Avon 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.carrying amount of the assets was recoverable. Based on our expected cash flows associated with the asset group, we determined that the carrying amount

of the assets, carried at their historical U.S. dollar cost basis, was not recoverable. As such, an impairment charge of $90.3 to selling, general and

administrative expenses was recorded to reflect the write-down of the long-lived assets to their estimated fair value of $15.7.

In February 2014, the Venezuelan government announced a foreign exchange system which began operating on March 24, 2014, referred to as the SICAD II

exchange (“SICAD II”) and we concluded that we should utilize the SICAD II exchange rate to remeasure our Venezuelan operations effective March 31,

2014. At March 31, 2014, the SICAD II exchange rate was approximately 50, as compared to the official exchange rate of 6.30 that we used previously,

which caused the recognition of a devaluation of approximately 88%. As a result of using the historical United States (“U.S.”) dollar cost basis of non-

monetary assets, such as inventories, these assets continued to be remeasured, following the change to the SICAD II rate, at the applicable rate at the time of

their acquisition. As a result, we determined that an adjustment of $115.7 to cost of sales was needed to reflect certain non-monetary assets, primarily

inventories, at their net realizable value. In 2014, we recognized an additional negative impact of $21.4 to operating profit and net income relating to these

non-monetary assets. In addition to the negative impact to operating profit, as a result of the devaluation of Venezuelan currency, during 2014, we recorded

an after-tax loss of $41.8 ($53.7 in other expense, net, and a benefit of $11.9 in income taxes), primarily reflecting the write-down of monetary assets and

liabilities.

In 2013, as a result of using the historical U.S. dollar cost basis of non-monetary assets, such as inventories, acquired prior to the devaluation, 2013 operating

profit was negatively impacted by $49.6, due to the difference between the historical U.S. dollar cost at the previous official exchange rate of 4.30 and the

official exchange rate of 6.30. In addition to the negative impact to operating profit and net income, as a result of the devaluation of Venezuelan currency,

during 2013, we recorded an after-tax loss of $50.7 ($34.1 in other expense, net, and $16.6 in income taxes), primarily reflecting the write-down of

monetary assets and liabilities and deferred tax benefits.

See discussion of our Venezuela operations in “Segment Review – Latin America” within MD&A on pages 47 through 51 and Note 1, Description of the

Business and Summary of Significant Accounting Policies on pages F-8 through F-14 of our 2015 Annual Report for more information.

(3) During 2014, our operating profit and operating margin were negatively impacted by the additional $46 accrual, and during 2013, our operating profit and

operating margin were negatively impacted by the $89 accrual, both recorded for the settlements related to the FCPA investigations. See Note 15,

Contingencies on pages F-48 through F-51 of our 2015 Annual Report for more information.

(4) During 2015, our operating profit and operating margin were negatively impacted by settlement charges associated with the U.S. defined benefit pension

plan. As a result of the lump-sum payments made to former employees who were vested and participated in the U.S. defined benefit pension plan, in the

third quarter of 2015, we recorded a settlement charge of $23.8. As the settlement threshold was exceeded in the third quarter of 2015, a settlement charge

of $4.1 was also recorded in the fourth quarter of 2015, as a result of additional payments from our U.S. defined benefit pension plan. These settlement

charges were allocated between Global Expenses and Discontinued Operations.

During 2014, our operating profit and operating margin were negatively impacted by settlement charges associated with the U.S. defined benefit pension

plan. As a result of the payments made to former employees who were vested and participated in the U.S. defined benefit pension plan, in the second

quarter of 2014, we recorded a settlement charge of $23.5. As the settlement threshold was exceeded in the second quarter of 2014, settlement charges of

$5.4 and $7.5 were also recorded in the third and fourth quarters of 2014, respectively, as a result of additional payments from our U.S. defined benefit

pension plan. These settlement charges were allocated between Global Expenses and Discontinued Operations.

See “Segment Review – Global and Other Expenses” within MD&A on pages 54 through 56, and Note 11, Employee Benefit Plans on pages F-34 through

F-42 of our 2015 Annual Report for a further discussion of the settlement charges.

(5) During 2015, our operating profit and operating margin were negatively impacted by transaction-related costs of $3.1 associated with the planned separation

of North America that were included in continuing operations.

(6) During 2015, our operating profit and operating margin were negatively impacted by a non-cash impairment charge of $6.9 associated with goodwill of our

Egypt business. During 2013 and 2012, our operating profit and operating margin were negatively impacted by non-cash impairment charges of $42.1 and

$44.0, respectively, associated with goodwill and intangible assets of our China business. See Note 16, Goodwill and Intangible Assets on pages F-51 through

F-53 of our 2015 Annual Report for more information on Egypt and China.

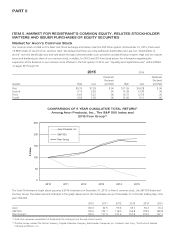

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS (“MD&A”)

(U.S. dollars in millions, except per share and share data)

You should read the following discussion of the results of operations and financial condition of Avon Products, Inc. and its majority and

wholly owned subsidiaries in conjunction with the information contained in the Consolidated Financial Statements and related Notes

contained in our 2015 Annual Report. When used in this discussion, the terms “Avon,” “Company,” “we,” “our” or “us” mean, unless the

context otherwise indicates, Avon Products, Inc. and its majority and wholly owned subsidiaries.

See “Non-GAAP Financial Measures” on pages 30 through 32 of this MD&A for a description of how Constant dollar (“Constant $”)

growth rates (a Non-GAAP financial measure) are determined.

Overview

We are a global manufacturer and marketer of beauty and related products. Our business is conducted primarily in the direct-selling

channel. During 2015, we had sales operations in 57 countries and territories, and distributed products in 15 more. In addition, in our North

America business (which has been presented as discontinued operations) we had sales operations in 3 countries and territories, and

A V O N 2015 27

7553_fin.pdf 29