Avon 2015 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

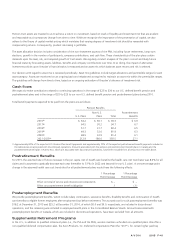

assets annually and adjust as necessary. In determining the net cost for the year ended December 31, 2015, the assumed rate of return on

assets globally was 6.87%, which represents the weighted-average rate of return on all plan assets, including the U.S. and non-U.S. defined

benefit pension plans. Amounts associated with the pension and postretirement benefit plans in Canada and the postretirement benefit plan

in Puerto Rico, which are associated with discontinued operations, have been excluded from all amounts.

The assumed rate of return for determining 2015 net costs for the U.S. defined benefit pension plan was 7.25%. In addition, the current

rate of return assumption for the U.S. defined benefit pension plan was based on an asset allocation of approximately 70% in corporate and

government bonds and mortgage-backed securities (which are expected to earn approximately 3% to 5% in the long term) and

approximately 30% in equity securities and high yield securities (which are expected to earn approximately 5% to 7% in the long term). In

addition to the physical assets, the asset portfolio has derivative instruments which increase our exposure to higher yielding securities. Similar

assessments were performed in determining rates of return on non-U.S. defined benefit pension plan assets, to arrive at our weighted-

average assumed rate of return of 6.55% for determining 2015 net cost.

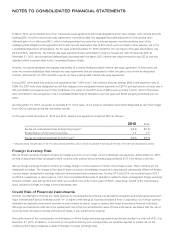

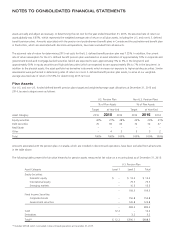

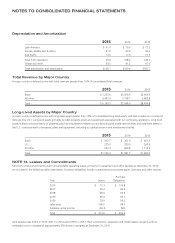

Plan Assets

Our U.S. and non-U.S. funded defined benefit pension plans target and weighted-average asset allocations at December 31, 2015 and

2014, by asset category were as follows:

U.S. Pension Plan Non-U.S. Pension Plans

% of Plan Assets % of Plan Assets

Target at Year-End Target at Year-End

Asset Category 2016 2015 2014 2016 2015 2014

Equity securities 30% 27% 28% 23% 23% 61%

Debt securities 70 69 69 72 72 37

Real Estate – – – – – –

Other – 4 3 5 5 2

Total 100% 100% 100% 100% 100% 100%

Amounts associated with the pension plan in Canada, which are included in discontinued operations, have been excluded from all amounts

in the table above.

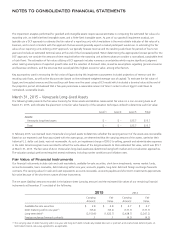

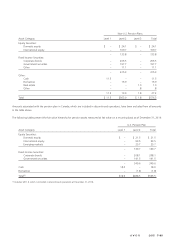

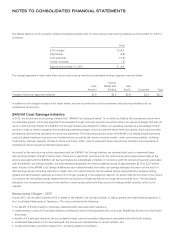

The following tables present the fair value hierarchy for pension assets measured at fair value on a recurring basis as of December 31, 2015:

U.S. Pension Plan

Asset Category Level 1 Level 2 Total

Equity Securities:

Domestic equity $ – $ 13.3 $ 13.3

International equity – 79.5 79.5

Emerging markets – 16.5 16.5

– 109.3 109.3

Fixed Income Securities:

Corporate bonds – 156.8 156.8

Government securities – 126.8 126.8

– 283.6 283.6

Cash 12.2 – 12.2

Derivatives – 3.2 3.2

Total(4) $ 12.2 $396.1 $408.3

(4) Includes $374.8 which is included in discontinued operations at December 31, 2015.

7553_fin.pdf 110