Audi 2014 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2014 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECONOMIC REPORT

BUSINESS AND UNDERLYING SITUATION

156

>>

From a low prior-year level, France and Italy achieved growth of

0.5 and 4.9 percent, while continuing high demand from private

customers in the United Kingdom drove up new registrations by

9.3 percent. The automotive market in Spain benefited from

government incentives for buyers. 18.3 percent more vehicles

were newly registered there than in the previous year. The Ger-

man car market showed a positive development thanks to higher

demand from business customers, with growth of 2.9 percent

taking the sales volume to 3.0 (3.0) million passenger cars.

While most Central European passenger car markets enjoyed

rising sales figures, demand for cars in Eastern Europe was down

mainly due to fewer new registrations in Russia. The Russian

car market thus achieved a sales volume of 2.3 (2.6) million units

– a decrease of 10.0 percent compared with the previous year.

The U.S. car market was characterized by a sound pace of growth.

Favorable credit terms, positive consumer confidence and the

continuing high level of replacement demand were the main

factors behind a 5.9 percent increase in new registrations to

16.5 (15.6) million passenger cars and light commercial vehicles.

In South America, the Brazilian passenger car market fell well

short of the prior-year total at 2.5 (2.8) million units. The

main causes of the 9.4 percent drop in demand were the

difficult overall economic situation and higher interest rates.

The Asia-Pacific region was again the main driver of the

global car market in 2014, with 30.3 (28.1) million newly

registered passenger cars. The Chinese car market proved

especially dynamic. On the back of the robust general eco-

nomic situation, it expanded by 12.1 percent to 17.9 (15.9)

million new registrations. There was also growth for the

automobile market in Japan, which grew by 2.9 percent com-

pared with the previous year’s registration total to 4.7 (4.6)

million new passenger cars, despite the increase in the VAT

rate on April 1, 2014.

/

INTERNATIONAL MOTORCYCLE MARKET

Worldwide demand for motorcycles in the displacement seg-

ment above 500 cc showed a positive development in the 2014

fiscal year. International registrations of new motorcycles in the

established markets increased by 5.3 percent. The improving

overall economic situation also fueled increased demand in

Western Europe’s volume markets. For example, the total num-

ber of newly registered motorcycles in Germany and France was

up 9.6 and 3.8 percent respectively. Demand in Italy also devel-

oped positively with a rise of 4.2 percent. In the United Kingdom

and Spain, motorcycle sales even grew by 13.1 and 32.7 percent

respectively. The motorcycle market in the United States saw

only a slight rise in demand of 0.6 percent and thus remained at

the previous year’s already high level. Registrations of new mo-

torcycles in Japan were up 14.8 percent.

/

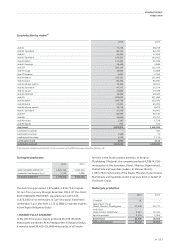

MANAGEMENT’S OVERALL ASSESSMENT

The Audi Group continued its course of growth in the past

fiscal year and increased deliveries of the core brand Audi by

10.5 percent to 1,741,129 (1,575,480) cars. We achieved

new sales records in over 50 individual markets, as a result

of which we extended our strong competitive position in the

premium segment.

In the course of the dynamic development in volume, the Audi

Group increased its revenue to EUR 53,787 (49,880) million.

Despite high upfront expenditures for the expansion of our

international manufacturing structures and for new models

and technologies, in particular to comply with tougher COĊ

requirements worldwide, the Audi Group succeeded in increas-

ing its operating profit to EUR 5,150 (5,030) million. Continu-

ous improvements to processes and cost structures along the

entire value chain once again favorably impacted profit per-

formance. The operating return on sales for 2014 reached 9.6

(10.1) percent and was therefore within the strategic target

corridor of 8 to 10 percent.

We again generated a high net cash flow in the past fiscal year

despite increased investment spending. The figure of

EUR 2,970 (3,189) million highlights the financial strength of

the Audi Group. Disregarding changes in participations, the net

cash flow came to EUR 3,162 (3,225) million. The past fiscal

year saw the Audi Group invest substantial amounts in expand-

ing and updating its product portfolio, in pioneering technolo-

gies and in its worldwide production capacities. The ratio of

investments in property, plant and equipment of 5.5 (4.8)

percent was therefore at the upper end of the strategic target

corridor of 5.0 to 5.5 percent. The return on investment came to

23.2 (26.4) percent. The average size of the Audi Group’s work-

force over the year increased to 77,247 (71,781) employees.