Audi 2014 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2014 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

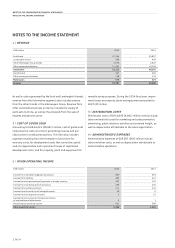

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

RECOGNITION AND MEASUREMENT PRINCIPLES

234

>>

The item “Available-for-sale financial assets” includes non-

derivative financial instruments that are either allocated to

this category or cannot be allocated to any of the other cate-

gories. This includes equity instruments, such as shares in

equity, and debt instruments, such as interest-bearing securi-

ties. As a general rule, financial instruments that fall into this

category are reported at fair value. In the case of listed finan-

cial instruments – exclusively securities in the case of the Audi

Group – the fair value corresponds to the market value on the

balance sheet date. Fluctuations in value are accounted for

within equity in the reserve for the market valuation of securi-

ties, after taking deferred tax into account. Lasting impair-

ment of the fair value is included in the financial result.

“Available-for-sale financial assets” are impaired if there is

objective evidence of a long-term loss of value. In the case of

equity instruments, a permanent value reduction is deemed to

have occurred if the market value falls below the cost of pur-

chase on a significant basis (more than 20 percent) or on a

long-term basis (more than 10 percent of the average market

prices throughout a year). Debt instruments are impaired if

future payment flows from the financial asset are expected to

fall. Any rise in risk-free interest rates or credit spreads, how-

ever, does not constitute objective evidence of a loss in value.

As soon as impairment occurs, the cumulative loss is removed

from the reserve for fair value measurement of securities and

recognized in the Income Statement. Reversals of impairments

– provided that the securities affected are equity instruments –

are recognized without affecting profit or loss. If, on the other

hand, the securities concerned are debt instruments, impairment

losses are reversed with an effect on profit or loss (no higher

than the previous impairment amount) if the increase in the

fair value, when viewed objectively, is based on an event that

occurred after the impairment loss was recorded with an effect

on profit or loss.

As well as securities, the item “Available-for-sale financial assets”

also contains investments in non-consolidated subsidiaries and

other participations that are not valued according to the equity

method. As there is no active market for these participations

and their fair value cannot be reliably ascertained, they are

carried at their cost of purchase. Where there is evidence that

the fair value is lower, corresponding value adjustments are

carried out. As of the balance sheet date, there is no intention

to sell any material participations.

//

DERIVATIVE FINANCIAL INSTRUMENTS AND

HEDGE ACCOUNTING

Derivative financial instruments are used as a hedge against

foreign exchange and commodity price risks for items on the

Balance Sheet and for future cash flows (underlying transac-

tions). Futures, as well as options in the case of foreign

exchange risks, are taken out for this purpose.

Additionally, under the rules of IAS 39, some contracts are

classed as derivative financial instruments:

>rights to acquire shares in companies,

>agreements entered into by the Audi Group with authorized

dealers with a view to hedging against potential losses from

buy-back obligations for leased vehicles.

According to the rules, hedge accounting is used if a clear

hedging relationship between the underlying transaction and

the hedge is documented and its effectiveness demonstrated.

Recognition of the fair value changes in hedges depends on the

nature of the hedging relationship.

When hedging against exchange rate risks from future cash

flows (cash flow hedges), the fluctuations in the market value

of the effective portion of a derivative financial instrument are

initially reported within equity in the reserve for cash flow

hedges, with no effect on profit or loss, and are only recog-

nized as income or expense under operating profit once the

hedged item is due. The ineffective portion of a hedge is rec-

ognized immediately in profit or loss. Derivative financial

instruments that are used to hedge market risks according to

commercial criteria but do not fully meet the requirements of

IAS 39 with regard to effectiveness of hedging relationships

are categorized as “measured at fair value through profit or

loss.” Rights to acquire shares in companies, and the model for

dealer hedging against potential losses from buy-back obliga-

tions for leased vehicles, are also reported in accordance with

the rules for “financial instruments measured at fair value

through profit or loss.” The results from “financial instruments

measured at fair value through profit or loss” are reported

under the financial result.