Avon 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

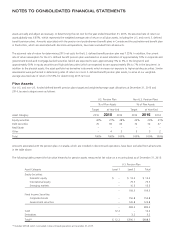

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

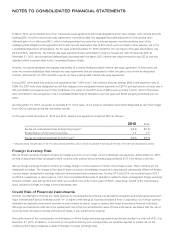

The U.S. pension plans include a funded qualified plan and unfunded non-qualified plans. As of December 31, 2015, the U.S. qualified

pension plan had benefit obligations of $578.4 and plan assets of $408.3, of which $507.6 and $374.8, respectively, are included in

discontinued operations. As of December 31, 2014, the U.S. qualified pension plan had benefit obligations of $673.1 and plan assets of

$506.5, of which $544.7 and $411.6, respectively, are included in discontinued operations. We believe we have adequate investments and

cash flows to fund the liabilities associated with the unfunded non-qualified plans.

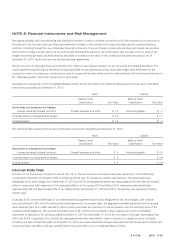

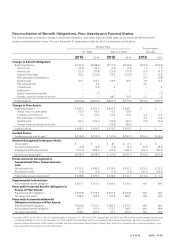

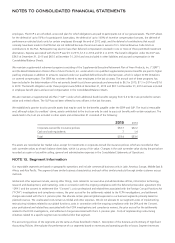

Components of Net Periodic Benefit Cost and Other Amounts Recognized in Other

Comprehensive Loss

Pension Benefits

Postretirement BenefitsU.S. Plans Non-U.S. Plans

2015 2014 2013 2015 2014 2013 2015 2014 2013

Net Periodic Benefit Cost:

Service cost $ 13.0 $ 14.1 $ 15.7 $ 5.3 $ 6.0 $ 9.2 $ .7 $ .7 $ 1.4

Interest cost 25.1 27.8 27.5 23.6 31.0 31.4 3.7 4.1 4.3

Expected return on plan assets (32.6) (35.8) (37.4) (36.4) (36.4) (33.9) – – –

Amortization of prior service credit (.7) (.3) (.3) (.1) (.1) (.3) (4.0) (4.4) (4.7)

Amortization of net actuarial losses 43.7 45.1 47.2 8.4 6.5 8.5 1.8 1.3 2.3

Amortization of transition obligation – – – .1 – – – – –

Settlements/curtailments 27.9 38.0 – .5 2.7 (4.3) – (2.7) (1.8)

Other – – – – – – – – –

Net periodic benefit cost(2) $ 76.4 $ 88.9 $ 52.7 $ 1.4 $ 9.7 $ 10.6 $ 2.2 $(1.0) $ 1.5

Other Changes in Plan Assets and

Benefit Obligations Recognized in

Other Comprehensive (Loss) Income:

Actuarial losses (gains) $ 1.8 $105.9 $ (80.8) $(34.2) $ 97.0 $ (6.0) $ (5.6) $ 2.0 $(22.5)

Prior service (credit) cost – (2.0) – – – – (9.0) – (1.3)

Amortization of prior service credit .7 .3 .3 .1 .1 7.9 4.0 7.2 7.0

Amortization of net actuarial losses (71.6) (81.5) (47.2) (9.1) (9.9) (13.4) (1.8) (1.6) (3.1)

Amortization of transition obligation – – – (.1) – – – – –

Foreign currency changes – – – (19.4) (28.0) 4.2 .2 .1 (.1)

Total recognized in other comprehensive (loss)

income* $(69.1) $ 22.7 $(127.7) $(62.7) $ 59.2 $ (7.3) $(12.2) $ 7.7 $(20.0)

Total recognized in net periodic benefit cost

and other comprehensive (loss) income $ 7.3 $111.6 $ (75.0) $(61.3) $ 68.9 $ 3.3 $(10.0) $ 6.7 $(18.5)

(2) Includes $53.7, $62.6 and $35.2 of the U.S. pension plans in 2015, 2014 and 2013, respectively, and immaterial amounts of the postretirement benefit plans

(related to the U.S.) in 2015, 2014 and 2013, which are included in discontinued operations. Amounts associated with the pension and postretirement

benefit plans in Canada and the postretirement benefit plan in Puerto Rico, which are included in discontinued operations, have been excluded from all

amounts in the table above.

* Amounts represent the pre-tax effect classified within other comprehensive (loss) income. The net of tax amounts are classified within the Consolidated

Statements of Comprehensive Income (Loss).

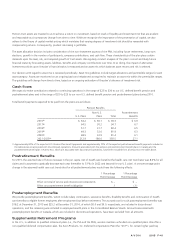

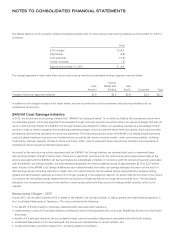

As a result of the lump-sum payments made to former employees that were vested and participated in the PRA, in the third quarter of 2015,

we recorded a settlement charge of $23.8. These lump sum payments were made from our plan assets and were not the result of a specific

offer to participants of our PRA as described below. Because the settlement threshold was exceeded in the third quarter of 2015, a

settlement charge of $4.1 was also recorded in the fourth quarter of 2015, as a result of additional payments from the PRA. These

settlement charges were allocated between Global Expenses and Discontinued Operations.

In an effort to reduce our pension benefit obligations, in March 2014, we offered former employees who were vested and participated in

the PRA a payment that would fully settle our pension plan obligation to those participants who elected to receive such payment. The

7553_fin.pdf 108