Avon 2015 Annual Report Download - page 53

Download and view the complete annual report

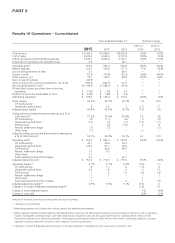

Please find page 53 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The increase of 220 basis points in Adjusted selling, general and administrative expenses as a percentage of revenue was primarily due to the

following:

• an increase of approximately 210 basis points due to the unfavorable impact of foreign currency translation and foreign currency

transaction losses;

• an increase of 60 basis points associated with the net impact of VAT credits in Brazil recognized in revenue in 2014 that did not recur in

2015;

• an increase of 60 basis points as a result of the IPI tax law on cosmetics in Brazil, which reduced revenue as we did not raise the prices

paid by Representatives to the same extent as the IPI tax; and

• an increase of 40 basis points due to higher expenses associated with long-term employee incentive compensation plans as the prior-year

period includes the benefit from the reversal of such accruals that did not recur in the current-year period.

These items were partially offset by the following:

• a decrease of 160 basis points primarily due to the impact of Constant $ revenue growth with respect to our fixed expenses. In addition,

lower fixed expenses, primarily resulting from our cost savings initiatives, mainly reductions in headcount, were largely offset by the

inflationary impact on our expenses.

See “Segment Review – Latin America” in this MD&A for a further discussion of the VAT credits and IPI tax law in Brazil.

Impairment of Goodwill and Intangible Assets

During the fourth quarter of 2015, we recorded a non-cash impairment charge of approximately $7 for goodwill associated with our Egypt

business. See Note 16, Goodwill and Intangible Assets on pages F-51 through F-53 of our 2015 Annual Report for more information on

Egypt.

See “Segment Review” in this MD&A for additional information related to changes in operating margin by segment.

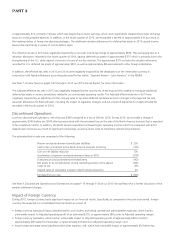

Other Expense

Interest expense increased by approximately $12 compared to the prior-year period, primarily due to the increase in the interest rates on the

2013 Notes (defined below) as a result of the long-term credit rating downgrades.

Interest income decreased by approximately $2 compared to the prior-year period.

Loss on extinguishment of debt in 2015 was comprised of approximately $5 for the make-whole premium and approximately $1 for the

write-off of debt issuance costs and discounts associated with the prepayment of our 2.375% Notes (as defined below in “Liquidity and

Capital Resources”). Refer to Note 5, Debt and Other Financing on pages F-19 through F-21 of our 2015 Annual Report and “Liquidity and

Capital Resources” in this MD&A for additional information.

Other expense, net, decreased by approximately $66 compared to the prior-year period, primarily due to a less significant impact from the

devaluation of the Venezuelan currency on monetary assets and liabilities in conjunction with highly inflationary accounting, as we recorded

a benefit of approximately $4 in the first quarter of 2015 as compared to a loss of approximately $54 in the first quarter of 2014. In

addition, the decrease in other expense, net was partially due to lower foreign exchange losses, which decreased by approximately $10

compared to the prior-year period. See “Segment Review – Latin America” in this MD&A for a further discussion of our Venezuela

operations.

Gain on sale of business in 2015 was the result of the sale of Liz Earle in July 2015. Refer to Note 3, Discontinued Operations and

Divestitures on pages F-15 through F-18 of our 2015 Annual Report, for additional information regarding the sale of Liz Earle.

Effective Tax Rate

The effective tax rate in 2015 was negatively impacted by additional valuation allowances for U.S. deferred tax assets of approximately $670.

The additional valuation allowances in 2015 were due to the continued strengthening of the U.S. dollar against currencies of some of our

key markets and the impact on the benefits from our tax planning strategies associated with the realization of our deferred tax assets. In

addition, the effective tax rate in 2015 was negatively impacted by additional valuation allowances for deferred tax assets outside of the U.S.

A V O N 2015 41

7553_fin.pdf 43