Avon 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

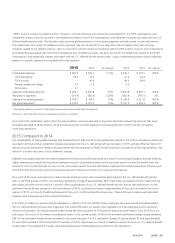

Cash Flows

2015 2014 2013

Net cash from continuing operating activities $ 91.4 $ 288.9 $ 470.5

Net cash from continuing investing activities 142.5 (100.5) (190.6)

Net cash from continuing financing activities (430.5) (208.7) (469.4)

Effect of exchange rate changes on cash and equivalents (80.7) (183.3) (80.8)

Net Cash from Continuing Operating Activities

Net cash provided by continuing operating activities during 2015 was approximately $198 lower than during 2014. The approximate $198

decrease to net cash provided by continuing operating activities was primarily due to lower cash-related earnings, which were impacted by

the unfavorable impact of foreign currency translation. Lower operating tax payments (such as VAT), primarily in Brazil, and lower payments

for employee incentive compensation in 2015 as compared to 2014, partially offset these items.

Net cash provided by continuing operating activities during 2014 was approximately $182 lower than during 2013. The approximate $182

decrease to net cash provided by continuing operating activities was primarily due to lower cash-related earnings, which was impacted by

the unfavorable impact of foreign currency translation, the $68 fine paid in connection with the FCPA settlement with the DOJ and higher

payments for employee incentive compensation. These unfavorable impacts to the year-over-year comparison of cash from operating

activities were partially offset by the benefit due to the timing of accounts payable, primarily for inventory purchases. In addition, operating

cash flow during 2013 was unfavorably impacted by payments for the make-whole premiums of approximately $90 in connection with the

prepayment of debt and an approximate $25 contribution to the United Kingdom pension plan as a result of our decision to freeze the plan,

both of which did not recur in 2014.

We maintain defined benefit pension plans and unfunded supplemental pension benefit plans (see Note 11, Employee Benefit Plans on

pages F-34 through F-42 of our 2015 Annual Report). Our funding policy for these plans is based on legal requirements and available cash

flows. The amounts necessary to fund future obligations under these plans could vary depending on estimated assumptions (as detailed in

“Critical Accounting Estimates – Pension and Postretirement Expense” in this MD&A). The future funding for these plans will depend on

economic conditions, employee demographics, mortality rates, the number of associates electing to take lump-sum distributions, investment

performance and funding decisions. Based on current assumptions, we expect to make contributions in the range of $25 to $30 to our U.S.

defined benefit pension and postretirement plans and in the range of $20 to $25 to our non-U.S. defined benefit pension and

postretirement plans during 2016.

Net Cash from Continuing Investing Activities

Net cash provided by continuing investing activities during 2015 was approximately $143, as compared to net cash used of $101 during

2014. The approximate $243 increase to net cash provided (used) by continuing investing activities was primarily due to the net proceeds on

the sale of Liz Earle of approximately $208, which was partially offset by lower capital expenditures.

Net cash used by continuing investing activities during 2014 was approximately $101, as compared to $191 during 2013. The approximate

$90 decrease to net cash used by continuing investing activities was primarily due to lower capital expenditures.

Capital expenditures during 2015 were approximately $92 compared with approximately $126 during 2014. Capital expenditures during

2014 were approximately $126 compared with approximately $190 during 2013, driven by the decision to halt the further roll-out of SMT

beyond Canada in the fourth quarter of 2013.

Capital expenditures in 2016 are currently expected to be in the range of $115 to $135 and are expected to be funded by cash from

operations.

Net Cash from Continuing Financing Activities

Net cash used by continuing financing activities was approximately $431 during 2015 compared to approximately $209 during 2014

primarily due to the prepayment of $250 principal amount of our 2.375% Notes (as defined below) in the third quarter of 2015, partially

offset by the repayment of the remaining $53 outstanding principal amount of a term loan agreement in the second quarter of 2014. See

Note 5, Debt and Other Financing on pages F-19 through F-21 of our 2015 Annual Report for more information.

A V O N 2015 57

7553_fin.pdf 59