Audi 2014 Annual Report Download - page 252

Download and view the complete annual report

Please find page 252 of the 2014 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTES TO THE BALANCE SHEET

252

>>

30 /

PROVISIONS FOR PENSIONS

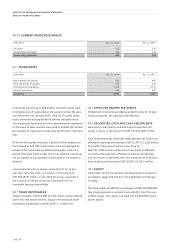

Provisions for pensions are created on the basis of plans to

provide retirement, disability and surviving dependent benefits.

The benefit amounts are generally contingent on the length of

service and the remuneration of the employees.

Both defined contribution and defined benefit plans exist within

the Audi Group for retirement benefit arrangements. In the case

of defined contribution plans, the Company pays contributions

to public or private-sector pension plans on the basis of statu-

tory or contractual requirements, or on a voluntary basis.

Payment of these contributions releases the Company from

any other benefit obligations. Current contribution payments

are reported as an expense for the year in question. In the case

of the Audi Group, they totaled EUR 341 (319) million. Of this,

contributions of EUR 319 (299) million were paid in Germany

toward statutory pension insurance.

The retirement benefit systems are based predominantly on

defined benefit plans, with a distinction being made between

systems based on provisions and externally financed benefit

systems. The provisions for pensions for defined benefit plans

are calculated by independent actuaries in accordance with

IAS 19 using the projected unit credit method, a method

commonly used internationally. This measures future obliga-

tions on the basis of the pro rata benefit claims acquired as of

the balance sheet date. The measurement takes account of

actuarial assumptions regarding discounting rates, remunera-

tion and retirement benefit trends, staff turnover rates and

increasing costs of health care. Actuarial gains and losses

result from deviations in what has actually occurred compared

with the assumptions made during the previous year and from

changes in assumptions. They are reported in equity with no

effect on profit or loss during the period in which they occur, as

part of revaluations, taking deferred taxes into account. These

revaluations also include the interest income from plan assets.

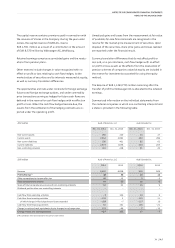

The retirement benefit scheme within the Audi Group was

evolved into a Contractual Trust Arrangement (CTA) in Germany

on January 1, 2001. The trust is a contribution-based retire-

ment benefit scheme with guarantees backed by Volkswagen

Pension Trust e.V., Wolfsburg. An annual cost of providing

benefits, based on remuneration and status, is converted into

a retirement benefits entitlement payable for life (guarantee

components) using annuity conversion factors. The annuity

conversion factors include a guaranteed rate of interest. When

the benefits are due, the retirement benefits components

acquired annually are added together. The cost of providing

benefits is invested on an ongoing basis in a dedicated fund

that is managed on a fiduciary basis by Volkswagen Pension

Trust e.V. and invested in the capital market. If the plan assets

are higher than the present value of the obligations calculated

using the guaranteed interest rate, a surplus is allocated

(surplus components).

The pension fund model is classed as a defined benefit plan

pursuant to IAS 19. The dedicated fund administered on a

fiduciary basis satisfies the requirements of IAS 19 as plan

assets and has therefore been offset against the obligations.

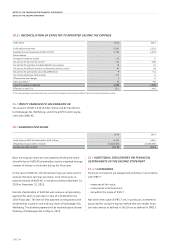

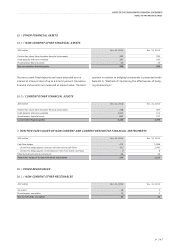

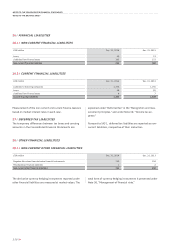

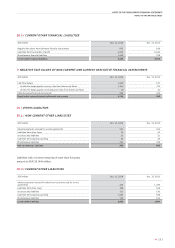

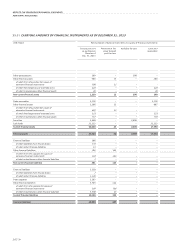

30.1 /

AMOUNTS RECORDED IN THE BALANCE SHEET FOR DEFINED BENEFIT OBLIGATIONS

EUR million

Dec. 31, 2014 Dec. 31, 2013

Present value of externally funded defined benefit obligations 1,662 1,032

Fair value of plan assets 1,156 972

Financing status (balance) 505 60

Present value of defined benefit obligations not externally funded 4,079 3,150

Due to the limit on a defined benefit asset amount

not capitalized under IAS 19 – –

Provisions for pensions recognized in the Balance Sheet 4,585 3,209