Avon 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

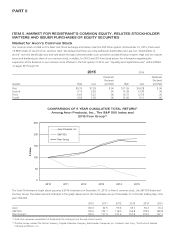

The Stock Performance Graph above shall not be deemed to be “soliciting material” or to be “filed” with the United States Securities and

Exchange Commission or subject to the liabilities of Section 18 under the Securities Exchange Act of 1934 as amended (the “Exchange

Act”). In addition, it shall not be deemed incorporated by reference by any statement that incorporates this annual report on Form 10-K by

reference into any filing under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act, except to the extent that we specifically

incorporate this information by reference.

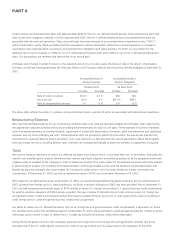

Issuer Purchases of Equity Securities

The following table provides information about our purchases of our common stock during the quarterly period ended December 31, 2015:

Total Number

of Shares

Purchased

Average Price

Paid per Share

Total Number of Shares

Purchased as Part of

Publicly Announced

Programs

Approximate Dollar

Value of Shares that

May Yet Be Purchased

Under the Program

10/1/15 –10/31/15 10,944(1) $3.38 * *

11/1/15 –11/30/15 24,796(1) 3.99 * *

12/1/15 –12/31/15 8,640(1) 3.24 * *

Total 44,380 $3.70 * *

* These amounts are not applicable as the Company does not have a share repurchase program in effect.

(1) All shares were repurchased by the Company in connection with employee elections to use shares to pay withholding taxes upon the vesting of their

restricted stock units.

Some of these share repurchases may reflect a brief delay from the actual transaction date.

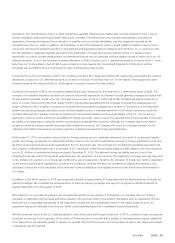

ITEM 6. SELECTED FINANCIAL DATA

(U.S. dollars in millions, except per share data)

We derived the following selected financial data from our audited Consolidated Financial Statements. The following data should be read in

conjunction with our MD&A and our Consolidated Financial Statements and related Notes contained in our 2015 Annual Report.

2015 2014 2013 2012 2011

Statement of Operations Data

Total revenue $ 6,160.5 $7,648.0 $8,496.8 $8,810.2 $9,227.0

Operating profit(1) 165.0 434.3 539.8 448.2 952.2

(Loss) income from continuing operations, net of tax(1) (796.5) (344.5) 67.5 39.8 600.5

Diluted (loss) earnings per share from continuing operations $ (1.81) $ (.79) $ .14 $ .09 $ 1.38

Cash dividends per share $ .24 $ .24 $ .24 $ .75 $ .92

Balance Sheet Data

Total assets* $ 3,779.5 $5,496.8 $6,492.3 $7,382.5 $7,735.0

Debt maturing within one year 55.2 121.7 171.2 564.3 838.8

Long-term debt 2,159.6 2,428.7 2,488.1 2,572.3 2,410.7

Total debt 2,214.8 2,550.4 2,659.3 3,136.6 3,249.5

Total shareholders’ (deficit) equity (1,056.4) 305.3 1,127.5 1,233.3 1,585.2

* Total assets at December 31, 2015 and 2014 in the table above exclude the $100.0 receivable from continuing operations that was presented within current

assets of discontinued operations.

(1) A number of items, shown below, impact the comparability of our operating profit and (loss) income from continuing operations, net of tax. See Note 14,

Restructuring Initiatives on pages F-45 through F-48 of our 2015 Annual Report, Note 1, Description of the Business and Summary of Significant Accounting

Policies on pages F-8 through F-14 of our 2015 Annual Report, “Results Of Operations – Consolidated” within MD&A on pages 38 through 46, “Segment

Review – Latin America” within MD&A on pages 47 through 51, Note 15, Contingencies on pages F-48 through F-51 of our 2015 Annual Report, “Segment

A V O N 2015 25

7553_fin.pdf 27