Avon 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

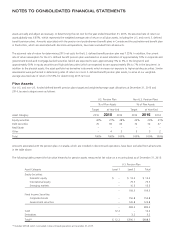

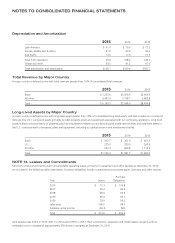

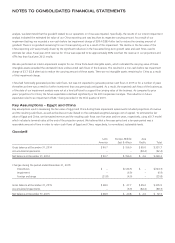

The liability balance, which primarily consists of employee-related costs, for these various restructuring initiatives as of December 31, 2015 is

as follows:

Total

2015 charges $ 24.9

Adjustments (2.8)

Cash payments (17.8)

Foreign exchange (.3)

Balance at December 31, 2015 $ 4.0

The charges approved to date under these various restructuring initiatives by reportable business segment were as follows:

Latin

America

Europe,

Middle East

& Africa

Asia

Pacific Corporate Total

Charges incurred on approved initiatives $2.9 $4.2 $5.8 $9.2 $22.1

In addition to the charges included in the tables above, we have incurred other costs to implement restructuring initiatives such as

professional services fees.

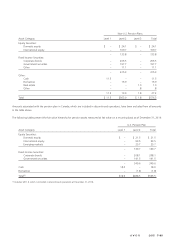

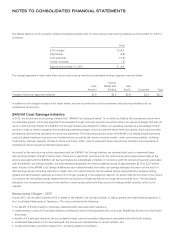

$400M Cost Savings Initiative

In 2012, we announced a cost savings initiative (the “$400M Cost Savings Initiative”) in an effort to stabilize the business and return Avon

to sustainable growth, which was expected to be achieved through restructuring actions as well as other cost-savings strategies that will not

result in restructuring charges. The $400M Cost Savings Initiative was designed to reduce our operating expenses as a percentage of total

revenue to help us achieve a targeted low double-digit operating margin, which included the North America business which has since been

presented as discontinued operations for all periods presented. The restructuring actions under the $400M Cost Savings Initiative primarily

consist of global headcount reductions and related actions, as well as the closure of certain smaller, under-performing markets, including

South Korea, Vietnam, Republic of Ireland, Bolivia and France. Other costs to implement these restructuring initiatives consist primarily of

professional service fees and accelerated depreciation.

As a result of the restructuring actions associated with the $400M Cost Savings Initiative, we recorded total costs to implement these

restructuring initiatives of $165.7 before taxes. There are no significant remaining costs for restructuring actions approved-to-date as the

actions associated with the $400M Cost Savings Initiative are substantially complete. In connection with the restructuring actions associated

with the $400M Cost Savings Initiative, we have realized substantially all of the annualized savings of approximately $215 to $225 before

taxes. As part of the $400M Cost Savings Initiative we also realized benefits from other cost-savings strategies that were not the result of

restructuring charges (including reductions in legal costs). For market closures, the annualized savings represented the foregone selling,

general and administrative expenses as a result of no longer operating in the respective markets. For actions that did not result in the closure

of a market, the annualized savings represented the net reduction of expenses that will no longer be incurred by Avon. The annualized

savings do not incorporate the impact of the decline in revenue associated with these actions (including market closures), which is not

material.

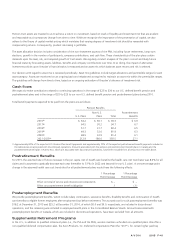

Restructuring Charges – 2015

During 2015, we recorded a benefit of $3.5 related to the $400M Cost Savings Initiative, in selling, general and administrative expenses, in

the Consolidated Statements of Operations. The costs consisted of the following:

• net benefit of $4.4 primarily for employee-related benefits, associated with severance;

• implementation costs of $.9 primarily related to professional service fees associated with our Europe, Middle East & Africa and Asia Pacific

businesses;

• benefit of $.4 primarily related to the accumulated foreign currency translation adjustments associated with Asia Pacific markets;

• accelerated depreciation of $.3 associated with the closure and rationalization of certain facilities; and

• contract termination and other charge of $.1, primarily related to Asia Pacific.

7553_fin.pdf 118