Avon 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

“DPA”) and the consent to settlement (the “Consent”), prior professional and related fees associated with the FCPA investigations and

compliance reviews, the prior accrual for the settlements related to the FCPA investigations, and settlement charges associated with the U.S.

defined benefit pension plan. We allocate certain planned global expenses to our business segments primarily based on planned revenue.

The unallocated costs remain as Global and other expenses. We do not allocate to our segments costs of implementing restructuring

initiatives related to our global functions, costs in connection with the ongoing compliance with the DPA and the Consent, prior professional

and related fees associated with the FCPA investigations and compliance reviews, the prior accrual for the settlements related to the FCPA

investigations, and settlement charges associated with the U.S. defined benefit pension plan. Costs of implementing restructuring initiatives

related to a specific segment are recorded within that segment.

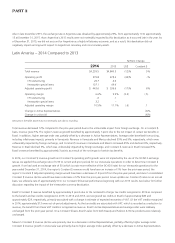

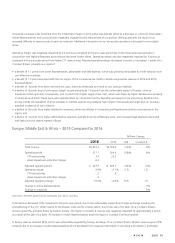

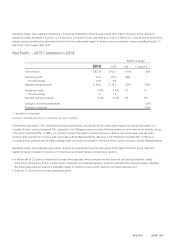

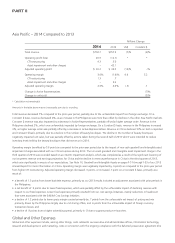

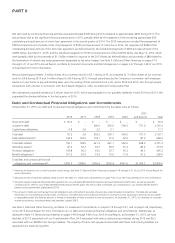

2015 2014 % Change 2014 2013 % Change

Total global expenses $ 487.9 $ 549.7 (11)% $ 549.7 $ 707.5 (22)%

CTI restructuring 33.4 27.4 27.4 22.8

FCPA accrual – 46.0 46.0 89.0

Pension settlement charge 7.3 9.5 9.5 –

Other items 3.1 – – –

Adjusted total global expenses $ 444.1 $ 466.8 (5)% $ 466.8 $ 595.7 (22)%

Allocated to segments (297.4) (382.4) (22)% (382.4) (374.1) 2%

Adjusted net global expenses $ 146.7 $ 84.4 74% $ 84.4 $ 221.6 (62)%

Net global expenses(1) $ 190.5 $ 167.3 14% $ 167.3 $ 333.4 (50)%

(1) Net global expenses represents total global expenses less amounts allocated to segments.

Amounts in the table above may not necessarily sum due to rounding.

As a result of its classification within discontinued operations, amounts allocated to segments have been reduced by amounts that were

previously allocated to North America for all periods presented, as these represent costs associated with functions of the Company’s

continuing operations.

2015 Compared to 2014

The comparability of total global expenses was impacted by the $46 accrual for the settlements related to the FCPA investigations which was

recorded in 2014 and lower settlement charges associated with the U.S. defined benefit pension plan in 2015, partially offset by higher CTI

restructuring and transaction-related costs associated with the separation of North America that were included in continuing operations. See

below for a further discussion of the settlement charges.

Adjusted total global expenses decreased compared to the prior-year period primarily as a result of cost savings initiatives, partially offset by

higher expenses associated with long-term employee incentive compensation plans as the prior-year period includes the benefit from the

reversal of such accruals that did not recur in the current-year period. Amounts allocated to segments decreased compared to the prior-year

period primarily due to lower planned corporate expenses, primarily as a result of our cost savings initiatives.

As a result of the lump-sum payments made to former employees who were vested and participated in the U.S. defined benefit pension

plan, in the third quarter of 2015, we recorded a settlement charge of approximately $24. These lump sum payments were made from our

plan assets and were not the result of a specific offer to participants of our U.S. defined benefit pension plan as described below. As the

settlement threshold was exceeded in the third quarter of 2015, a settlement charge of approximately $4 was also recorded in the fourth

quarter of 2015, as a result of additional payments from our U.S. defined benefit pension plan. These settlement charges were allocated

between Global Expenses and Discontinued Operations.

In an effort to reduce our pension benefit obligations, in March 2014, we offered former employees who were vested and participated in

the U.S. defined benefit pension plan a payment that would fully settle our pension plan obligation to those participants who elected to

receive such payment. The election period ended during the second quarter of 2014 and the payments were made in June 2014 from our

plan assets. As a result of the lump-sum payments made, in the second quarter of 2014, we recorded a settlement charge of approximately

$24. As the settlement threshold was exceeded in the second quarter of 2014, settlement charges of approximately $5 and approximately

$7 were also recorded in the third and fourth quarters of 2014, respectively, as a result of additional payments from our U.S. defined benefit

pension plan. These settlement charges were allocated between Global Expenses and Discontinued Operations.

A V O N 2015 55

7553_fin.pdf 57