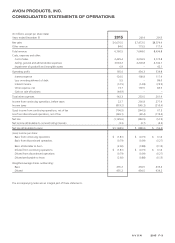

Avon 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AVON PRODUCTS, INC.

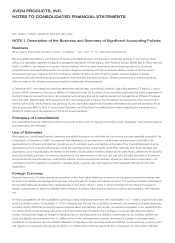

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

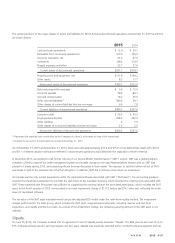

(U.S. dollars in millions, except per share and share data)

NOTE 1. Description of the Business and Summary of Significant Accounting Policies

Business

When used in these notes, the terms “Avon,” “Company,” “we,” “our” or “us” mean Avon Products, Inc.

We are a global manufacturer and marketer of beauty and related products. Our business is conducted primarily in one channel, direct

selling. Our reportable segments are based on geographic operations in three regions: Latin America; Europe, Middle East & Africa; and Asia

Pacific. In addition, we operate our business in North America, which has been presented as discontinued operations for all periods

presented and is discussed further below. Our product categories are Beauty and Fashion & Home. Beauty consists of skincare (which

includes personal care), fragrance and color (cosmetics). Fashion & Home consists of fashion jewelry, watches, apparel, footwear,

accessories, gift and decorative products, housewares, entertainment and leisure products, children’s products and nutritional products.

Sales are made to the ultimate consumer principally by independent Representatives.

In December 2015, we entered into definitive agreements with affiliates controlled by Cerberus Capital Management (“Cerberus”), which

include a $435 investment in Avon by an affiliate of Cerberus through the purchase of our convertible preferred stock and the separation of

the North America business from Avon into a privately-held company that will be majority-owned and managed by an affiliate of Cerberus.

Avon will retain approximately 20% ownership in this new privately-held company. The transactions are expected to close concurrently in

the first half of 2016. North America was previously its own reportable segment and has been presented as discontinued operations for all

periods presented. Refer to Note 3, Discontinued Operations and Divestitures for additional information regarding the investment by an

affiliate of Cerberus and the separation of the North America business.

Principles of Consolidation

The consolidated financial statements include the accounts of Avon and our majority and wholly-owned subsidiaries. Intercompany balances

and transactions are eliminated.

Use of Estimates

We prepare our consolidated financial statements and related disclosures in conformity with accounting principles generally accepted in the

United States of America, or GAAP. In preparing these statements, we are required to use estimates and assumptions that affect the

reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ materially from those estimates and

assumptions. On an ongoing basis, we review our estimates, including those related to allowances for sales returns, allowances for doubtful

accounts receivable, provisions for inventory obsolescence, the determination of discount rate and other actuarial assumptions for pension

and postretirement benefit expenses, restructuring expense, income taxes and tax valuation allowances, share-based compensation, loss

contingencies and the evaluation of goodwill, intangible assets, property, plant and equipment and capitalized software for potential

impairment.

Foreign Currency

Financial statements of foreign subsidiaries operating in other than highly inflationary economies are translated at year-end exchange rates

for assets and liabilities and average exchange rates during the year for income and expense accounts. The resulting translation adjustments

are recorded within accumulated other comprehensive income (loss) (“AOCI”). Gains or losses resulting from the impact of changes in

foreign currency rates on assets and liabilities denominated in a currency other than the functional currency are recorded in other expense,

net.

For financial statements of Avon subsidiaries operating in highly inflationary economies, the United States (“U.S.”) dollar is required to be used

as the functional currency. At December 31, 2015, Venezuela was the only Avon subsidiary considered to be operating in a highly inflationary

economy. Highly inflationary accounting requires monetary assets and liabilities, such as cash, receivables and payables, to be remeasured into

U.S. dollars at the current exchange rate at the end of each period with the impact of any changes in exchange rates being recorded in

income. We record the impact of changes in exchange rates on monetary assets and liabilities in other expense, net. Similarly, deferred tax

assets and liabilities are remeasured into U.S. dollars at the current exchange rates; however, the impact of changes in exchange rates is

recorded in income taxes in the Consolidated Statements of Operations. Non-monetary assets and liabilities, such as inventory, property, plant

and equipment and prepaid expenses are recorded in U.S. dollars at the historical rates at the time of acquisition of such assets or liabilities.

7553_fin.pdf 80