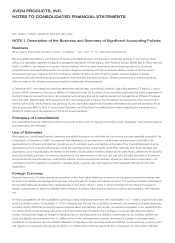

Avon 2015 Annual Report Download - page 91

Download and view the complete annual report

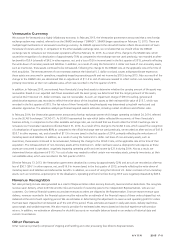

Please find page 91 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Venezuela Currency

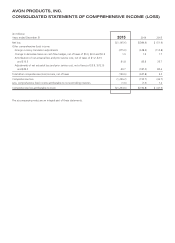

We account for Venezuela as a highly inflationary economy. In February 2015, the Venezuelan government announced that a new foreign

exchange system was created, referred to as the SIMADI exchange (“SIMADI”). SIMADI began operating on February 12, 2015. There are

multiple legal mechanisms in Venezuela to exchange currency. As SIMADI represents the rate which better reflects the economics of Avon

Venezuela’s business activity, in comparison to the other available exchange rates, we concluded that we should utilize the SIMADI

exchange rate to remeasure our Venezuelan operations effective February 12, 2015. As a result of the change to the SIMADI rate, which

caused the recognition of a devaluation of approximately 70% as compared to the exchange rate we used previously, we recorded an after-

tax benefit of $3.4 (a benefit of $4.2 in other expense, net, and a loss of $.8 in income taxes) in the first quarter of 2015, primarily reflecting

the write-down of monetary assets and liabilities. In addition, as a result of using the historical U.S. dollar cost basis of non-monetary assets,

such as inventories, these assets continued to be remeasured, following the change to the SIMADI rate, at the applicable rate at the time of

their acquisition. The remeasurement of non-monetary assets at the historical U.S. dollar cost basis causes a disproportionate expense as

these assets are consumed in operations, negatively impacting operating profit and net income by $18.5 during 2015. Also as a result of the

change to the SIMADI rate, we determined that an adjustment of $11.4 to cost of sales was needed to reflect certain non-monetary assets,

primarily inventories, at their net realizable value, which was recorded in the first quarter of 2015.

In addition, in February 2015, we reviewed Avon Venezuela’s long-lived assets to determine whether the carrying amount of the assets was

recoverable. Based on our expected cash flows associated with the asset group, we determined that the carrying amount of the assets,

carried at their historical U.S. dollar cost basis, was not recoverable. As such, an impairment charge of $90.3 to selling, general and

administrative expenses was recorded to reflect the write-down of the long-lived assets to their estimated fair value of $15.7, which was

recorded in the first quarter of 2015. The fair value of Avon Venezuela’s long-lived assets was determined using both market and cost

valuation approaches. The valuation analysis performed required several estimates, including market conditions and inflation rates.

In February 2014, the Venezuelan government announced a foreign exchange system which began operating on March 24, 2014, referred

to as the SICAD II exchange (“SICAD II”). As SICAD II represented the rate which better reflected the economics of Avon Venezuela’s

business activity, in comparison to the other available exchange rates, we concluded that we should utilize the SICAD II exchange rate to

remeasure our Venezuelan operations effective March 31, 2014. As a result of the change to the SICAD II rate, which caused the recognition

of a devaluation of approximately 88% as compared to the official exchange rate we used previously, we recorded an after-tax loss of $41.8

($53.7 in other expense, net, and a benefit of $11.9 in income taxes) in the first quarter of 2014, primarily reflecting the write-down of

monetary assets and liabilities. In addition, as a result of using the historical U.S. dollar cost basis of non-monetary assets, such as

inventories, these assets continued to be remeasured, following the change to the SICAD II rate, at the applicable rate at the time of their

acquisition. The remeasurement of non-monetary assets at the historical U.S. dollar cost basis causes a disproportionate expense as these

assets are consumed in operations, negatively impacting operating profit and net income by $21.4 during 2014. Also as a result, we

determined that an adjustment of $115.7 to cost of sales was needed to reflect certain non-monetary assets, primarily inventories, at their

net realizable value, which was recorded in the first quarter of 2014.

Effective February 13, 2013, the Venezuelan government devalued its currency by approximately 32% and as such we recorded an after-tax

loss of $50.7 ($34.1 in other expense, net, and $16.6 in income taxes) in the first quarter of 2013, primarily reflecting the write-down of

monetary assets and liabilities and deferred tax benefits. In addition, as a result of using the historical U.S. dollar cost basis of non-monetary

assets, such as inventories, acquired prior to the devaluation, operating profit and net loss during 2013 were negatively impacted by $49.6.

Revenue Recognition

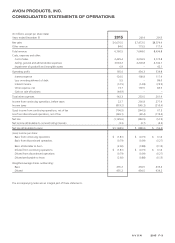

Net sales primarily include sales generated as a result of Representative orders less any discounts, taxes and other deductions. We recognize

revenue upon delivery, when both title and the risks and rewards of ownership pass to the independent Representatives, who are our

customers. Our internal financial systems accumulate revenues as orders are shipped to the Representative. Since we report revenue upon

delivery, revenues recorded in the financial system must be reduced for an estimate of the financial impact of those orders shipped but not

delivered at the end of each reporting period. We use estimates in determining the adjustments to revenue and operating profit for orders

that have been shipped but not delivered as of the end of the period. These estimates are based on daily sales levels, delivery lead times,

gross margin and variable expenses. We also record a provision for estimated sales returns based on historical experience with product

returns. In addition, we estimate an allowance for doubtful accounts on receivable balances based on an analysis of historical data and

current circumstances.

Other Revenue

Other revenue is primarily comprised of shipping and handling and order processing fees billed to Representatives.

A V O N 2015 F-9

7553_fin.pdf 81