Avon 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

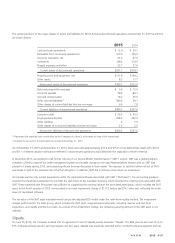

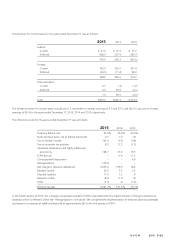

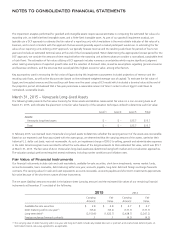

The provision for income taxes for the years ended December 31 was as follows:

2015 2014 2013

Federal:

Current $ 41.6 $ 57.3 $ 75.7

Deferred 668.3 207.9 (180.7)

709.9 265.2 (105.0)

Foreign:

Current 132.3 252.0 221.4

Deferred (24.3) (11.4) 98.3

108.0 240.6 319.7

State and other:

Current 0.7 (.4) (1.2)

Deferred 0.6 39.9 (3.1)

1.3 39.5 (4.3)

Total $819.2 $545.3 $ 210.4

The foreign provision for income taxes includes the U.S. tax benefit on foreign earnings of $.0 and $3.5, and the U.S. tax cost on foreign

earnings of $9.9 for the years ended December 31, 2015, 2014 and 2013, respectively.

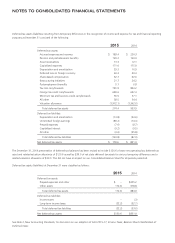

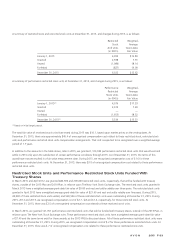

The effective tax rate for the years ended December 31 was as follows:

2015 2014 2013

Statutory federal rate 35.0% 35.0% 35.0%

State and local taxes, net of federal tax benefit 2.5 7.0 (.5)

Tax on foreign income 141.4 (6.5) (9.8)

Tax on uncertain tax positions 8.2 17.3 (1.3)

Venezuela devaluation and highly inflationary

accounting 168.1 27.4 16.5

FCPA accrual – (7.1) 11.2

China goodwill impairment – – 4.9

Reorganizations (173.5) – –

Net change in valuation allowances 3,395.6 193.9 18.4

Blocked income 29.3 3.5 2.3

Imputed royalties 11.9 1.2 .9

Research credits (8.9) (1.0) (.5)

Other (7.9) .8 (1.4)

Effective tax rate 3,601.7% 271.5% 75.7%

In the fourth quarter of 2015, the Company recognized a benefit of $18.7 associated with the implementation of foreign tax planning

strategies which is reflected within the “Reorganizations” line above. We completed the implementation of these tax planning strategies

and expect to recognize an additional benenfit of approximately $30 in the first quarter of 2016.

A V O N 2015 F-23

7553_fin.pdf 95