Avon 2015 Annual Report Download - page 131

Download and view the complete annual report

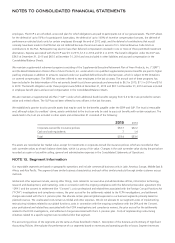

Please find page 131 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As previously reported, in December 2014, the United States District Court for the Southern District of New York (the “USDC”) approved a

DPA entered into between the Company and the DOJ related to charges of violations of the books and records and internal controls

provisions of the FCPA. In addition, Avon Products (China) Co. Ltd., a subsidiary of the Company operating in China, pleaded guilty to

conspiring to violate the books and records provision of the FCPA and was sentenced by the USDC to pay a $68 fine. The SEC also filed a

complaint against the Company charging violations of the books and records and internal controls provisions of the FCPA and the Consent

which was approved in a judgment entered by the USDC in January 2015, and included $67 in disgorgement and prejudgment interest. The

DPA, the above-mentioned guilty plea and the Consent resolved the SEC’s and the DOJ’s investigations of the Company’s compliance with

the FCPA and related U.S. laws in China and additional countries. The fine was paid in December 2014 and the payment to the SEC was

made in January 2015, both of which had been previously accrued for before December 31, 2014.

Under the DPA, the DOJ will defer criminal prosecution of the Company for a term of three years. If the Company remains in compliance

with the DPA during its term, the charges against the Company will be dismissed with prejudice. Under the DPA, the Company also

represented that it has implemented and agreed that it will continue to implement a compliance and ethics program designed to prevent

and detect violations of the FCPA and other applicable anti-corruption laws throughout its operations.

Under the DPA and the Consent, among other things, the Company agreed to have a compliance monitor (the “monitor”). During July

2015, the Company engaged a monitor, who had been approved by the DOJ and SEC. With the approval of the DOJ and the SEC, the

monitor can be replaced by the Company after 18 months, if the Company agrees to undertake self-reporting obligations for the remainder

of the monitoring period. The monitoring period is scheduled to expire in July 2018. There can be no assurance as to whether or when the

DOJ and the SEC will approve replacing the monitor with the Company’s self-reporting. If the DOJ determines that the Company has

knowingly violated the DPA, the DOJ may commence prosecution or extend the term of the DPA, including the monitoring provisions

described above, for up to one year.

The monitor is assessing and monitoring the Company’s compliance with the terms of the DPA and the Consent by evaluating, among other

things, the Company’s internal accounting controls, recordkeeping and financial reporting policies and procedures. The monitor may

recommend changes to our policies and procedures that we must adopt unless they are unduly burdensome or otherwise inadvisable, in

which case we may propose alternatives, which the DOJ and the SEC may or may not accept. In addition, operating under the oversight of

the monitor may result in additional time and attention on these matters by members of our management, which may divert their time from

the operation of our business. Assuming the monitor is replaced by a self-reporting period, the Company’s self-reporting obligations may be

costly or time-consuming.

While the costs have not been significant to date, we currently cannot estimate the costs that we are likely to incur in connection with

ongoing compliance with the DPA and the Consent, including the monitorship, the costs, if applicable, of self-reporting, and the costs of

implementing the changes, if any, to our policies and procedures required by the monitor. These costs could be significant.

Litigation Matters

In July and August 2010, derivative actions were filed in state court against certain present or former officers and/or directors of the

Company (Carol J. Parker, derivatively on behalf of Avon Products, Inc. v. W. Don Cornwell, et al. and Avon Products, Inc. as nominal

defendant (filed in the New York Supreme Court, Nassau County, Index No. 600570/2010); Lynne Schwartz, derivatively on behalf of Avon

Products, Inc. v. Andrea Jung, et al. and Avon Products, Inc. as nominal defendant (filed in the New York Supreme Court, New York County,

Index No. 651304/2010)). On November 22, 2013, a derivative action was filed in federal court against certain present or former officers

and/or directors of the Company and following the federal court’s dismissal, an additional action was subsequently filed in New York state

court on May 1, 2015 (Sylvia Pritika, derivatively on behalf of Avon Products, Inc. v. Andrea Jung, et al. and Avon Products, Inc. as nominal

defendant (filed in the New York Supreme Court, New York County, Index No. 651479/2015)). The claims asserted in one or more of these

actions include alleged breach of fiduciary duty, abuse of control, waste of corporate assets, and unjust enrichment, relating to the

Company’s compliance with the FCPA, including the adequacy of the Company’s internal controls. The relief sought against the individual

defendants in one or more of these derivative actions include certain declaratory and equitable relief, restitution, damages, exemplary

damages and interest. The Company is a nominal defendant, and no relief is sought against the Company itself. On April 28, 2015, an

action was filed to seek enforcement of demands for the inspection of certain of the Company’s books and records (Belle Cohen v. Avon

Products, Inc. (filed in the New York Supreme Court, New York County, Index No. 651418/2015)). The parties have reached agreements to

settle the derivative and books and records actions. The terms of settlement include certain corporate governance measures as well as

releases of claims. The Company has accrued approximately $4 with respect to these matters, which the Company expects will be paid by

A V O N 2015 F-49

7553_fin.pdf 121