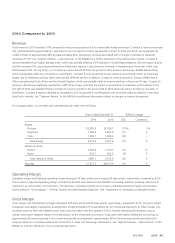

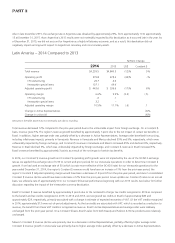

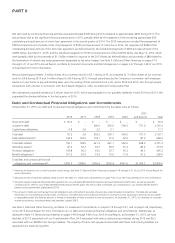

%/Point Change

2014 2013 US$ Constant $

Total revenue $2,705.8 $2,898.4 (7)% 1%

Operating profit 300.9 406.7 (26)% (18)%

CTI restructuring 23.2 17.7

Adjusted operating profit $ 324.1 $ 424.4 (24)% (16)%

Operating margin 11.1% 14.0% (2.9) (2.6)

CTI restructuring .9 .6

Adjusted operating margin 12.0% 14.6% (2.6) (2.4)

Change in Active Representatives (1)%

Change in units sold –%

Amounts in the table above may not necessarily sum due to rounding.

Total revenue decreased 7% compared to the prior-year period, due to the unfavorable impact from foreign exchange. On a Constant $

basis, revenue grew 1%. The region’s Constant $ revenue was negatively impacted by approximately 1 point as a result of the closure of the

France business.

In Russia, revenue declined 18%, which was unfavorably impacted by foreign exchange. On a Constant $ basis, Russia’s revenue declined

1%, primarily due to a decrease in Active Representatives, partially offset by higher average order. Russia was negatively impacted by a

difficult economy, including the impact of geopolitical uncertainties. Russia’s Constant $ revenue decline in the first half of 2014 was

partially offset by Constant $ revenue growth in the second half of 2014, driven by actions to improve unit sales. In the United Kingdom,

revenue increased 6%, which was favorably impacted by foreign exchange. On a Constant $ basis, the United Kingdom’s revenue increased

1%, primarily due to higher average order, partially offset by a decrease in Active Representatives. In Turkey, revenue declined 14%, which

was unfavorably impacted by foreign exchange. On a Constant $ basis, Turkey’s revenue declined 2%, primarily due to lower average order.

In South Africa, revenue declined 3%, which was unfavorably impacted by foreign exchange. On a Constant $ basis, South Africa’s revenue

increased 8%, primarily due to an increase in Active Representatives.

7553_fin.pdf 54